I’ve been thinking a lot lately about portfolio construction, especially for retirees, in these computer-algorithm dominated investment markets which swing wildly every time someone from the Fed speaks. Markets today are unbelievably short-term focused and my clients aren’t paying me to day-trade their retirement portfolios. This means that portfolios which are built with a long-term…

Chart of the Week: Consumer Discretionary Stocks are Not on Sale

This goes to show how distorted Quantitative Easing (QE) has made things. It’s a value investors nightmare… It’s important to use your head when investing in this market. A common mistake that investors tend to make is to pick a fund (or stock) based on past performance. They’ll think “look how well this fund has done…

Chart of the Week: One Way I “Time” Buying & Selling Decisions

I haven’t posted anything on the blog lately because there hasn’t been much to talk about in terms of new updates. Overall, things have been playing out “to a T” this month, following the same playbook as back in October/November (you can read about it here). Early April is when we’ll start to see whether the analog will continue…

Chart of the Week: Not a Good Sign for Global Stock Markets

The chart below was going around a lot last week. It shows a composition of AP Moller-Maersk (the world’s largest container shipping company) and Sotheby’s (the auction house of high-end art, etc.) in blue vs. the MSCI World Stock Index in orange. That’s a pretty tight correlation and a pretty wide gap we’re seeing right…

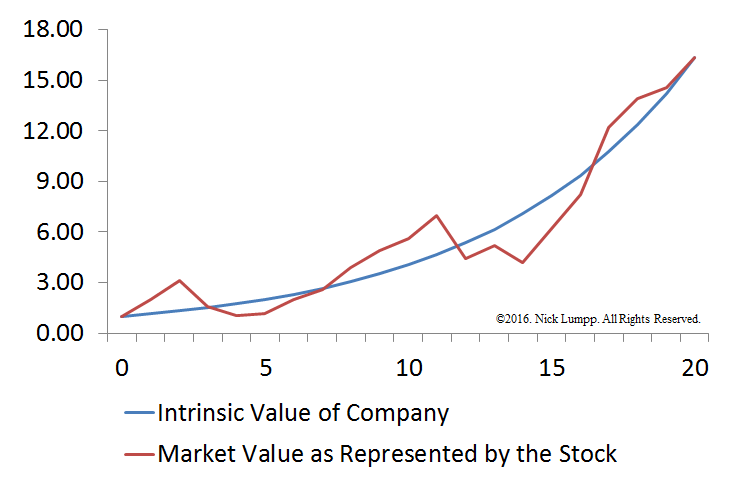

How to Produce Outsized Long-Term Returns from the Perspective of Value Investing

I’m going to let you in on a little secret: Wall Street doesn’t look out beyond 1 year. That’s it. Just 1… Wall Street is part of the brokerage industry and all that the brokerage industry cares about is making sure: 1) you remain invested in their expensive products, and 2) you continually churn your…

“Phase 3” Right Around the Corner for Stocks

For those of you that read my latest letter to clients (which I’m sure everyone did…but if you haven’t had a chance yet, you can find it here), the S&P 500 is about to enter what I consider “Phase 3”. This means it’s time to aggressively hedge/reduce stock risk. I spent a good bit of…

Recent Market Musings

China The Chinese stock market has probably been the hottest market over the last year. While exciting for the time being, I don’t trust it one bit. The Chinese economy has been supported by an unsustainable increase in credit the past few years and the bubble has the potential to pop at any moment. There…

S&P 500: Early Warning Signals Beginning to Flash

Two of the best ways to track investor’s sentiment toward risk are to track the Volatility Index (VIX) relative to stocks and high yield bonds relative to stocks – and both have been flashing “warning” signs since early July. These are important to watch because stocks are usually the last asset class to react to…