I haven’t written anything in a while but I’m still here, still doing what I’ve always done. This post will be about how I’ve actually adapted the management of client portfolios over the past handful of years to an ever-changing market environment. I think markets may potentially be in for an extended period of tough…

The Importance of Asymmetric Convexity for a Portfolio Moving Forward

After a long hiatus from the blog, I’m back! I never really went anywhere. Things were so hectic in March and April that I was focusing all of my time on staying on top of everything. After that, I was using direct communication to keep my clients updated and since then I just haven’t had…

Market Risk is Highest Since 2007/08

I’m going to try to keep this post a little shorter by not getting too deep into the explanations but I wanted to post an update with my thoughts based on what I’m seeing. Given the weakening economic backdrop, the risk across the board is probably at its highest point right now since 2007/08. The…

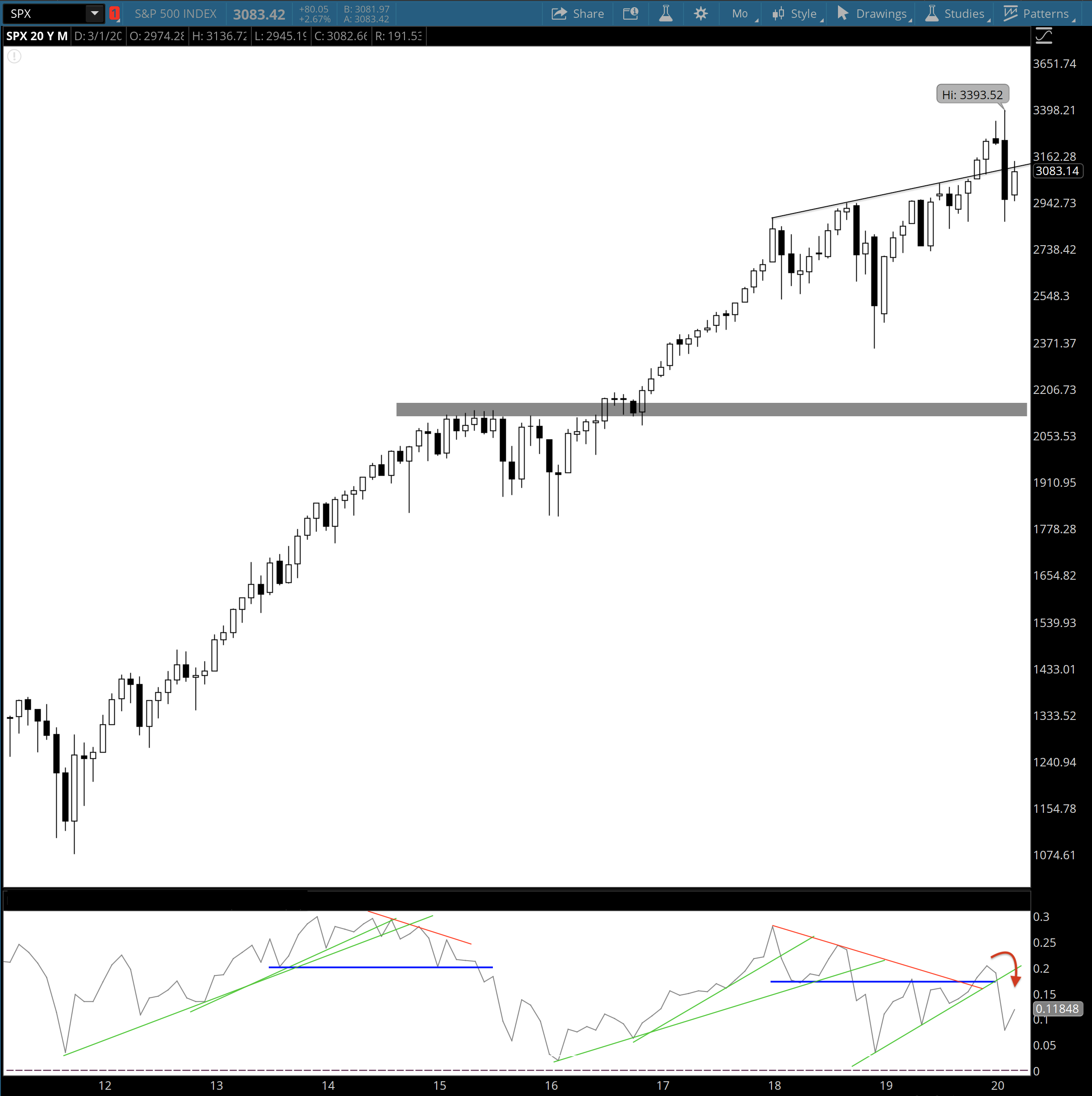

On the Verge of a Recession & the Most Important Chart Right Now (Feb 2020)

Unfortunately the employment numbers lately have been disappointing and the job openings number this morning was very worrying, down 14% on a year-over-year basis. Initial and Continuing Unemployment claims have also been rising on a year-over-year basis. So we have unemployment starting to tick higher and hiring slowing – two things seen at the…

Stock Market Update: October 2018

I haven’t written anything in over a month but now feels like a good time to provide an update of what I’m seeing and expecting. Investment markets in general, and stocks especially, typically act in one of two frames of mind. When investors are comfortable taking on risk virtually all bad news is ignored and…

Macro Update: Late Cycle Dynamics

I’ve been seeing warning signals since the spring that we’re in the later stages of this economic cycle so I wanted to post an update to illustrate. One thing to mention is that cycles tend to move very slowly which can be a double-edged sword. It’s nice because you can typically read the tea leaves…

Momentum, Cycles, and Trends

Asset markets move in cycles, flipping between periods of growth and decline (or consolidation). You can see these cycles in pretty much every asset class and on multiple levels due to the fractal nature of markets. This means there is a short-term cycle within an intermediate-term cycle within a long-term cycle, and so on. You…

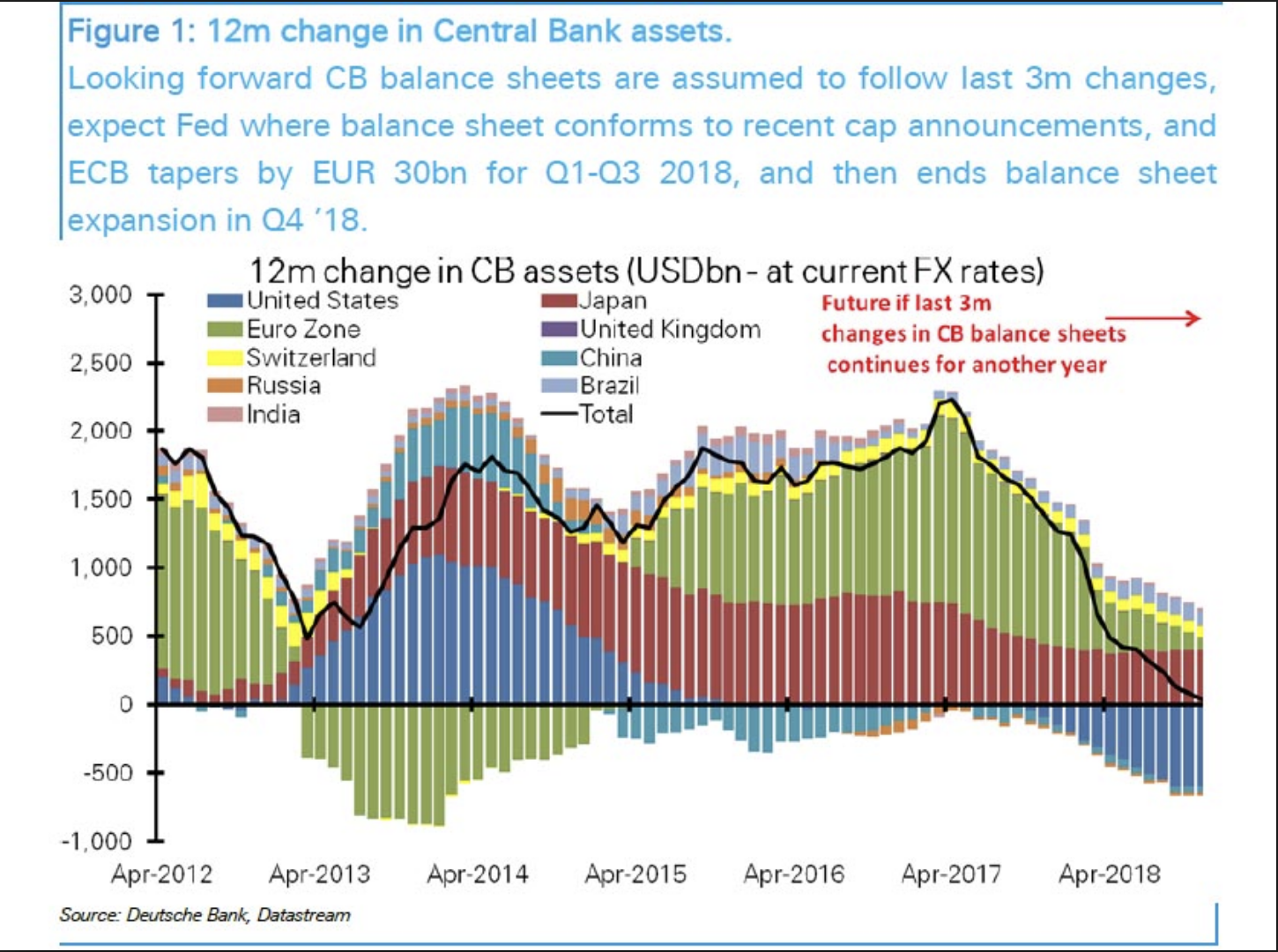

When Correlations go to 1, Short Volatility and Negative Convexity

2017 has been the year to sell volatility. Volatility on nearly all asset classes has been compressed to historically low levels, which is a function of the world’s major Central Banks going into asset purchase overdrive for the past 18 months. When you flood the global financial system with free money, people tend to leverage…