I generally look at Growth investments in one of two ways: either steady compounders or huge reward-to-risk, asymmetric growth opportunities. The steady compounders are the companies that can consistently post growth year after year in a secular manner – secular meaning a long-term story not affected by short-term cycles. Whereas the high growth opportunities tend…

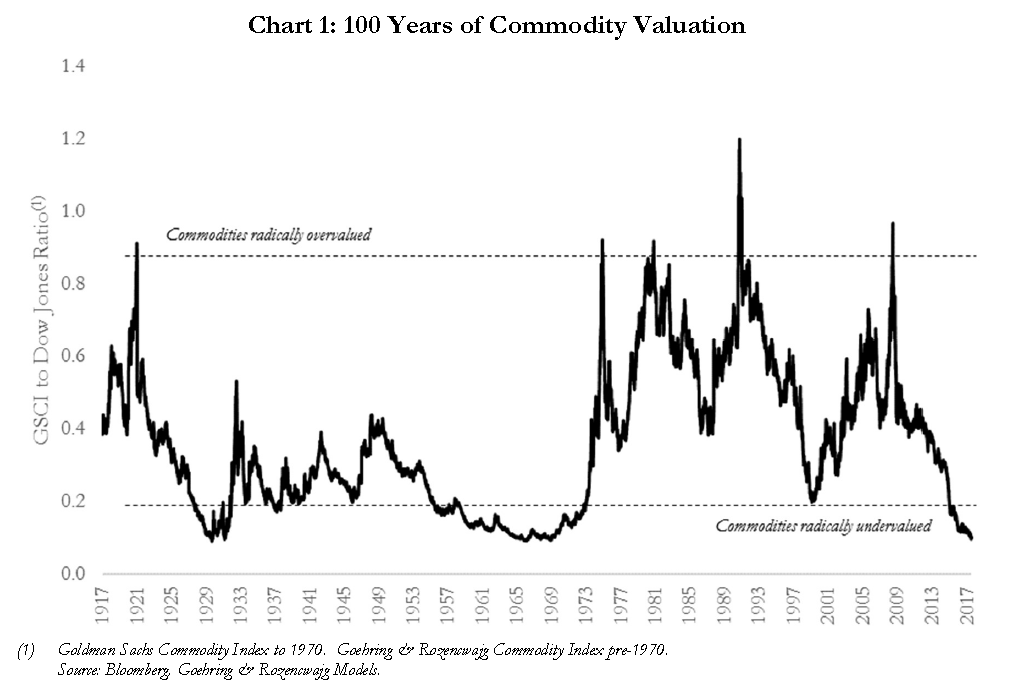

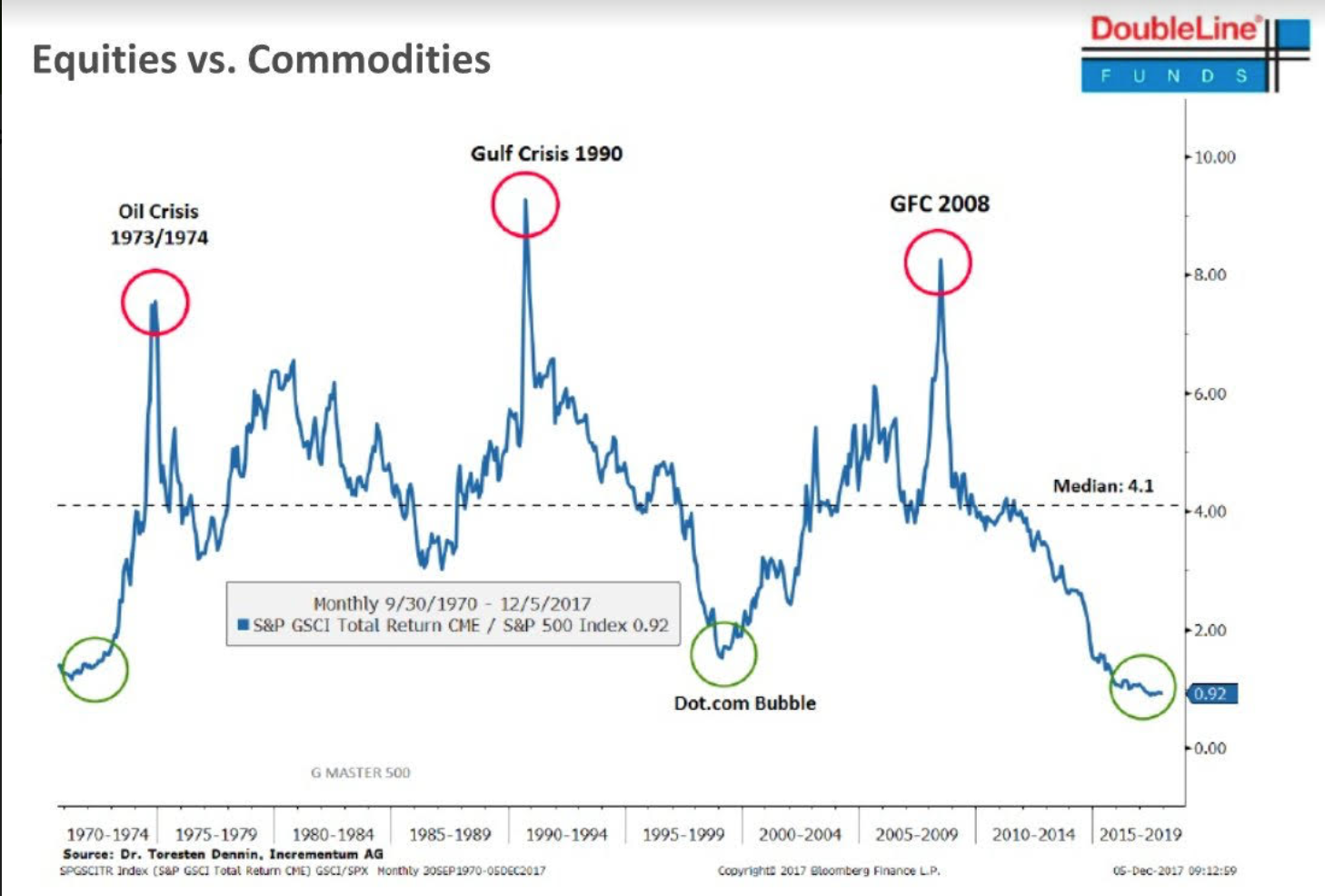

Why 2018 Might be the Year of Commodities

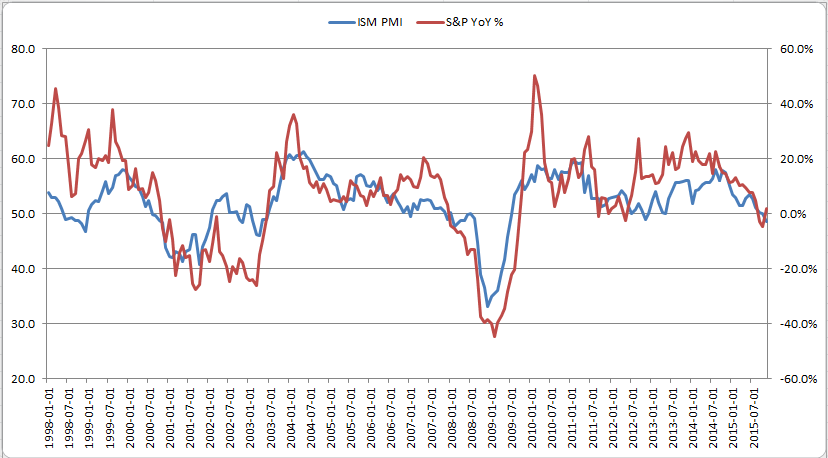

I’ve been telling my clients over the past few months that I expect inflation to pick up moving forward. The decline in the dollar this year and subsequent rally in most energy and industrial commodities is creating the year-over-year price change to bleed through to various inflation measures like CPI, PCE and (ISM) prices paid…

How the Economic Cycle Impacts your Portfolio: Shifting to the Next Stage

There’s a general playbook for investing when it comes to the macro-economic business cycle. The cycle includes four stages: Reflation, Recovery, Overheat and Stagflation. You might also hear other terms used to describe each stage but we’ll run with these because Merrill Lynch made this nice chart for us. Within each stage, investment assets tend…

Earnings Updates

Once again, I’ve been very pleased with the earnings and outlook reported by the majority of the companies we own. A few of our core holdings held their conference calls this morning so I wanted to provide a quick update. CF Industries (CF) & Terra Nitrogen (TNH) CF is our largest “Growth” holding and TNH…

Making Sense of the Nonsense

I’d like to comment on two things that have been a huge disservice to the average (nonprofessional) investor. One is CNBC and the second is the Federal Reserve. Do yourself a favor and don’t watch CNBC. Like all media companies, CNBC is in the business of collecting eyeballs. They want strong ratings so they can…