Well, it finally happened. The short volatility trade blew up and the volatility genie is now out of the bottle. Credit and monetary conditions are still extremely loose so this should calm down soon, but I doubt we see a low volatility regime like 2017 in a long time. So here’s what happened: Two Inverse…

When Correlations go to 1, Short Volatility and Negative Convexity

2017 has been the year to sell volatility. Volatility on nearly all asset classes has been compressed to historically low levels, which is a function of the world’s major Central Banks going into asset purchase overdrive for the past 18 months. When you flood the global financial system with free money, people tend to leverage…

Reducing Risk Exposure

I use a few different risk management systems to help in determining when to reduce exposure to higher risk investments like stocks and high yield bonds. These take into consideration economic data, market data (i.e. bond spreads, market breadth, etc.) and technical charting for trend strength. Monday was the last day of October and the…

The Next Market Fad to Blow Up

Following the slowest month in a long time, with volatility being compressed again, I thought it was a good time to highlight an important underlying driver of markets these days: volatility. Volatility (more importantly implied volatility) is measured and today is an actual asset class that you can “invest” in for diversification purposes. A few…

Adapting Portfolio Construction – 2 Updates

I’ve been thinking a lot lately about portfolio construction, especially for retirees, in these computer-algorithm dominated investment markets which swing wildly every time someone from the Fed speaks. Markets today are unbelievably short-term focused and my clients aren’t paying me to day-trade their retirement portfolios. This means that portfolios which are built with a long-term…

Why I Like Risk, Volatility and a Falling Stock Market

I know the posts this week weren’t the most upbeat, but hey, I’m not CNBC. My job is to be a fiduciary on behalf of my clients which means I need to be realistic. I understand that it’s more enjoyable to read about exciting, new investment opportunities so I try to limit the doom and gloom.…

Should I Be Bothered by Drops in the Stock Market?

It all depends. As a long-term investor, which most people are, you shouldn’t necessarily worry about short-term volatility. The best long-term investments come with the baggage of short-term volatility, that’s just the way it is. This is where proper diversification and strategies like allocating “buckets” of money for retirement spending come into play so one…

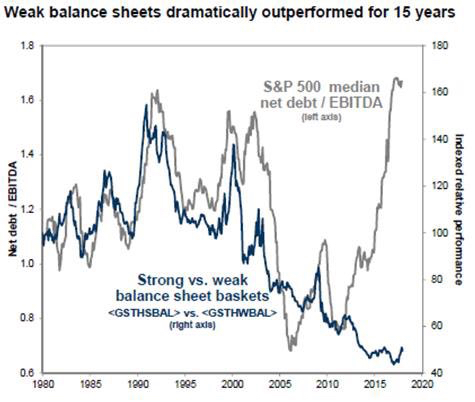

“Phase 3” Right Around the Corner for Stocks

For those of you that read my latest letter to clients (which I’m sure everyone did…but if you haven’t had a chance yet, you can find it here), the S&P 500 is about to enter what I consider “Phase 3”. This means it’s time to aggressively hedge/reduce stock risk. I spent a good bit of…