Here are some books and writings that I have found to be the most helpful in shaping my thinking this year. For a longer-term geopolitical framework, I highly recommend Disunited Nations, by Peter Zeihan. It’s a very easy, somewhat fun, yet informative read on the shifting geopolitical tides we’re likely to see play out over…

It’s All Connected – Why Gold is Starting to Shine

If you don’t own gold, you know neither history nor economics. -Ray Dalio I haven’t written anything in a little while because, well, there hasn’t been a whole lot going on to write about. We have had the usual Fed go full-panic-dove-mode, we’ve reportedly made progress on a trade deal with China about 28 times…

The Fed, Curve Inversion & Conflicting Signals

The Federal Reserve raised the target range for the effective federal funds rates (EFF) again last week, now up to a range of 1.75% – 2.00%. They also raised the rate they pay banks interest on excess reserves (IOER) by 0.20%. With this bump, I wanted to see the print for the average bank prime…

Some Key Metrics to Watch

Macro changes occur at a glacial speed but these are typically the most important metrics to track. This is separating the signal (macro shifts, leading data points, etc.) from the noise (CNBC). Warning Signals from the Yield Curve One of the most basic yet crucial metrics is the yield curve, which has certainly received a…

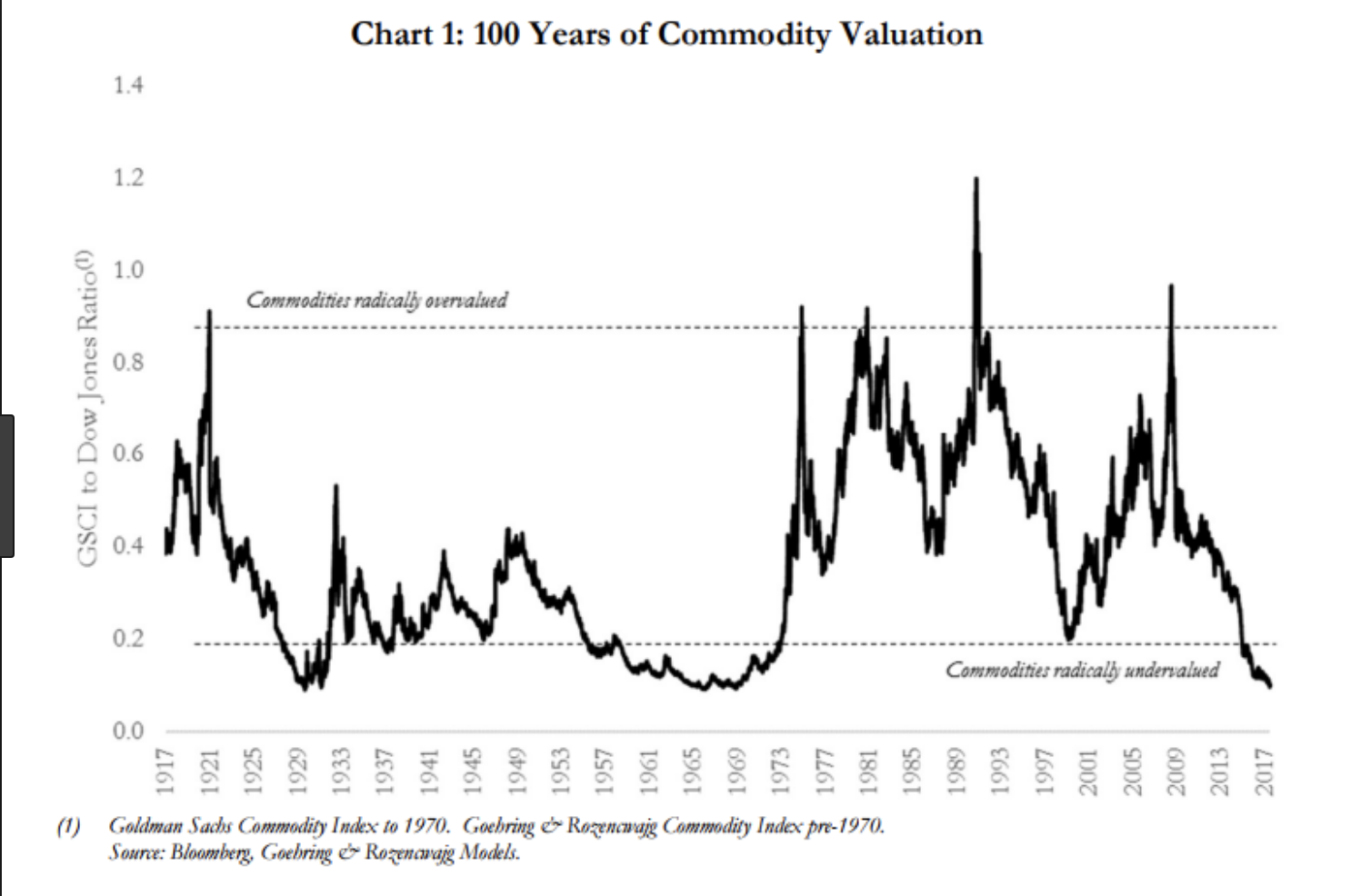

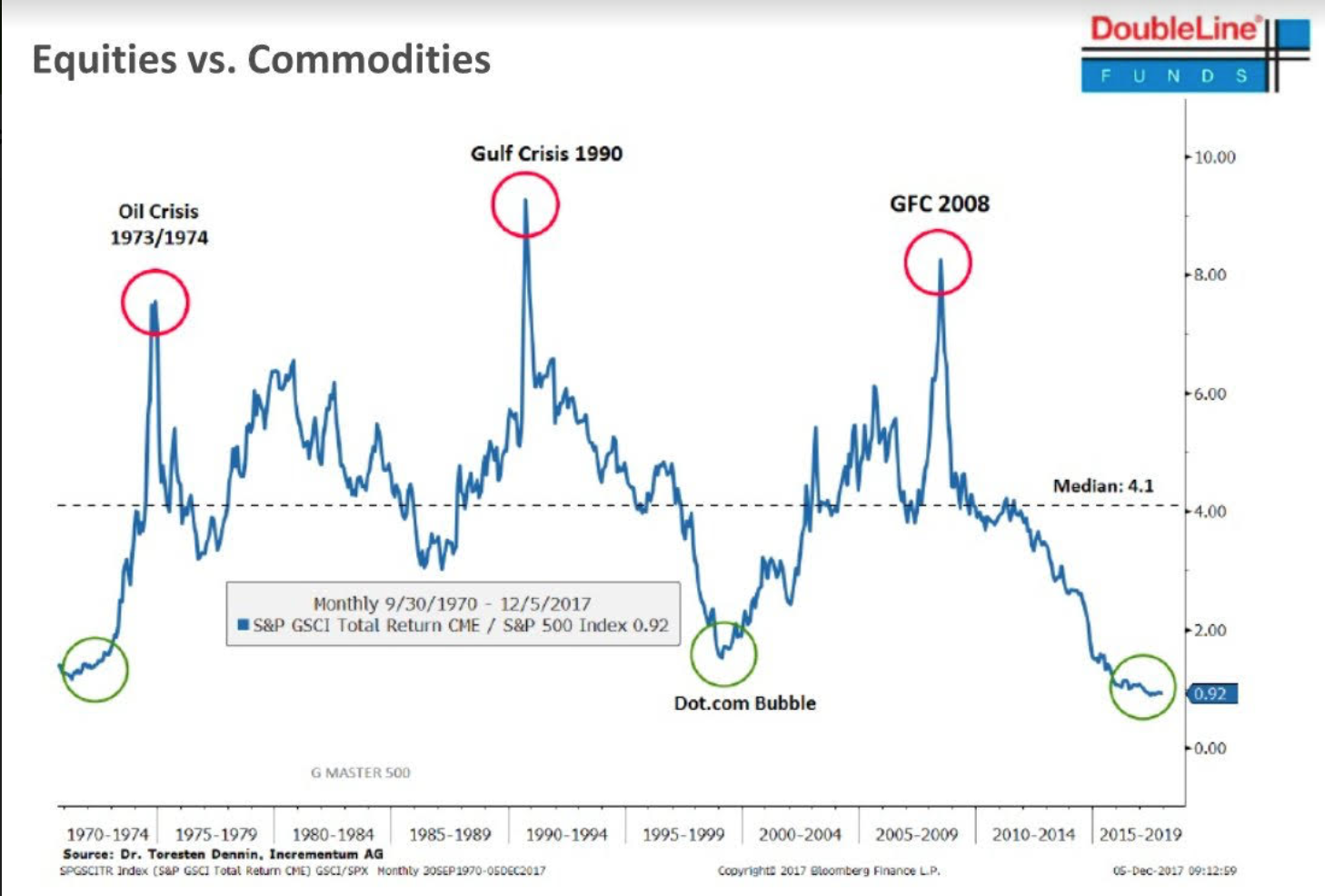

Why 2018 Might be the Year of Commodities

I’ve been telling my clients over the past few months that I expect inflation to pick up moving forward. The decline in the dollar this year and subsequent rally in most energy and industrial commodities is creating the year-over-year price change to bleed through to various inflation measures like CPI, PCE and (ISM) prices paid…

How the Economic Cycle Impacts your Portfolio: Shifting to the Next Stage

There’s a general playbook for investing when it comes to the macro-economic business cycle. The cycle includes four stages: Reflation, Recovery, Overheat and Stagflation. You might also hear other terms used to describe each stage but we’ll run with these because Merrill Lynch made this nice chart for us. Within each stage, investment assets tend…

Interesting Trends & New Investments

It’s been a while since I last posted anything. I’ve been spending a good bit of time researching some new investments and writing my semi-annual letter to clients. Here are some interesting charts and trends I’ve come across over the past couple of weeks. 1) Rent vs wages – inflation in all the wrong places…

Adapting Portfolio Construction – 2 Updates

I’ve been thinking a lot lately about portfolio construction, especially for retirees, in these computer-algorithm dominated investment markets which swing wildly every time someone from the Fed speaks. Markets today are unbelievably short-term focused and my clients aren’t paying me to day-trade their retirement portfolios. This means that portfolios which are built with a long-term…