For most of this spring, I’ve been telling clients that I’ve been in “wait and see” mode. The US dollar, bonds and stocks have all been rallying this year, and while that can happen in the short-term, the dynamics of the market say that can’t last in the long run. Basically, 1 of the 3…

Potential Sea Change

Last week’s FOMC meeting may have signaled a coming change in the investment markets. During the press conference, Janet Yellen began to lay out how the Fed will start to reduce its balance sheet (i.e. all of the bonds that they have purchased through QE). She said it could begin in the very near future. …

Chart of the Week: US Interest Rates vs. Japanese Rates

Here’s a chart I saw over the weekend comparing the current path of the US Federal Funds Rate (blue line) to the path of the Japanese Policy Rate (red dotted) 16 years ago. The United States is not Japan. But our demographic structure today is very similar to Japan’s 15-20 years ago, and demographics ultimately…

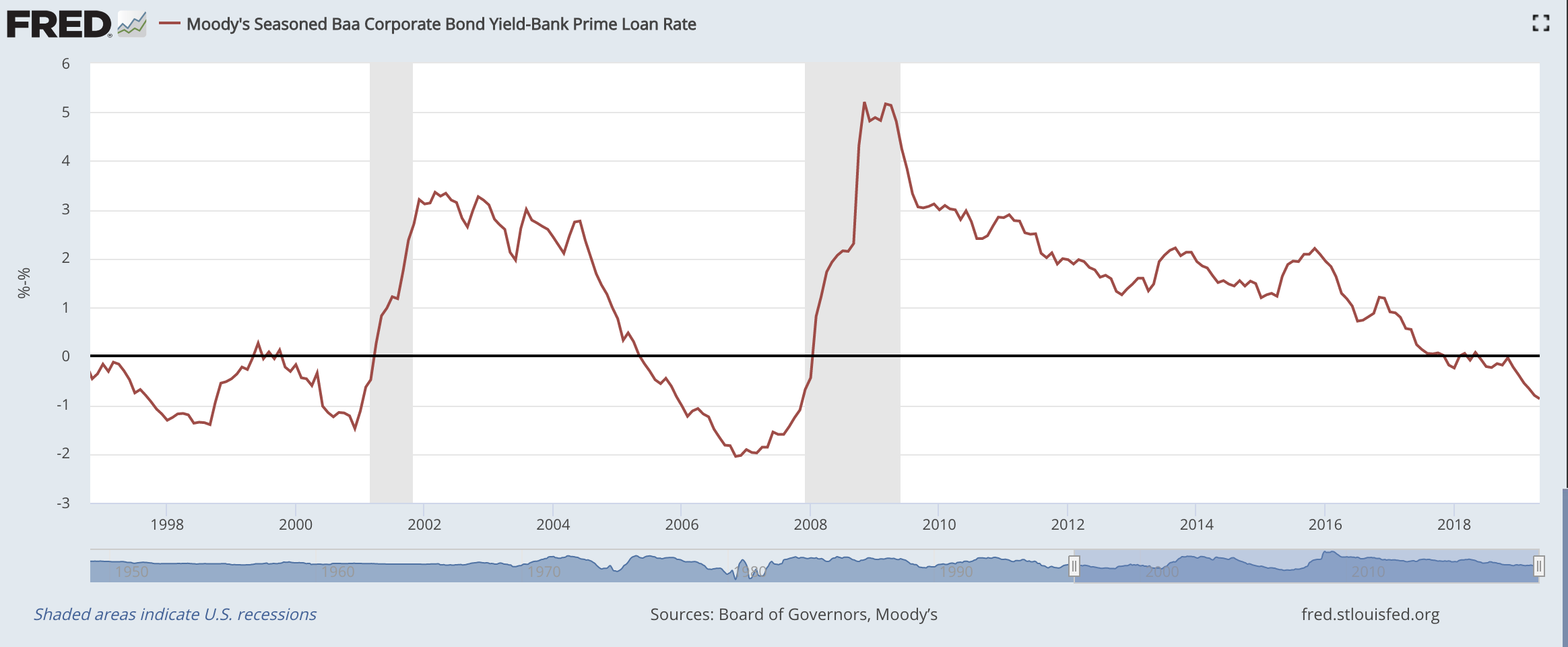

Why Recessions are Necessary for Growth

Why has the economy been stagnant since 2008? Not the stock market…the real economy: real growth, higher wages, etc. Because we never let the system clear itself of waste, excess, inefficiency and poor investment decisions. I think a good analogy to explain this concept is to think of the economy like a balloon. In order…

Chart of the Week: Effects of QE, Straight from the Horse’s Mouth

This week’s Chart of the Week comes from Jesse Felder, a very astute investor. I’ve posted charts like this in the past, illustrating the effects of the Fed’s Quantitative Easing on asset markets, but it’s worth revisiting after the former head of the Dallas Federal Reserve branch, Richard Fisher, openly stated that the main goal of…

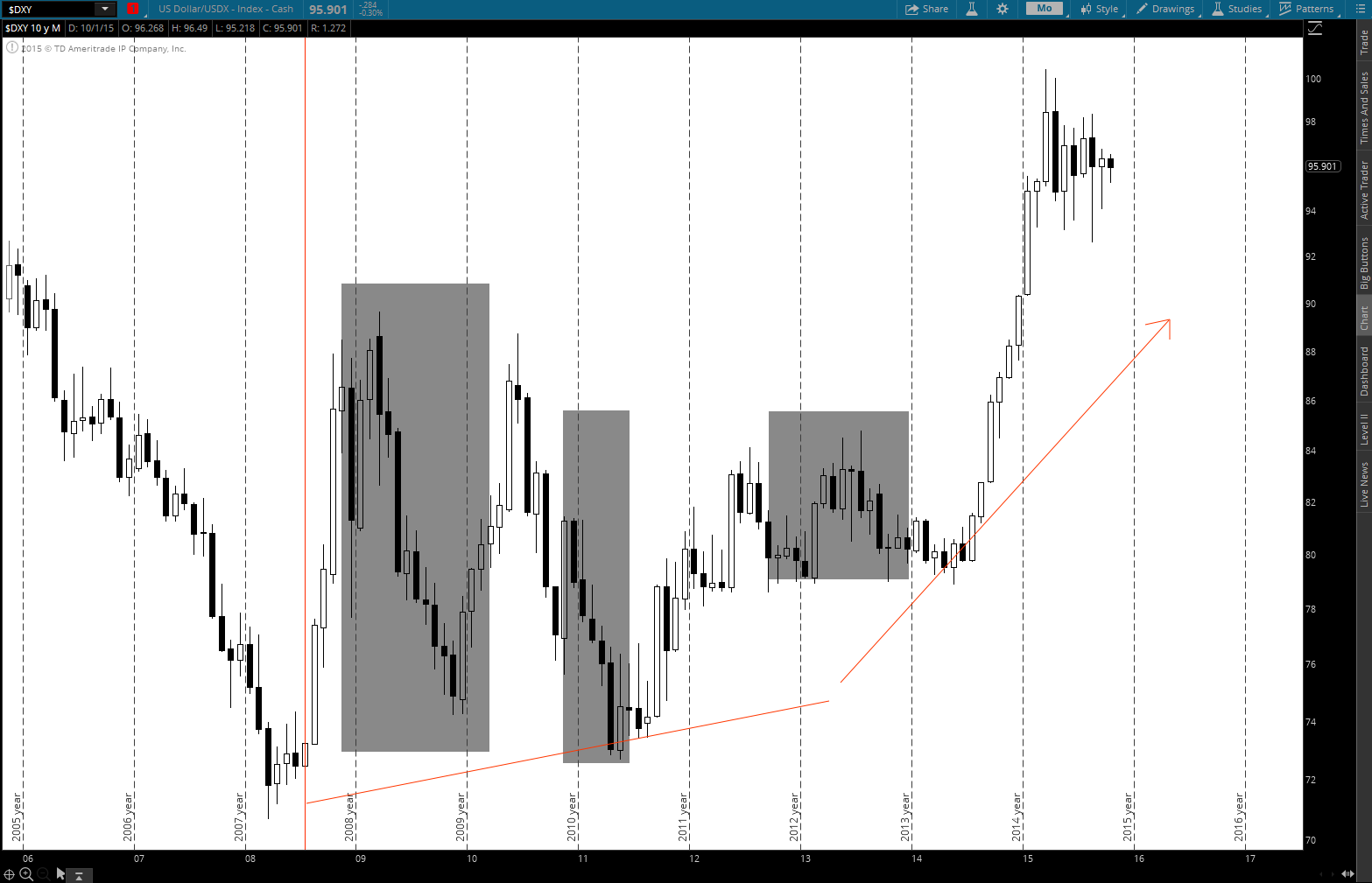

My Long Term View and How I’m Positioning Portfolios (Oct, 2015)

I’ll preface this post by saying that this is a long one (sorry about that) but it’s worth the time. To continue on the post from earlier this week where I mentioned that the best long-term investment opportunities typically come with short-term volatility, I’d like to outline my long-term view on how the world, global…

Liquidation is Spreading

Ever since Janet Yellen finally admitted last week that the global economy does matter, we’ve seen the deflationary-based selling spread to additional sectors, not just energy and metals as it was earlier this year. Anything sensitive to China and/or the global economy – like industrials, materials, transports, Emerging Markets, etc. – is being thrown out…

Recent Market Musings

China The Chinese stock market has probably been the hottest market over the last year. While exciting for the time being, I don’t trust it one bit. The Chinese economy has been supported by an unsustainable increase in credit the past few years and the bubble has the potential to pop at any moment. There…