I haven’t posted anything in a while because every time I’m about to write an update, a new piece of pretty big news develops that potentially shifts the picture. So here’s a high level overview of my thoughts from the past month. There’s a debate going on right now if the current slowdown will…

When Correlations go to 1, Short Volatility and Negative Convexity

2017 has been the year to sell volatility. Volatility on nearly all asset classes has been compressed to historically low levels, which is a function of the world’s major Central Banks going into asset purchase overdrive for the past 18 months. When you flood the global financial system with free money, people tend to leverage…

Potential Sea Change

Last week’s FOMC meeting may have signaled a coming change in the investment markets. During the press conference, Janet Yellen began to lay out how the Fed will start to reduce its balance sheet (i.e. all of the bonds that they have purchased through QE). She said it could begin in the very near future. …

The Challenges Ahead for Long-Term Investors

I suppose this is my annual warning to long-term investors to tread carefully in the investment markets. 2016 has been a year of rotations with the net composite of a balanced portfolio not moving a whole lot (i.e. things that did well in the first half of the year have done poorly during the second half,…

Chart of the Week: Central Banks Attempting to Monetize the Whole World

The world’s top 6 central banks have now monetized, which means purchased with “printed” money, total assets worth almost $20 trillion (40% of global GDP). Since they’re running out of government bonds to buy (you know, since they’ve pushed yields negative), they’ve moved on to corporate bonds and stocks. The Swiss National Bank (SNB) is now…

Adapting Our Approach Toward Growth

Just about all of my clients are long-term, retirement oriented investors. The most frustrating thing the past few years for long-term investors is how the central banks have largely “killed” the markets in the traditional investment sense. What I mean by “killed” is that I cannot honestly consider bonds yielding less than 2% and stocks…

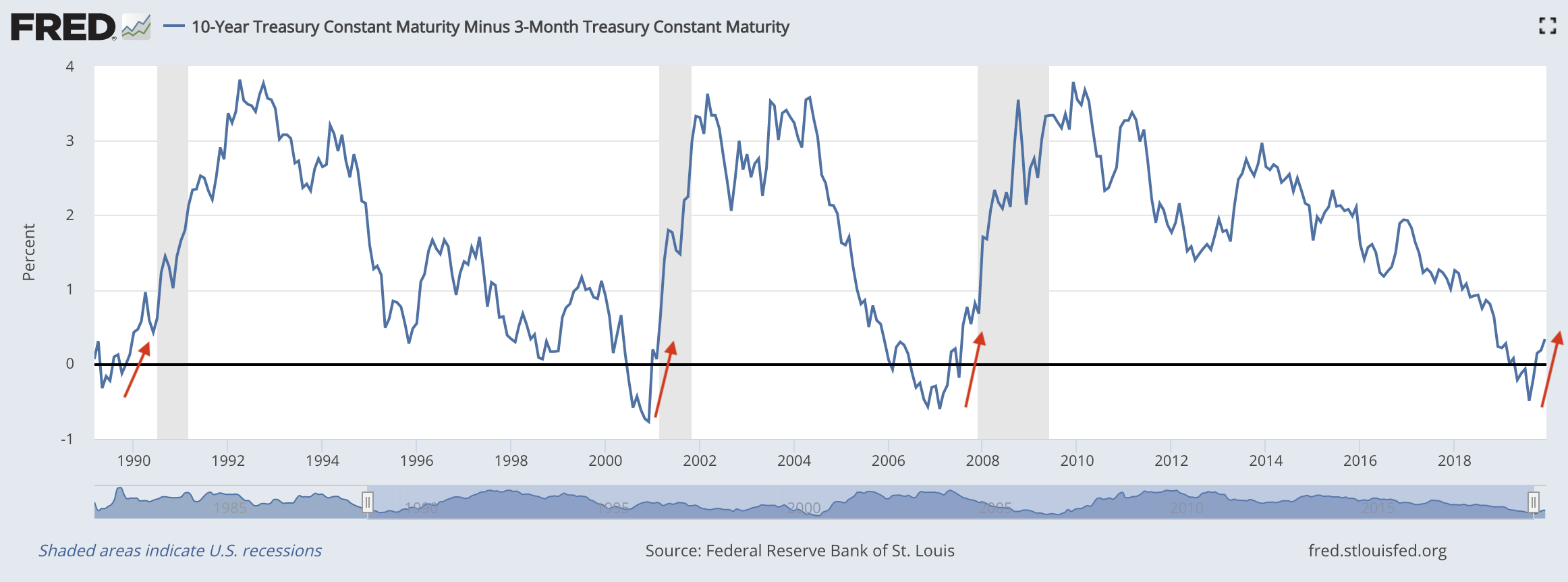

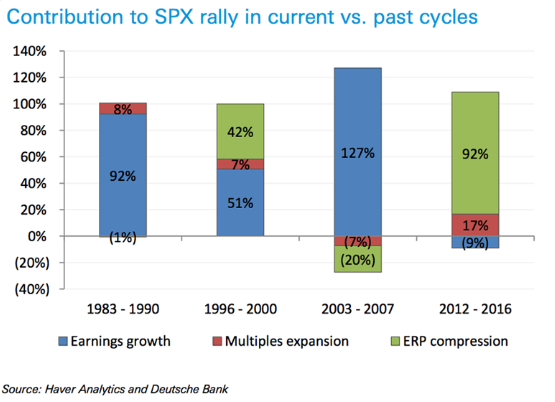

Charts of the Week: The Whole Story

These charts tell the whole story regarding the current state of the global economy and investment markets: Global central bank asset purchases compared to global equity % change (let’s be honest, there’s only one thing that matters…) Deutsche Bank’s recent report on the current stock market rally (’12 to ’16) compared to past market climbs…

Brexit

If you haven’t yet seen the news this morning, the UK voted to leave the European Union (EU) yesterday (results came out late last night). We’re seeing this type of movement across the globe right now. The vote to leave is a global middle class that is frustrated by ever growing wealth inequality, stagnant wages…