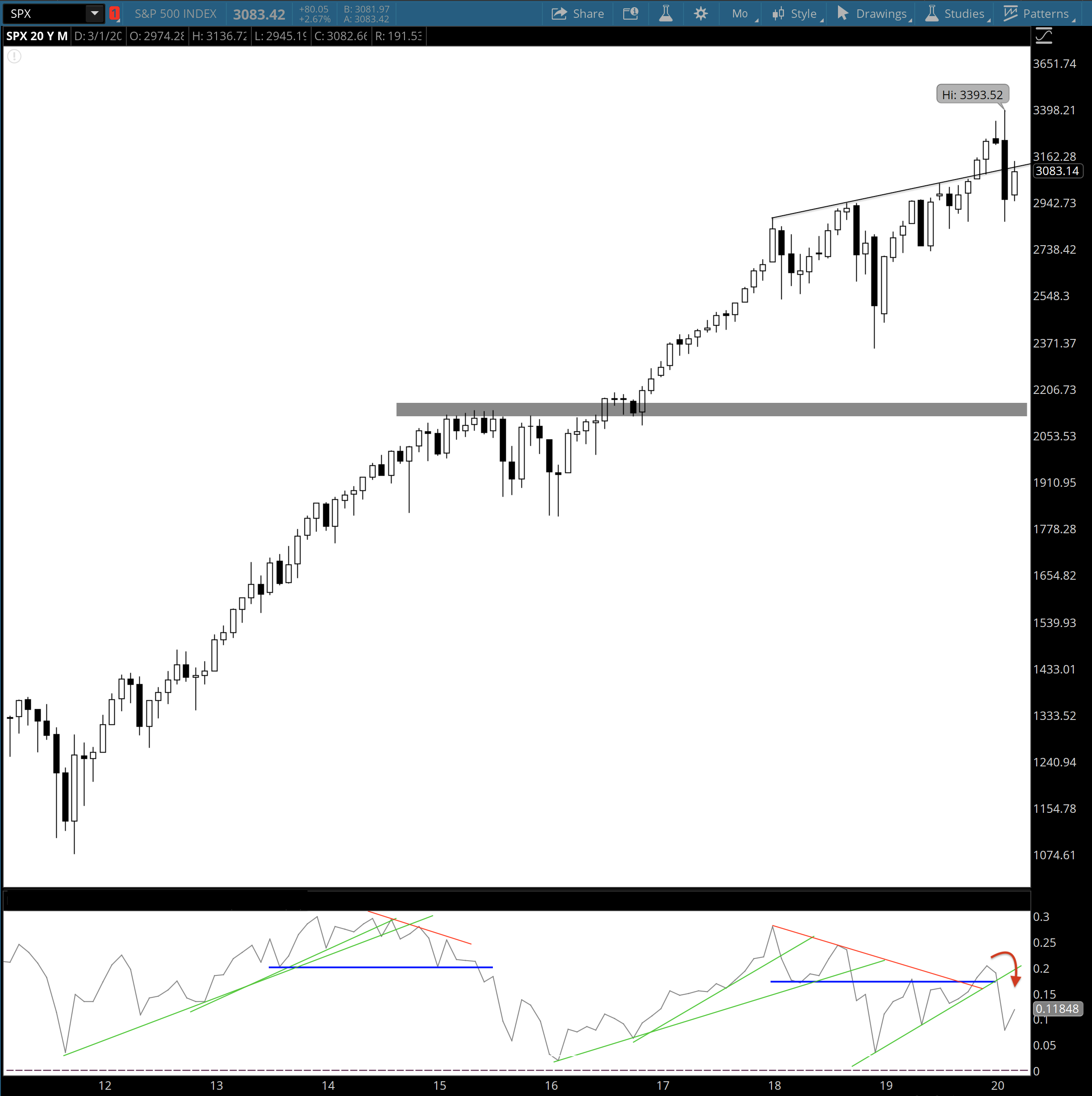

I’m going to try to keep this post a little shorter by not getting too deep into the explanations but I wanted to post an update with my thoughts based on what I’m seeing. Given the weakening economic backdrop, the risk across the board is probably at its highest point right now since 2007/08. The…

The Challenges Ahead for Long-Term Investors

I suppose this is my annual warning to long-term investors to tread carefully in the investment markets. 2016 has been a year of rotations with the net composite of a balanced portfolio not moving a whole lot (i.e. things that did well in the first half of the year have done poorly during the second half,…

Adapting Our Approach Toward Growth

Just about all of my clients are long-term, retirement oriented investors. The most frustrating thing the past few years for long-term investors is how the central banks have largely “killed” the markets in the traditional investment sense. What I mean by “killed” is that I cannot honestly consider bonds yielding less than 2% and stocks…

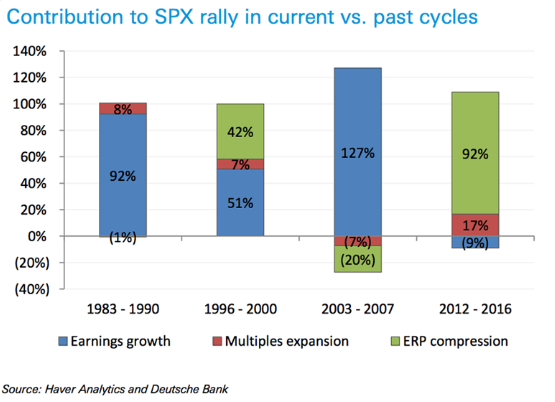

Charts of the Week: The Whole Story

These charts tell the whole story regarding the current state of the global economy and investment markets: Global central bank asset purchases compared to global equity % change (let’s be honest, there’s only one thing that matters…) Deutsche Bank’s recent report on the current stock market rally (’12 to ’16) compared to past market climbs…

Why I Like Risk, Volatility and a Falling Stock Market

I know the posts this week weren’t the most upbeat, but hey, I’m not CNBC. My job is to be a fiduciary on behalf of my clients which means I need to be realistic. I understand that it’s more enjoyable to read about exciting, new investment opportunities so I try to limit the doom and gloom.…

Muni Bonds & Risk

I’ve had growing concerns over the looming pension liabilities that so many local and state governments face and the recent Detroit bankruptcy could be changing things… It now appears likely that the Michigan courts will rule in favor of the pension/benefit obligations, knocking the “senior” General Obligation (GO) muni bonds down a peg. GO muni’s…

Bonds & Rates

A very important part of investing is recognizing when you’re wrong as quickly as possible to minimize losses. After watching Bernanke’s Q&A session yesterday after the close, I’m ready to admit I was wrong on interest rates. I’ve never seen someone stumble through questions like that before. It was almost hard to watch! It’s as…