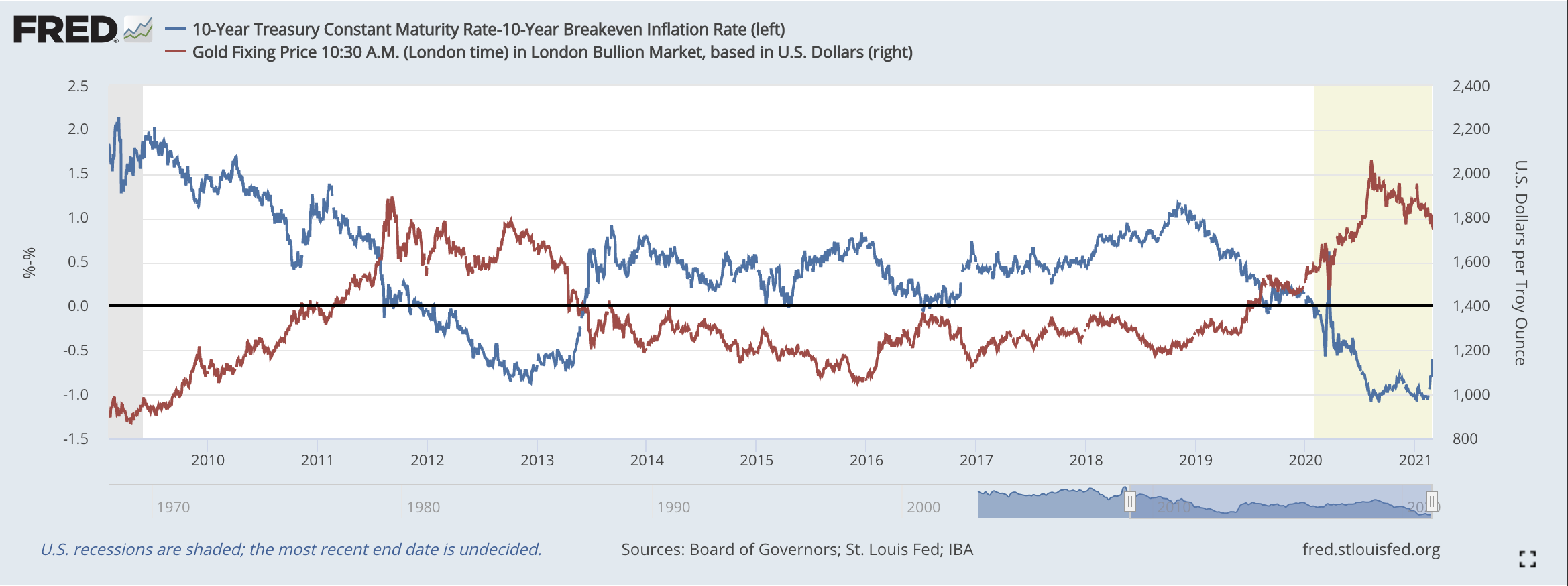

We’re soon going to find out where the Fed’s pain point lies. Treasury yields on the long end of the curve have been relentlessly pushing higher this year with the 10-year treasury pushing past 1.5%, all while pressures within the plumbing of the money markets and repo are pushing into negative territory. Quite the mix…

Yields & Income Investment Updates

The 10-year Treasury yield stopped just short of 3% last week and the recent Commitment of Trader’s data is showing massive short exposure to the 10-year futures contract by non-commercial traders. These are speculative positions betting that the 10-year yield will continue to rise (bond prices will continue to fall). The market has a funny…