Unfortunately the employment numbers lately have been disappointing and the job openings number this morning was very worrying, down 14% on a year-over-year basis. Initial and Continuing Unemployment claims have also been rising on a year-over-year basis. So we have unemployment starting to tick higher and hiring slowing – two things seen at the…

Macro & Markets Update: Dec 2019

I haven’t posted anything in a while because every time I’m about to write an update, a new piece of pretty big news develops that potentially shifts the picture. So here’s a high level overview of my thoughts from the past month. There’s a debate going on right now if the current slowdown will…

What Should vs What Is

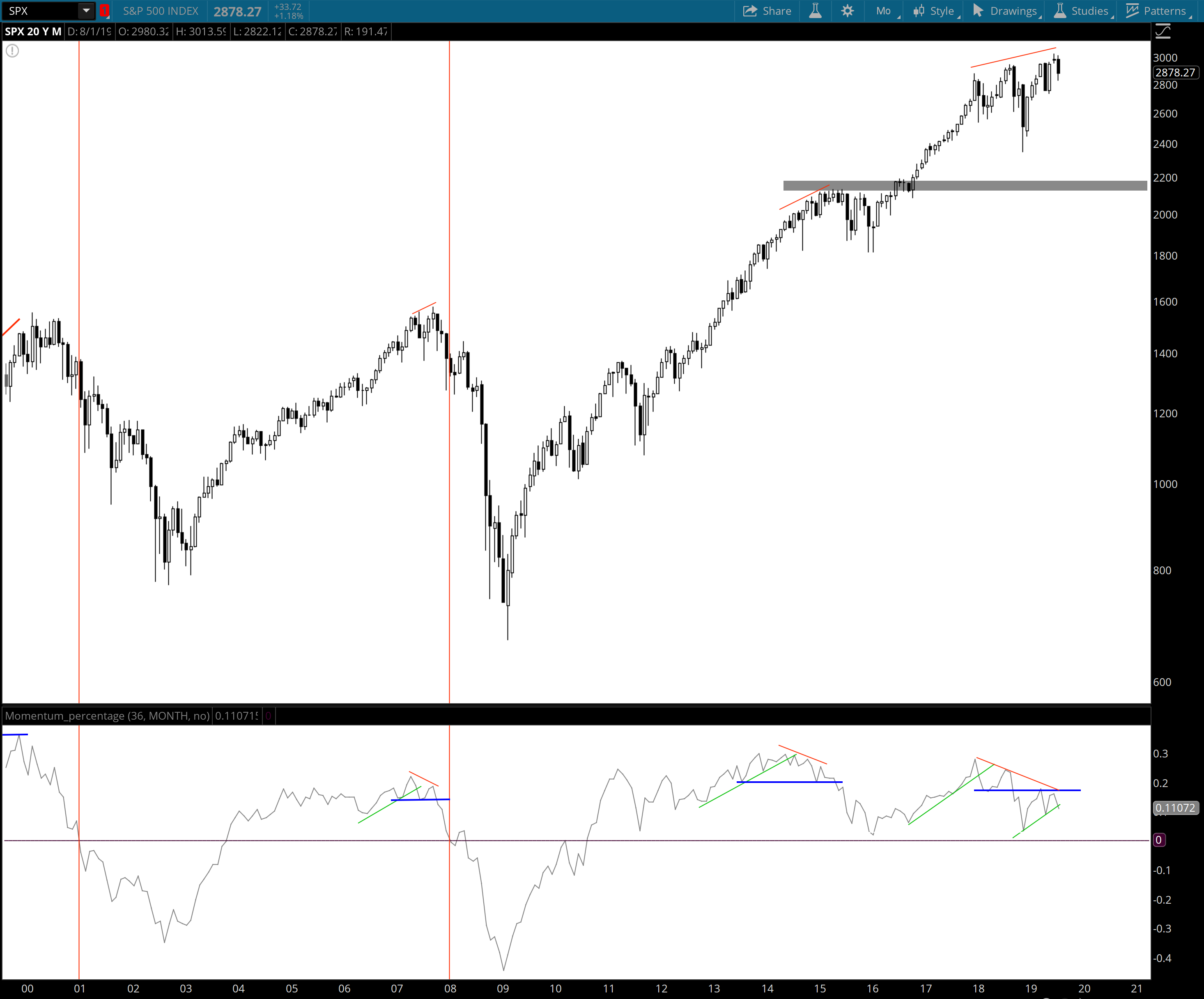

Markets have been fascinating this year. From my perspective, it has been a big battle of opposing forces. Macro economic analysis and fundamental analysis create a framework of what markets should do but obviously they don’t always cooperate. Technical analysis and systematic strategies attempt to analyze how one should be positioned based on what markets…

Markets & Macro Update – Aug 6th, 2019

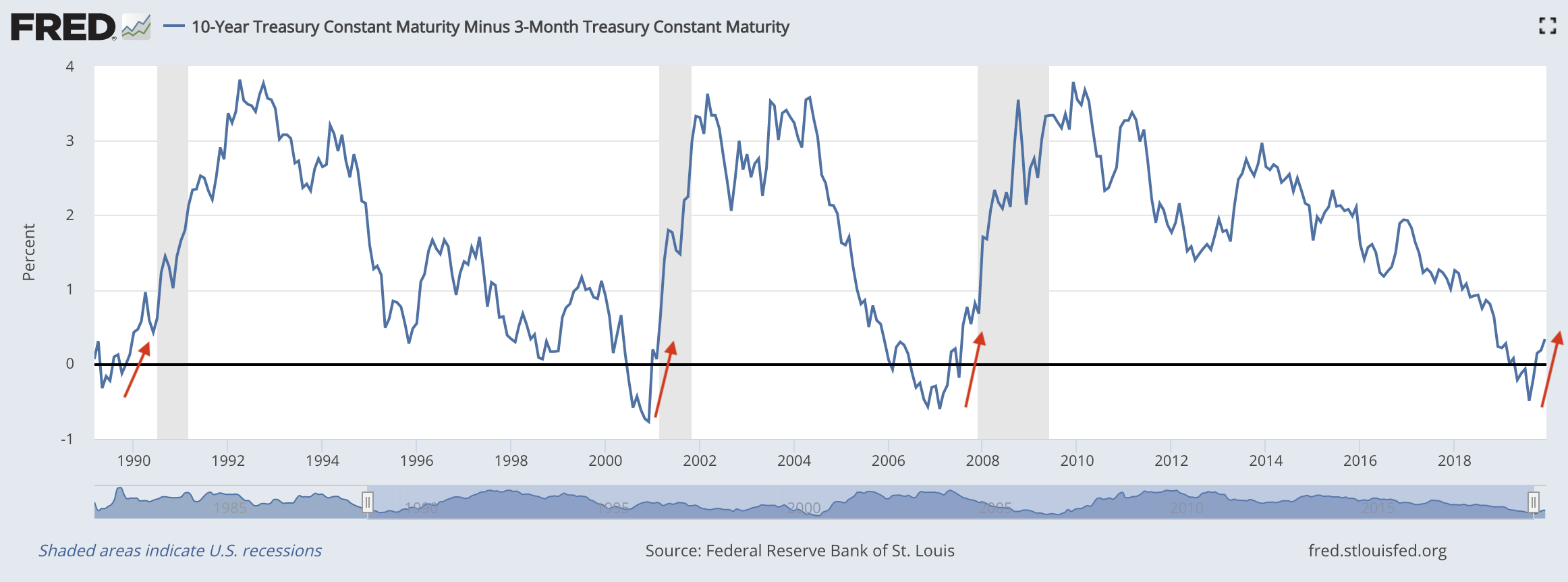

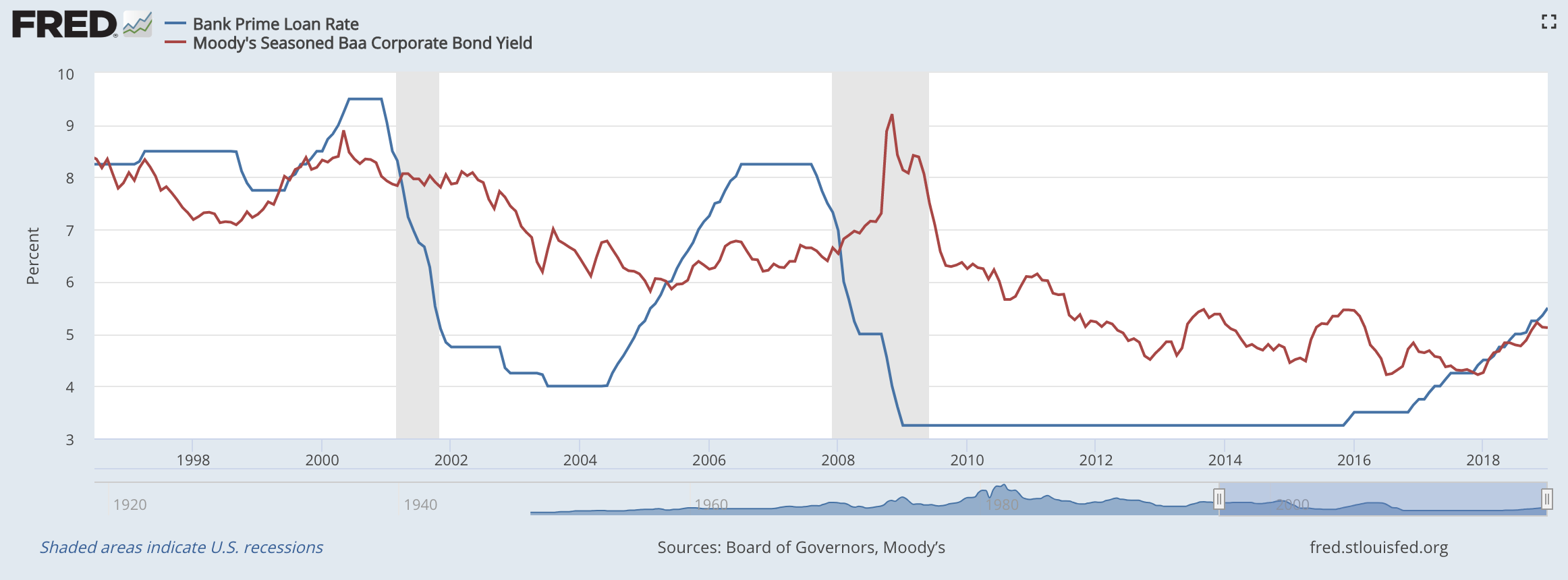

Last week the Fed cuts interest rates for the first time since the GFC a decade ago and the market’s response was pretty interesting. After referencing the 1995/96 one-and-done cut that prolonged the 90’s expansion all summer, I think they were hoping that they could get away with one cut as “insurance” that would ease…

Macro Update

Unsurprisingly, the Fed finally got the message from the markets and pulled a hard 180 last month. In a very short six weeks, they went from “balance sheet runoff on autopilot and more rate increases to come in 2019” to “we’re pausing rate increases and we’ll be flexible with the balance sheet.” Risk assets have…