Here’s an article from the Financial Times earlier this month that pretty much sums up the current state of the global markets. I think an easy way to envision our global financial system (a credit-based fiat system) so that it’s easier to understand is to think of it like a balloon. When credit is easy and liquidity is being…

Market & Portfolio Updates

I haven’t written on the blog in about two weeks because we’re in the middle of quarterly earnings. There is a 2 or 3 week stretch each quarter where I’m pretty busy listening to the earning’s conference calls of the companies we own as well as other companies I’m looking into. The good news is…

Making Sense of the Nonsense

I’d like to comment on two things that have been a huge disservice to the average (nonprofessional) investor. One is CNBC and the second is the Federal Reserve. Do yourself a favor and don’t watch CNBC. Like all media companies, CNBC is in the business of collecting eyeballs. They want strong ratings so they can…

Allergan – the Gift that Keeps on Giving

Pfizer and Allergan have announced a “merger” where Pfizer is essentially acquiring Allergan so it can perform a tax inversion to relocate to Ireland (where Allergan is based). This is the second time Allergan has been acquired since we purchased it back in June, 2013, with the first being the takeover by Actavis last fall. Then…

Are New Opportunities on the Horizon?

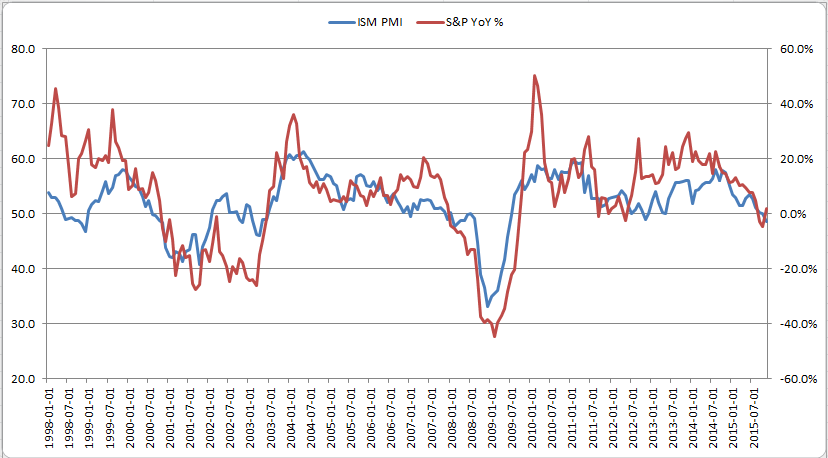

I find it fascinating that the stock market is still so fixated on stimulus (more quantitative easing), which says a lot about the nature of the global economy. Stocks posted a pretty strong rally yesterday after the European Central Bank (ECB) hinted at increasing their QE program. Then, this morning, the futures were driven even…

Why the Stock Market Dropped So Sharply

Two words – “The Fed.” The two primary goals of the Federal Reserve’s Quantitative Easing efforts over the past few years were to inflate asset prices (stocks, real estate, etc.) and lower interest rates. They call this the “wealth effect.” In theory, they think that higher asset prices will increase confidence, which will increase spending, business…

Reflections from the Week

It seems like the only thing I hear in the financial media these days is talk about when the Fed will raise interest rates but I think people are missing the forest for the trees. The US dollar continues to surge higher and by letting it rise, effectively the Fed is already tightening. I don’t…

Inflation or Deflation?

I’ve noticed lately that inflation continues to “surprise” to the downside, to a small degree here in the US but mainly overseas (notably Europe, Australia and Canada), creating expectations of further monetary easing. This is leaving many people who have been calling for hyperinflation and the collapse of fiat currencies scratching their heads. They say…