Here’s my brain dump on the recent market action and how I’m approaching things: Since stocks started to slide in October, I’ve been seeing signals that only appear during bear markets so I’ve been operating under that assumption by reducing exposure to higher risk assets (stocks, corporate bonds, etc.) on bounces. We’re now…

Recent Updates – Insurance, Biotechs, Dividends and Rates

Here are some recent updates from this month, including some new investments and some thoughts on how the market is setting up in terms of the economic outlook, interest rates and higher yielding (dividend) stocks. New Investment – Chubb Limited (CB) Insurance is an interesting industry in which to invest. When run properly, it can…

Rising Yields are Creating an Opportunity for Income Focused Investors

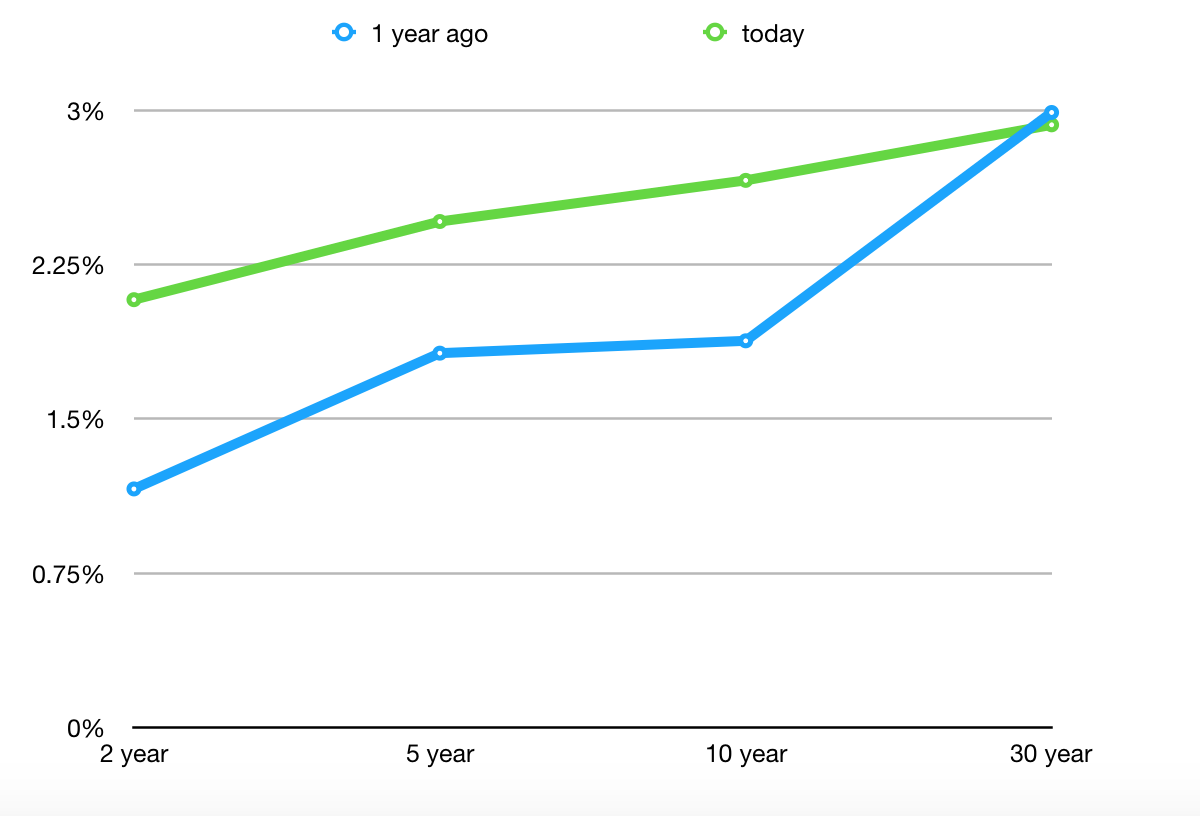

With stocks continuing to climb higher I’ve been a lot less active in terms of buying, especially on the Growth side of portfolios. However, there are some attractive opportunities popping up in the Income arena due to rising short and intermediate term bond yields. The yield curve is a line that measures yields at each…

How the Economic Cycle Impacts your Portfolio: Shifting to the Next Stage

There’s a general playbook for investing when it comes to the macro-economic business cycle. The cycle includes four stages: Reflation, Recovery, Overheat and Stagflation. You might also hear other terms used to describe each stage but we’ll run with these because Merrill Lynch made this nice chart for us. Within each stage, investment assets tend…

A High-Yield REIT for Retirement Income Portfolios

A Real Estate Investment Trust (REIT) is a type of investment structure that allows investors to add exposure to real estate in their portfolio. REITs receive preferential tax treatment at the company level, where virtually all taxation is passed on to the investors, if they pay out at least 90% of net income as dividends. …