I’ve been seeing warning signals since the spring that we’re in the later stages of this economic cycle so I wanted to post an update to illustrate. One thing to mention is that cycles tend to move very slowly which can be a double-edged sword. It’s nice because you can typically read the tea leaves…

The Pain & Opportunity of a Dollar Squeeze

Global investment markets are becoming very macro driven and it’s pretty important to understand the big picture dynamics at play right now. The US dollar is the key to everything and there has been a growing shortage of dollars throughout the global economy over the past few years which we’re now seeing create the usual…

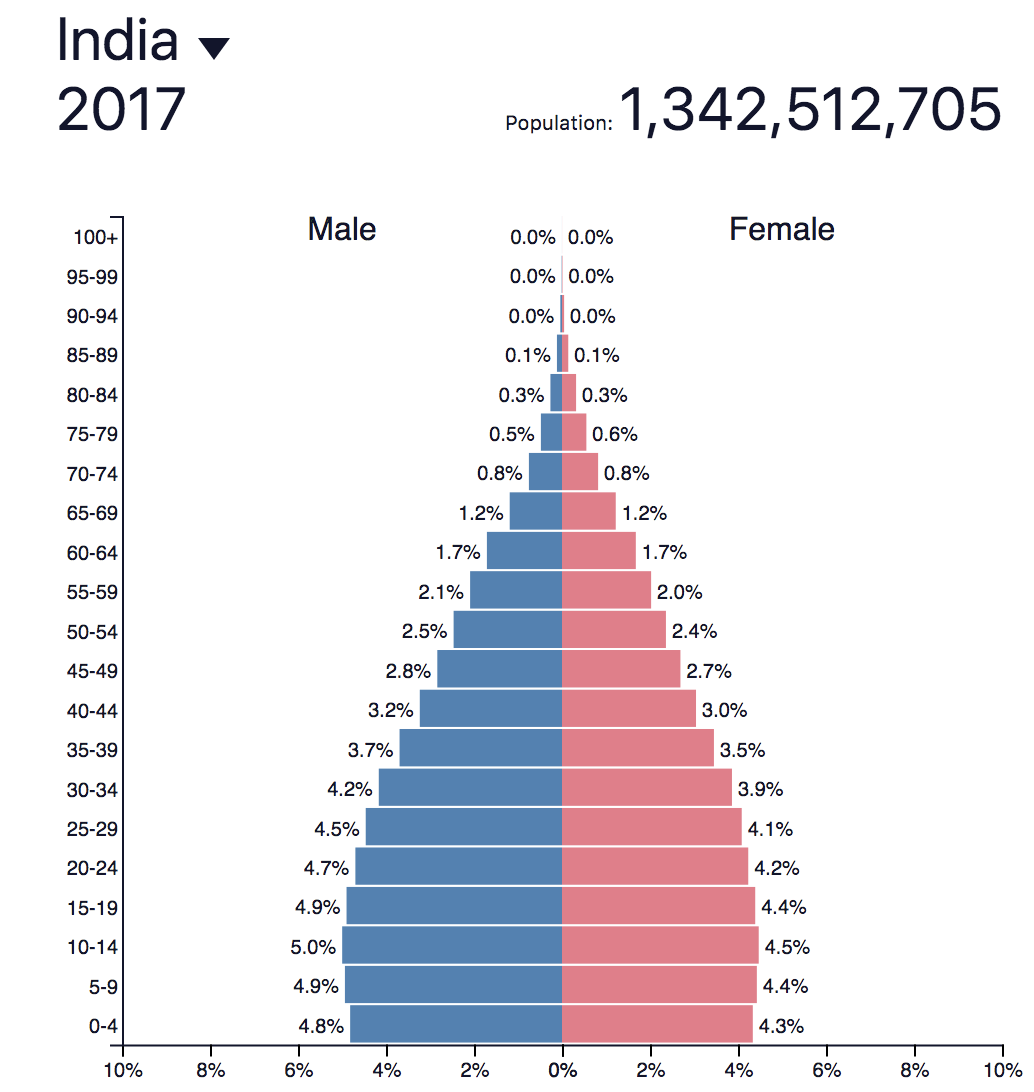

Why India will be the Center of Global Growth for the Next Decade

If you’re a long-term growth investor, you should be focusing on Asia. Everyone in the US loves to focus on the US stock market (home country bias) but valuations in the US are pointing to disappointing returns over the next decade. That’s not to say that there aren’t any attractive investment opportunities in the US…

GE, a Lesson on the Perils of Debt and the Current Market Environment

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

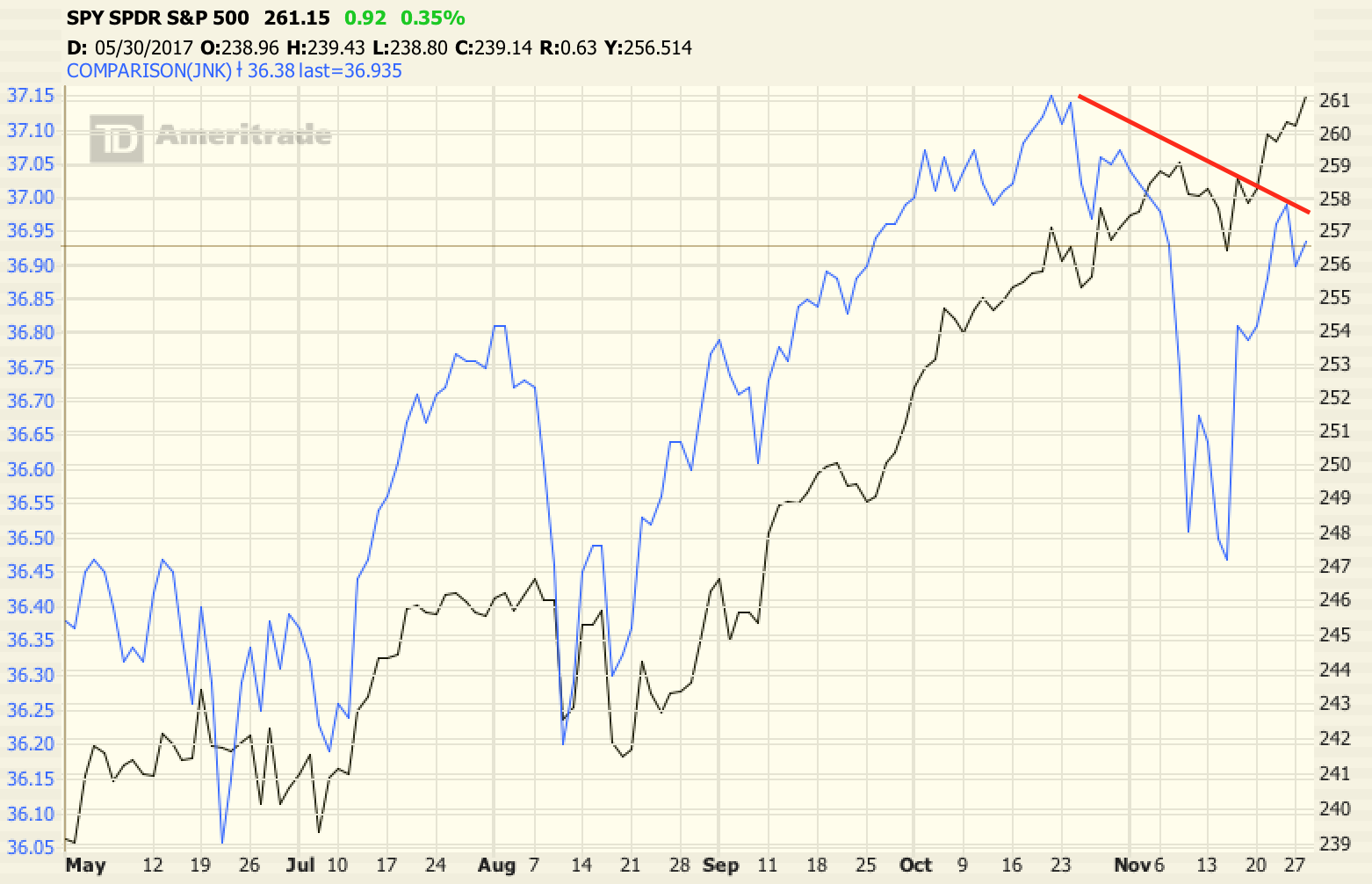

My Current Outlook for US Stocks

Sometimes I’ll receive a question along the lines of “Hey, what do you think the stock market is going to do this year?” I’m assuming they’re looking for a very specific answer like “the stock market is going to rise 10% this year…” but markets and investing are not that clear cut. Even when you…

New Stock Investments

I added to some existing positions (like Google and Celgene) during the selloff following the Brexit vote but also made some new purchases over the past few weeks that I’ve been meaning to detail. New Positions 1. Red Hat Software (RHT) Red Hat is a distributor of open-source Linux operating systems. Open-source means that the…

So What do I Like?

I realize that a lot of posts lately have been more focused on the risk side of things, pointing out assets that I feel are overvalued these days. Believe it or not, I’m pretty optimistic about some of the innovation we’re seeing in the world. I think we will see huge strides made over the…

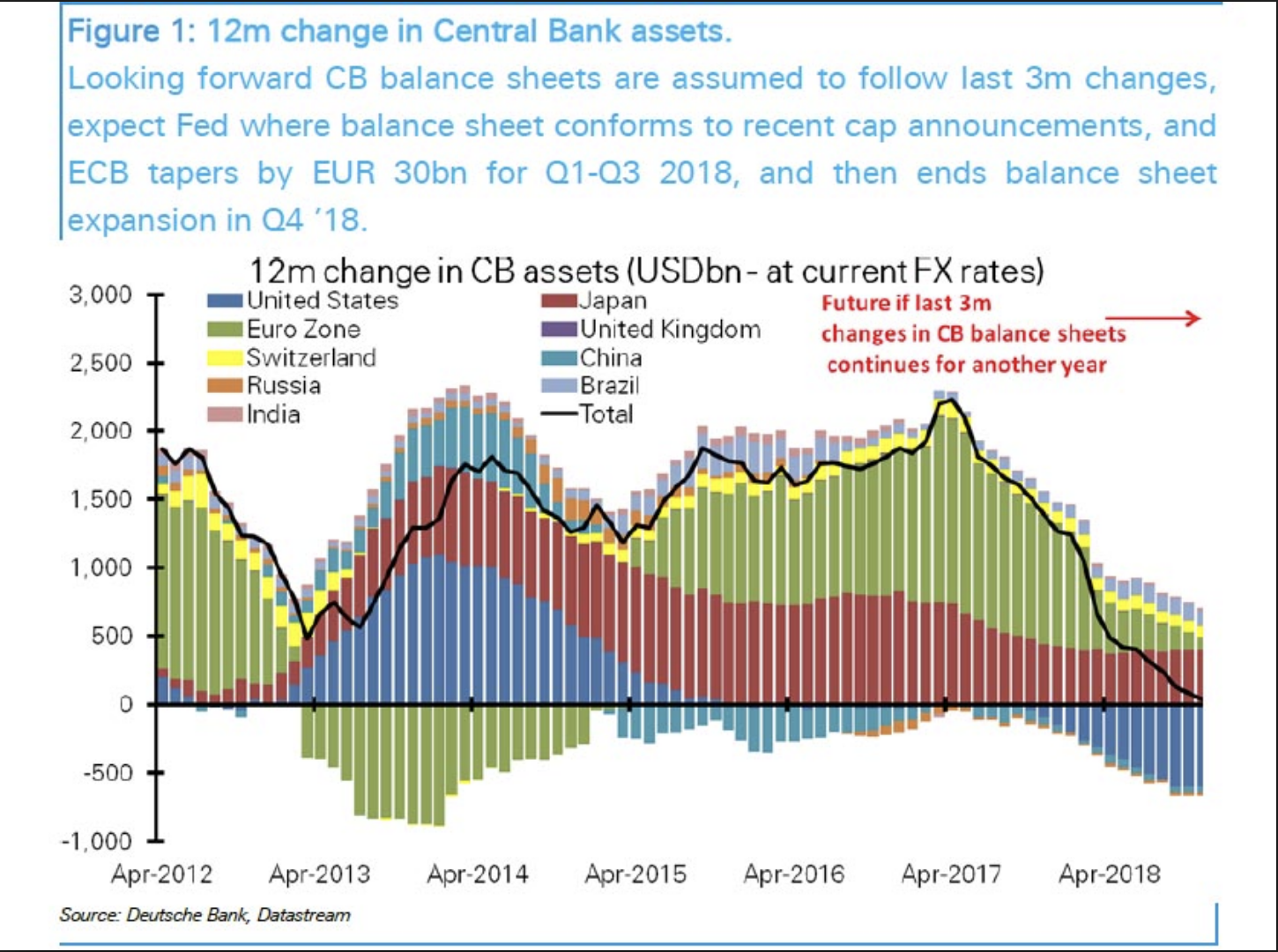

High-Level View of Today’s Global Economy & Markets

Here’s an article from the Financial Times earlier this month that pretty much sums up the current state of the global markets. I think an easy way to envision our global financial system (a credit-based fiat system) so that it’s easier to understand is to think of it like a balloon. When credit is easy and liquidity is being…