If you don’t own gold, you know neither history nor economics. -Ray Dalio I haven’t written anything in a little while because, well, there hasn’t been a whole lot going on to write about. We have had the usual Fed go full-panic-dove-mode, we’ve reportedly made progress on a trade deal with China about 28 times…

The Value of Scarcity

I very much value scarce and unique investments. One of the first economic lessons we tend to learn as kids is that the more rare something is, the more it is worth. This is something you probably learned quickly if you ever collected or traded something like baseball cards when you were younger. These are…

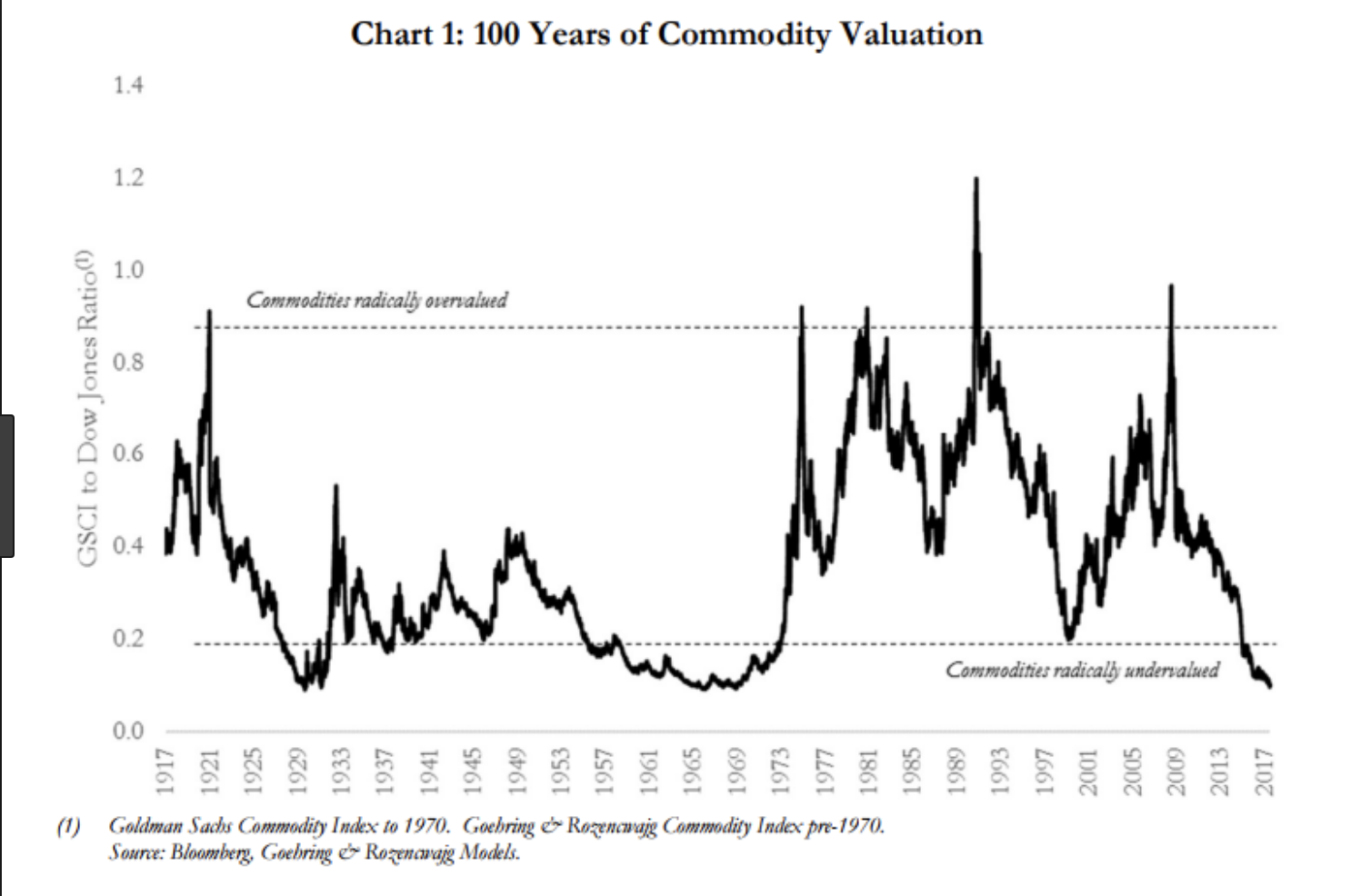

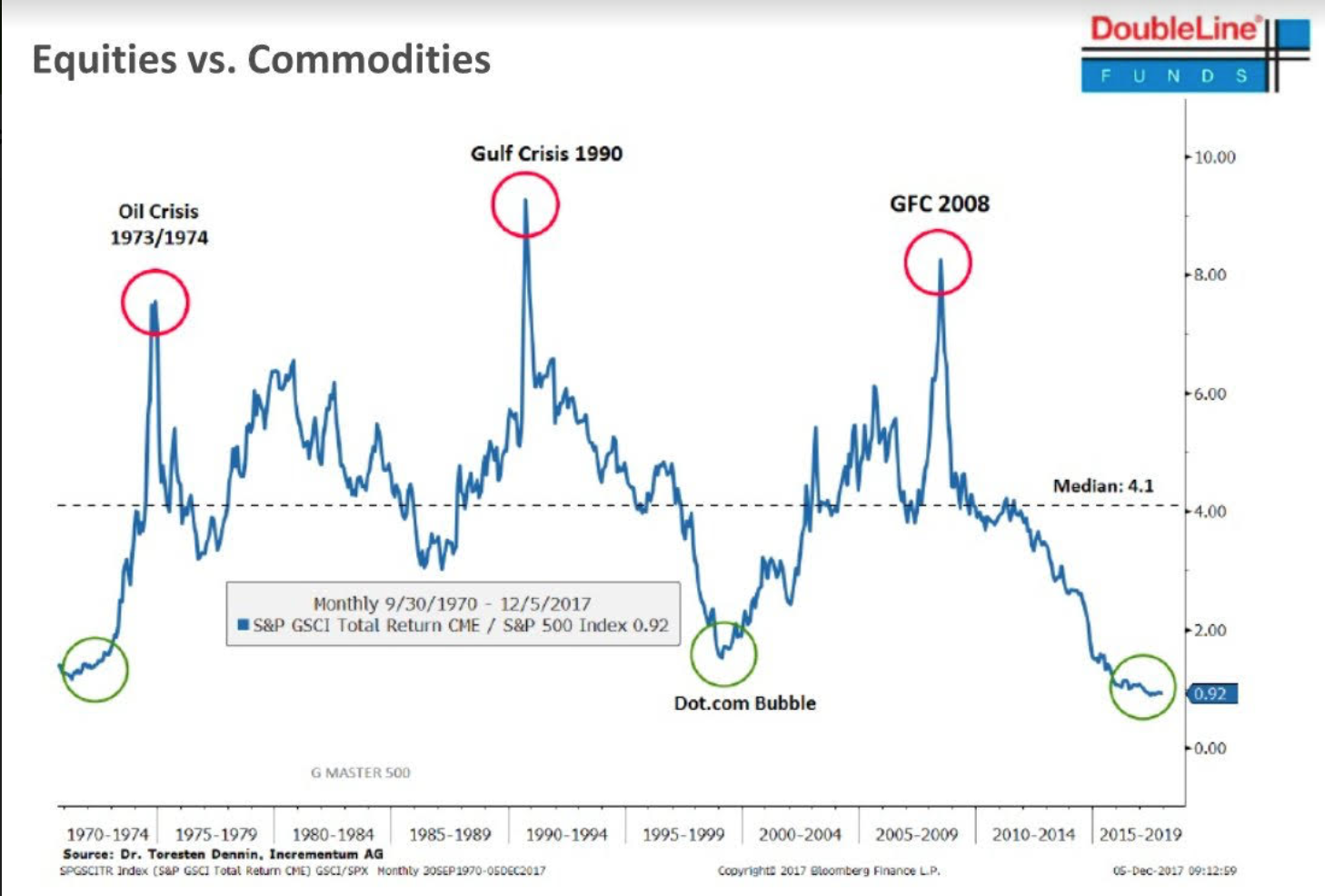

Why 2018 Might be the Year of Commodities

I’ve been telling my clients over the past few months that I expect inflation to pick up moving forward. The decline in the dollar this year and subsequent rally in most energy and industrial commodities is creating the year-over-year price change to bleed through to various inflation measures like CPI, PCE and (ISM) prices paid…

So What do I Like?

I realize that a lot of posts lately have been more focused on the risk side of things, pointing out assets that I feel are overvalued these days. Believe it or not, I’m pretty optimistic about some of the innovation we’re seeing in the world. I think we will see huge strides made over the…