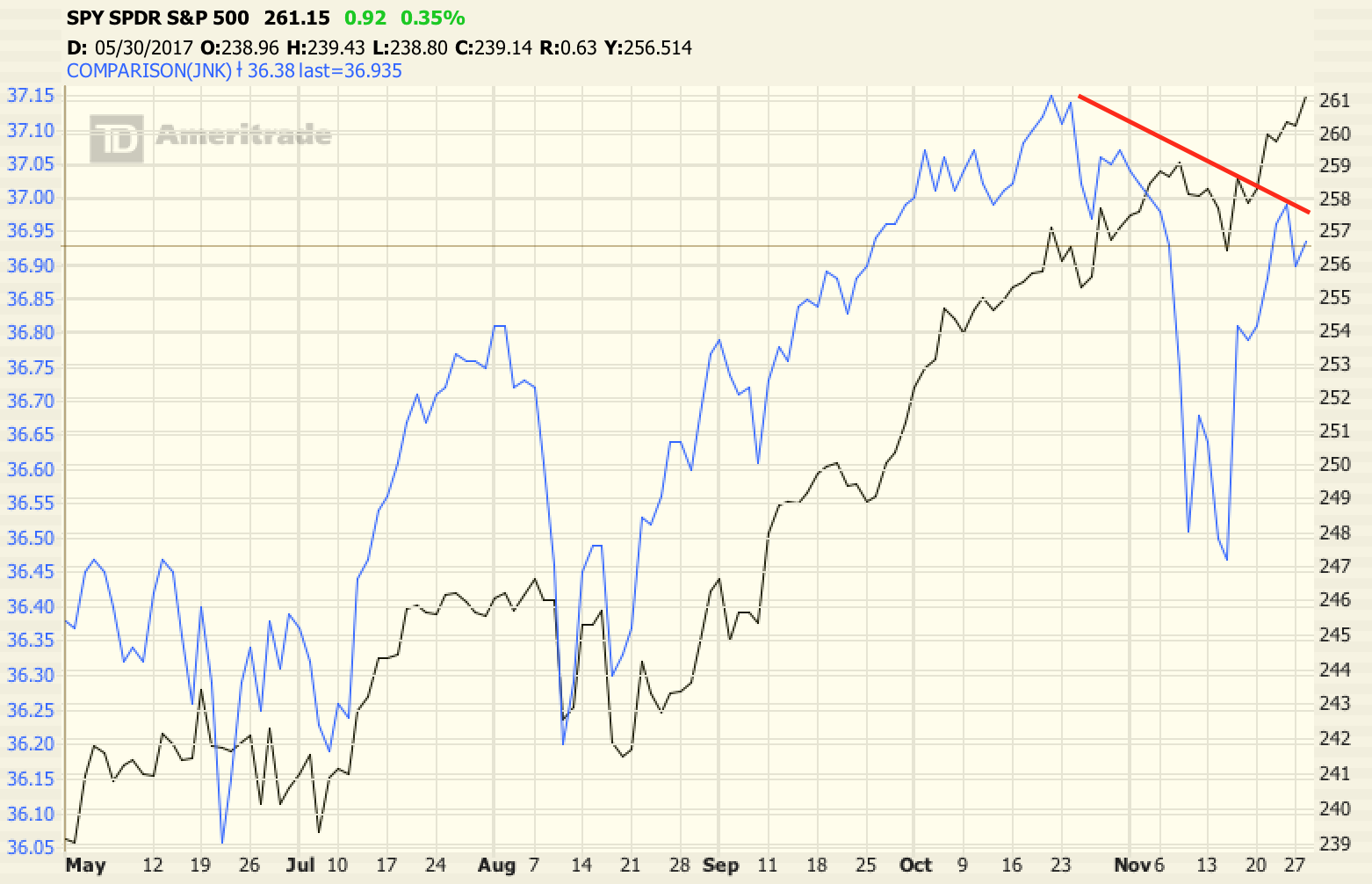

Here’s my brain dump on the recent market action and how I’m approaching things: Since stocks started to slide in October, I’ve been seeing signals that only appear during bear markets so I’ve been operating under that assumption by reducing exposure to higher risk assets (stocks, corporate bonds, etc.) on bounces. We’re now…

GE, a Lesson on the Perils of Debt and the Current Market Environment

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

Why I’m revamping our “Income” Holdings

I’ve been reworking the stock holdings within the income allocation of portfolios all year. To offer some background, I break portfolio allocations into two segments, Growth and Income, and fit clients based on the amount of volatility that’s appropriate for their retirement/financial plan. These days, “Income” oriented investments don’t offer much in the way of…