European Stocks European stocks and US stocks typically move with a fairly high correlation but they’ve diverged quite a bit over the past 3 years as both the euro currency and British pound have depreciated significantly against the US dollar. I’m thinking we’ll likely see this gap close over the next year so I started…

Adapting Portfolio Construction – 2 Updates

I’ve been thinking a lot lately about portfolio construction, especially for retirees, in these computer-algorithm dominated investment markets which swing wildly every time someone from the Fed speaks. Markets today are unbelievably short-term focused and my clients aren’t paying me to day-trade their retirement portfolios. This means that portfolios which are built with a long-term…

Chart of the Week: Consumer Discretionary Stocks are Not on Sale

This goes to show how distorted Quantitative Easing (QE) has made things. It’s a value investors nightmare… It’s important to use your head when investing in this market. A common mistake that investors tend to make is to pick a fund (or stock) based on past performance. They’ll think “look how well this fund has done…

The Concept of a Superior Investment

Everyone knows what it means when something is superior to something else. In this post, I’ll try to explain how I view potential investments in terms of superiority and what a superior investment looks like to me. Let’s say we’re looking at 3 potential investments: A, B & C. If B is superior to C…

Chart of the Week: One Way I “Time” Buying & Selling Decisions

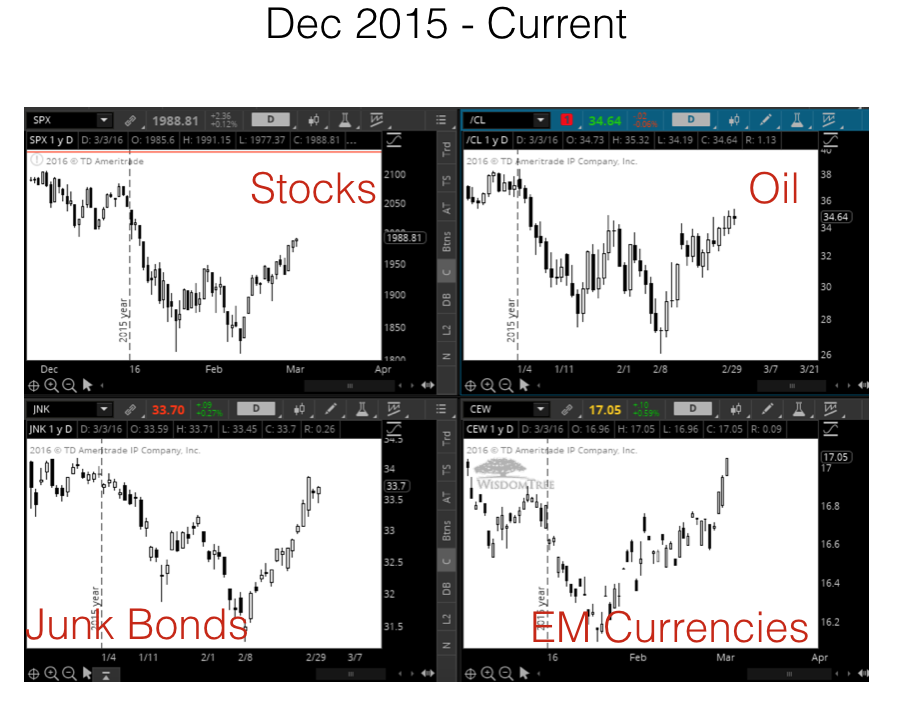

I haven’t posted anything on the blog lately because there hasn’t been much to talk about in terms of new updates. Overall, things have been playing out “to a T” this month, following the same playbook as back in October/November (you can read about it here). Early April is when we’ll start to see whether the analog will continue…

A Case of Deja Vu

The move in the S&P 500 since January 1st (the selloff, bounce, weak test of the lows and a big surge afterwards) has been so eerily similar to the Aug-Oct move a few months back that it’s a little weird… Even the multiple 2-day retracements in the middle of the surge. The August selloff unfolded after…

Chart of the Week: Not a Good Sign for Global Stock Markets

The chart below was going around a lot last week. It shows a composition of AP Moller-Maersk (the world’s largest container shipping company) and Sotheby’s (the auction house of high-end art, etc.) in blue vs. the MSCI World Stock Index in orange. That’s a pretty tight correlation and a pretty wide gap we’re seeing right…

What it Means to be “Hedged”

I’ve mentioned a few times over the past couple of months that I currently have the “Growth” allocation of client portfolios hedged against a drop in the stock market. In this post, I hope to explain what it means to be “hedged,” why it’s important to hedge risk, and how I’m currently doing so. From…