After a long hiatus from the blog, I’m back! I never really went anywhere. Things were so hectic in March and April that I was focusing all of my time on staying on top of everything. After that, I was using direct communication to keep my clients updated and since then I just haven’t had…

Macro & Markets Update: Dec 2019

I haven’t posted anything in a while because every time I’m about to write an update, a new piece of pretty big news develops that potentially shifts the picture. So here’s a high level overview of my thoughts from the past month. There’s a debate going on right now if the current slowdown will…

Markets & Macro Update – Aug 6th, 2019

Last week the Fed cuts interest rates for the first time since the GFC a decade ago and the market’s response was pretty interesting. After referencing the 1995/96 one-and-done cut that prolonged the 90’s expansion all summer, I think they were hoping that they could get away with one cut as “insurance” that would ease…

Macro Update: Stocks, Bonds, and the Dollar – One is Wrong

For most of this spring, I’ve been telling clients that I’ve been in “wait and see” mode. The US dollar, bonds and stocks have all been rallying this year, and while that can happen in the short-term, the dynamics of the market say that can’t last in the long run. Basically, 1 of the 3…

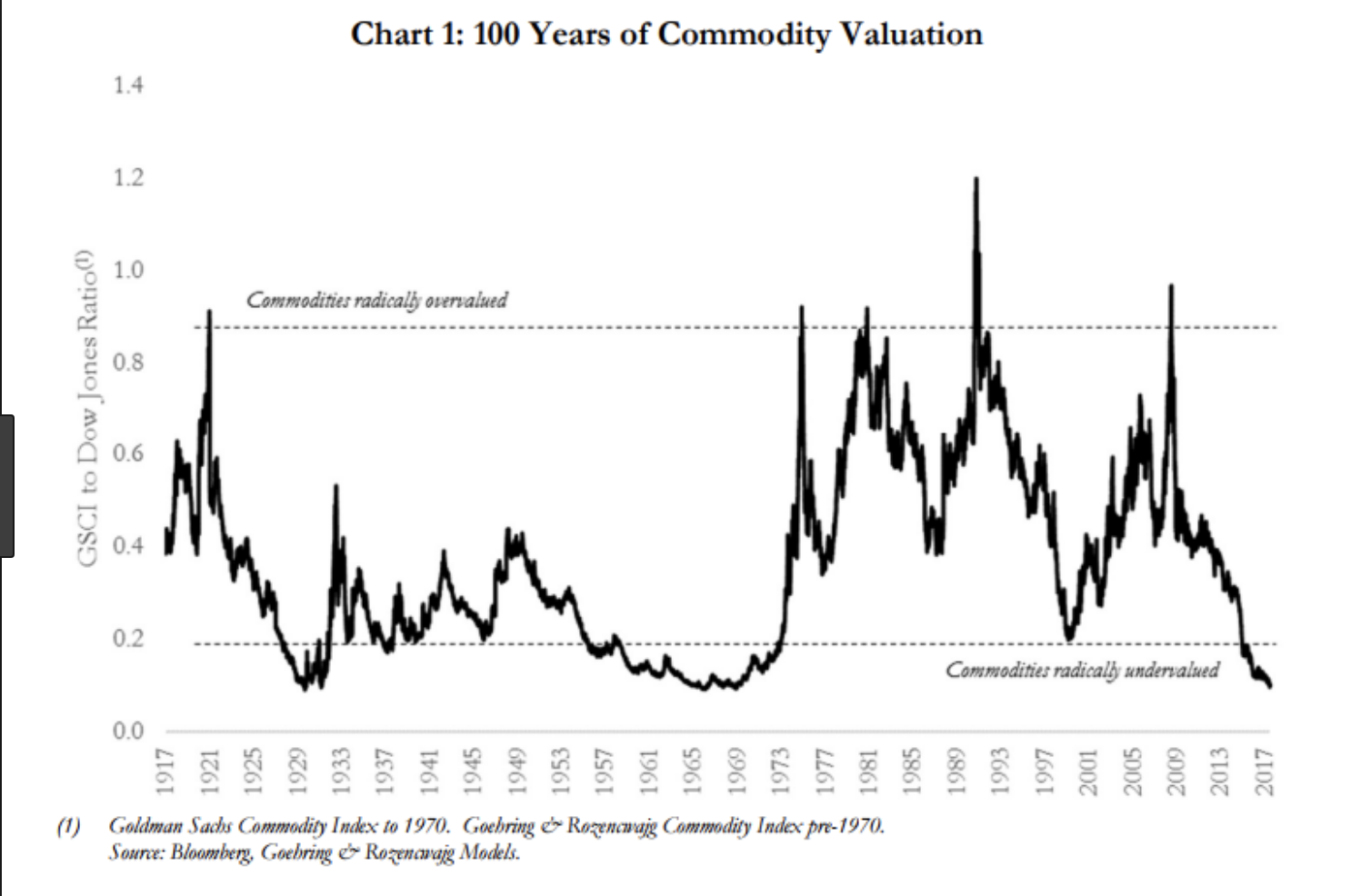

It’s All Connected – Why Gold is Starting to Shine

If you don’t own gold, you know neither history nor economics. -Ray Dalio I haven’t written anything in a little while because, well, there hasn’t been a whole lot going on to write about. We have had the usual Fed go full-panic-dove-mode, we’ve reportedly made progress on a trade deal with China about 28 times…

Macro Update: Late Cycle Dynamics

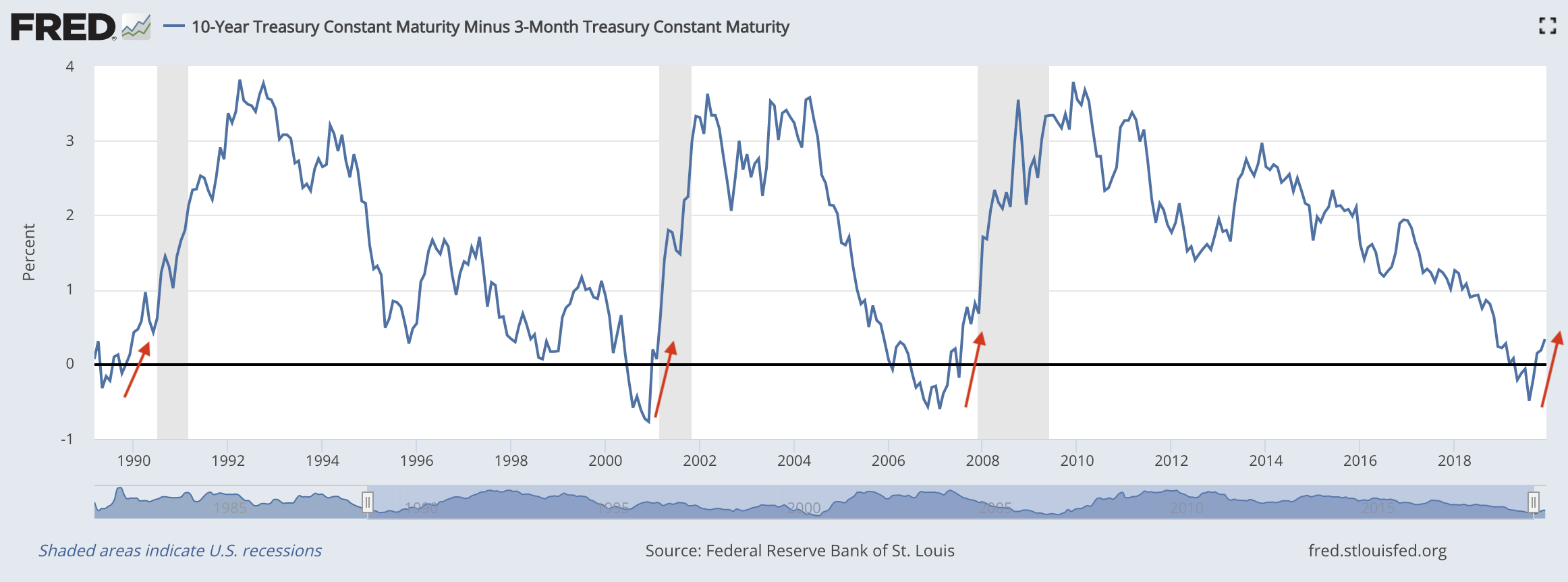

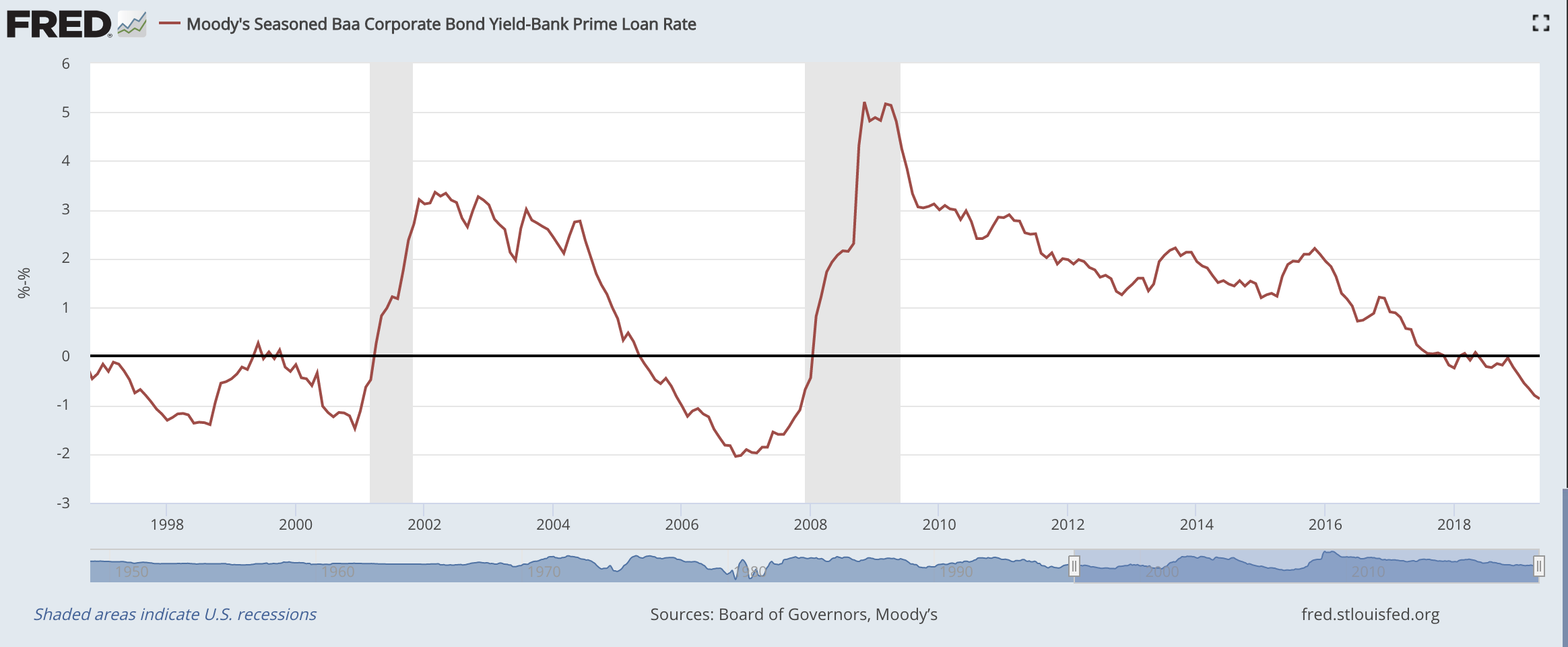

I’ve been seeing warning signals since the spring that we’re in the later stages of this economic cycle so I wanted to post an update to illustrate. One thing to mention is that cycles tend to move very slowly which can be a double-edged sword. It’s nice because you can typically read the tea leaves…

The Pain & Opportunity of a Dollar Squeeze

Global investment markets are becoming very macro driven and it’s pretty important to understand the big picture dynamics at play right now. The US dollar is the key to everything and there has been a growing shortage of dollars throughout the global economy over the past few years which we’re now seeing create the usual…

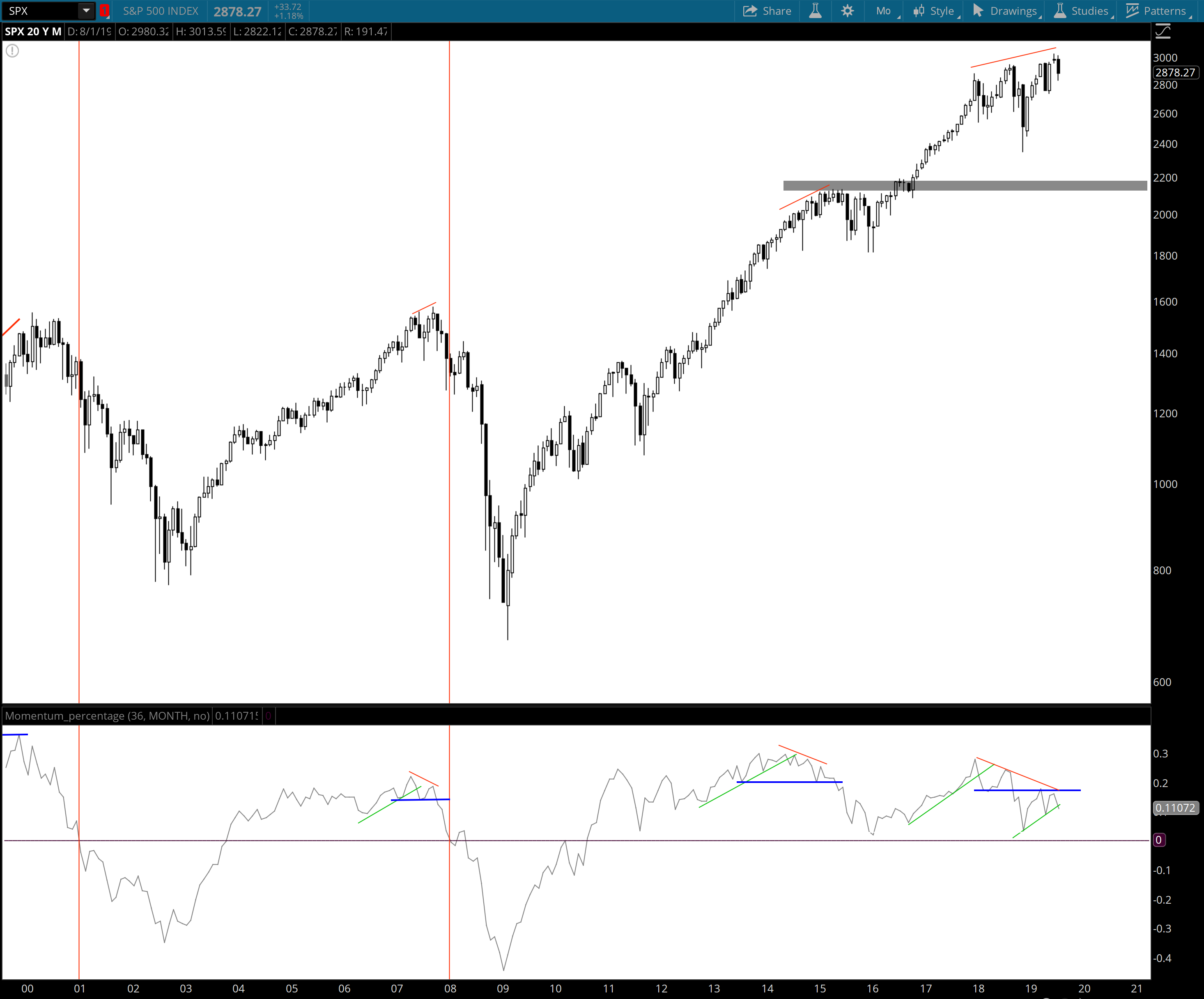

Momentum, Cycles, and Trends

Asset markets move in cycles, flipping between periods of growth and decline (or consolidation). You can see these cycles in pretty much every asset class and on multiple levels due to the fractal nature of markets. This means there is a short-term cycle within an intermediate-term cycle within a long-term cycle, and so on. You…