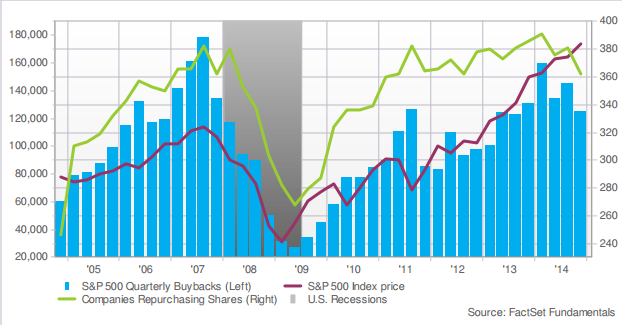

This week’s chart comes from an article on Bloomberg discussing the percentage of buybacks that are being funded by debt – now over 30% for the first time since June 2001. Notice how this measure tends to peak around high points in the overall market (2000/2001, 2007 and 2011). You can read the full article here.…

The Difference Between a Company and a Stock

As a follow-up on my last post which you can read here, I wanted to discuss the important difference between a company and a stock when investing. The old adage of “invest in what you know and buy” is very general and only goes so far. I would also say that it’s not nearly as…

Which is More Important: A Great Business Model or Good Management?

The answer is management, plain and simple. When you invest in the stock of a company, you entrust management to be the steward of your capital and to make smart, value enhancing business decisions. It doesn’t matter how great a product is or what competitive advantages a company may have, if management makes poor decisions…

Are stock buybacks good or bad?

As with almost everything in finance, the answer is that it depends. Buybacks have been receiving a lot of criticism lately in the financial media. The most common complaint I here is that companies are only growing earnings per share year-over-year because they’re reducing the outstanding number of shares and not making investments in the…