Well, it finally happened. The short volatility trade blew up and the volatility genie is now out of the bottle. Credit and monetary conditions are still extremely loose so this should calm down soon, but I doubt we see a low volatility regime like 2017 in a long time. So here’s what happened: Two Inverse…

GE, a Lesson on the Perils of Debt and the Current Market Environment

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

Chart of the Week: Debt-Funded Buybacks

This week’s chart comes from an article on Bloomberg discussing the percentage of buybacks that are being funded by debt – now over 30% for the first time since June 2001. Notice how this measure tends to peak around high points in the overall market (2000/2001, 2007 and 2011). You can read the full article here.…

Which is More Important: A Great Business Model or Good Management?

The answer is management, plain and simple. When you invest in the stock of a company, you entrust management to be the steward of your capital and to make smart, value enhancing business decisions. It doesn’t matter how great a product is or what competitive advantages a company may have, if management makes poor decisions…

Update on Kinder Morgan

I rushed to get yesterday’s post out and realized afterwards that I didn’t update you on what I was doing with the position. In short, we’re moving on to greener pastures. This story offers some good investment lessons so I’ll provide a few more details. Despite my concerns, I chose to stick with Kinder Morgan…

Here’s What Happens When you Play with Fire

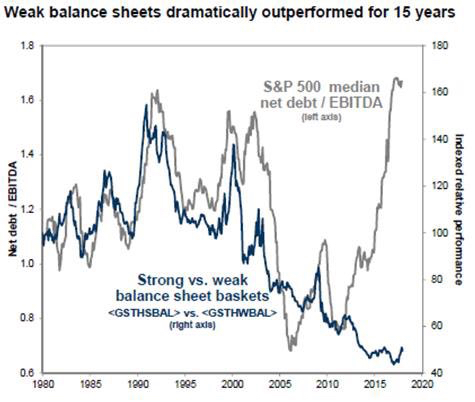

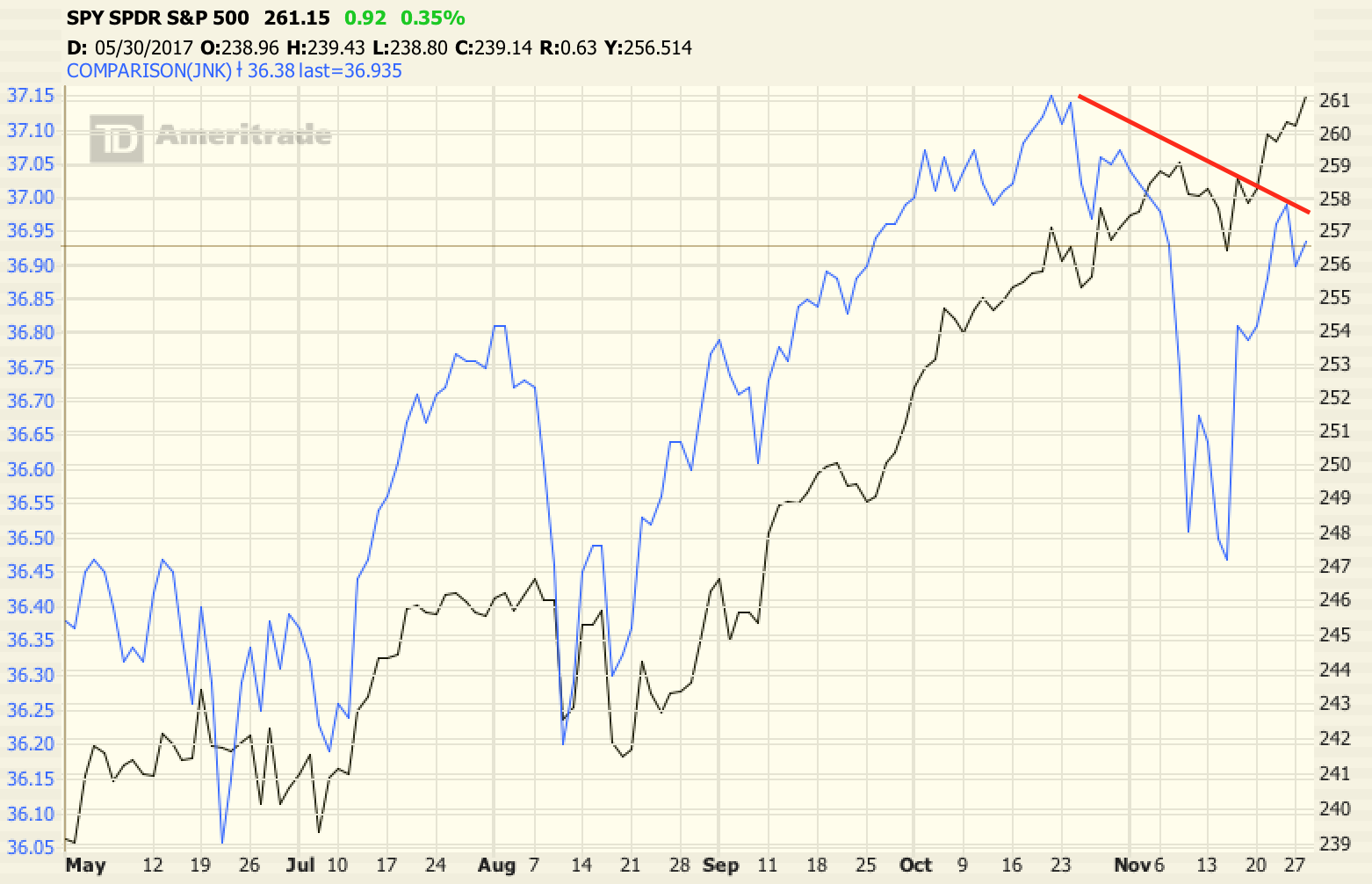

Earlier this year I cut all exposure to energy except for one company… A few month later, I started cutting back on all companies that were highly leveraged with debt because I could see the turn in the credit cycle coming and I knew that companies that were relying on the ability to access the…

Why Government Bonds are the Worst Long-Term Investment

Things are heating up between Greece and the rest of Europe and time is quickly running out without a solution. There are really only two solutions: Greece either 1) leaves the Eurozone and returns to the drachma which will rapidly lose value as they once again have the ability print as much as they want,…

Sovereign Debt Crisis

There have been some interesting developments over the past week that give me additional conviction that the next crisis the investment markets face will be a sovereign debt crisis (government bonds). We’ve already seen the early stages in Europe when yields in Greece, Portugal, Ireland, Italy and Spain spiked higher. Now we have bond yields…