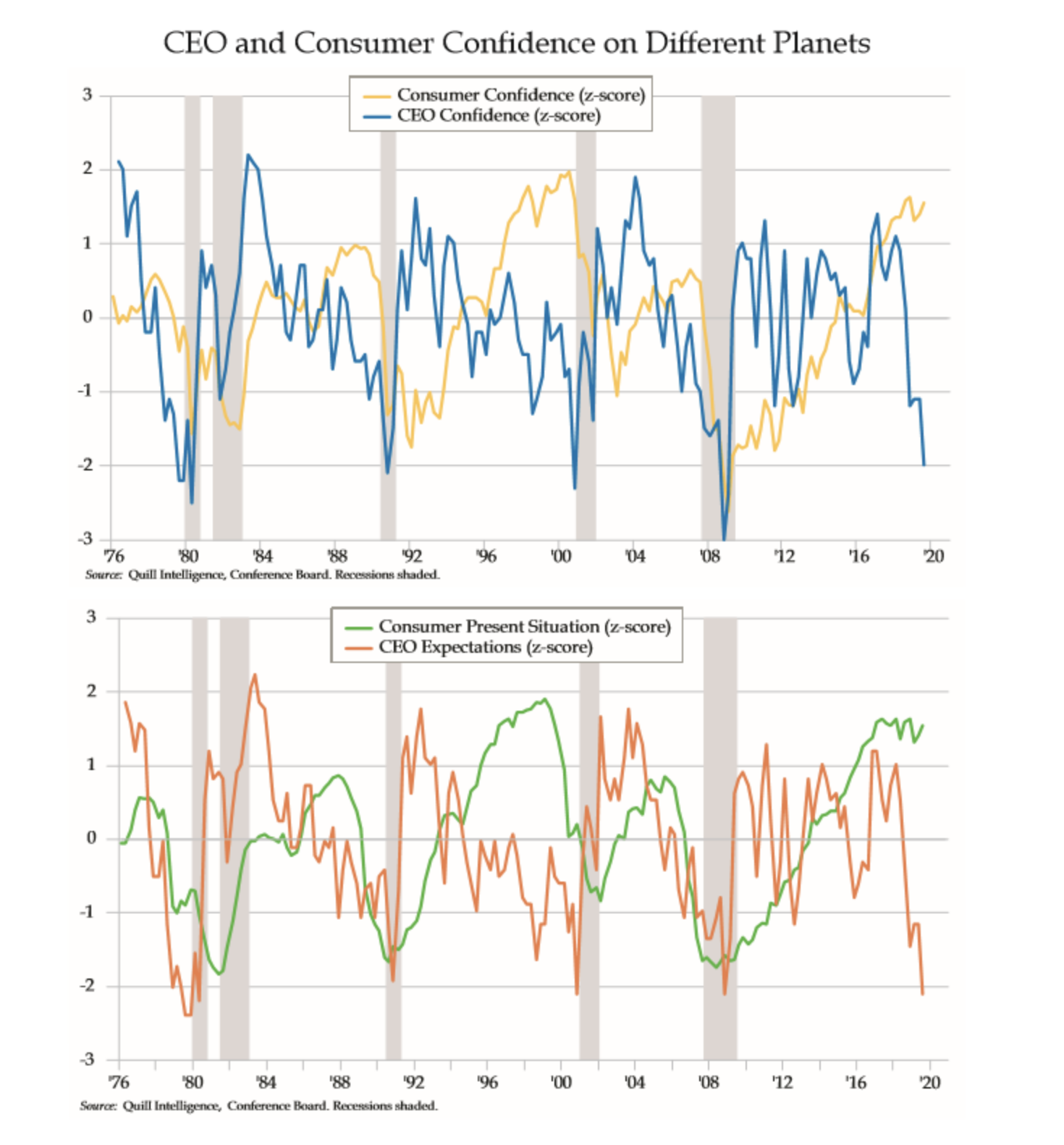

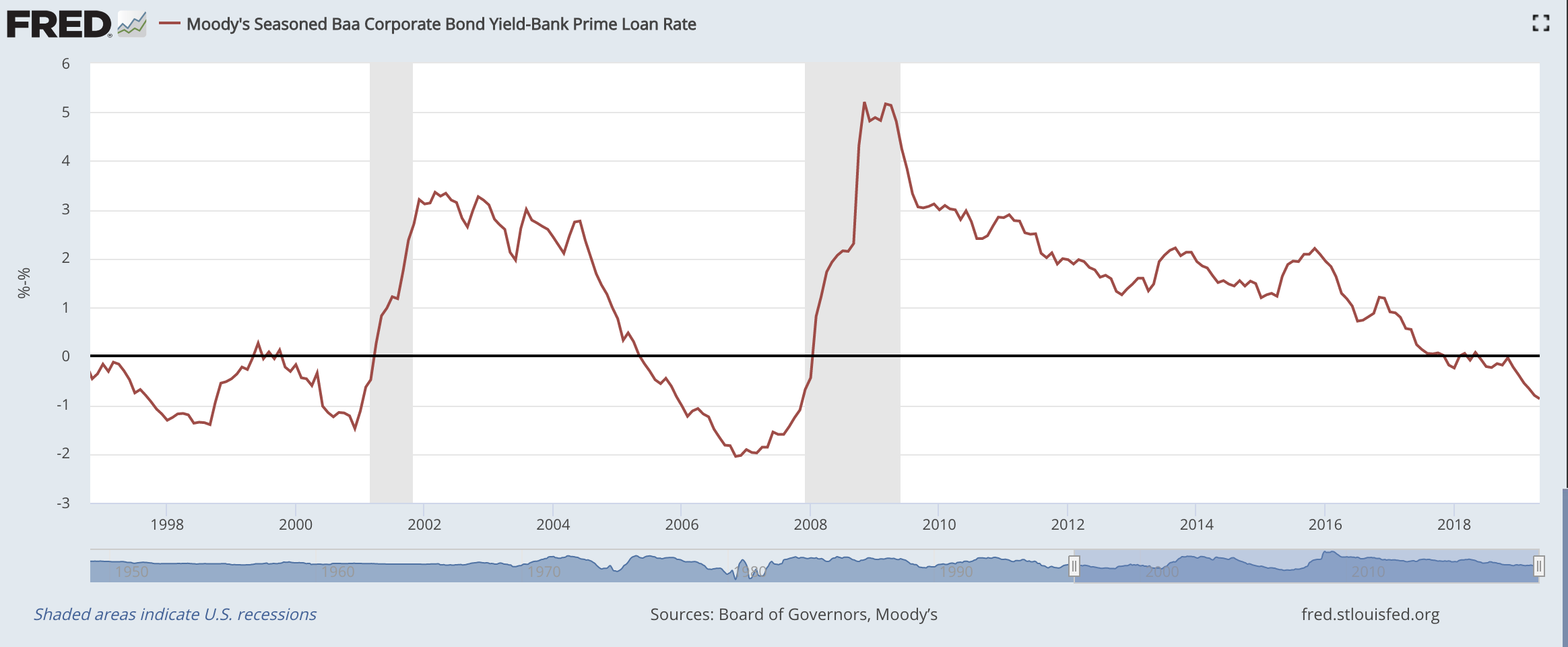

I continue to see classic signs of late cycle behavior. Late cycle doesn’t mean that it’s over today, and I still haven’t seen the deterioration in credit or stock markets to turn me bearish yet, but it does suggest caution and not being overexposed to risk. Danielle DiMartino Booth, a former advisor within the…

Using Mental Models to View and Classify Stocks

The stock market is often talked about like it’s one thing where an investor only has the choice of being in or out of “the market.” The usual perpetrators like the media and brokerage industry (you know, the people that always have something to sell) deserve most of the blame for this. In actuality, as…

What Should vs What Is

Markets have been fascinating this year. From my perspective, it has been a big battle of opposing forces. Macro economic analysis and fundamental analysis create a framework of what markets should do but obviously they don’t always cooperate. Technical analysis and systematic strategies attempt to analyze how one should be positioned based on what markets…

Things That Have Caught My Eye Lately – Sept, 2019

This post will be an all encompassing update of things that have caught my eye over the past month. The ECB, the IMF & Christine Lagarde Christine Lagarde, the head of the IMF, was selected to be the next president of the European Central Bank (ECB) and secured the backing of the European Parliament…

Markets & Macro Update – Aug 6th, 2019

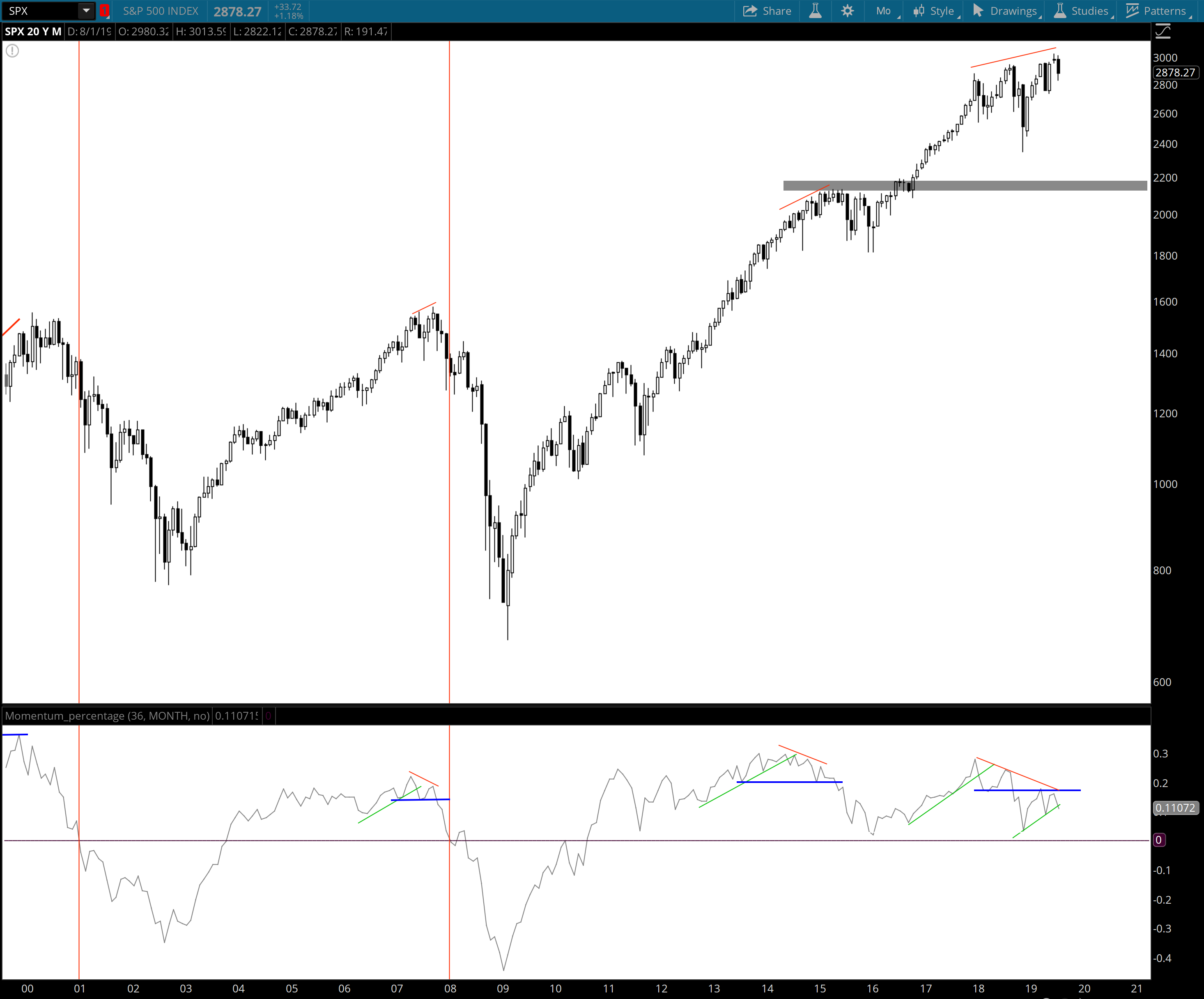

Last week the Fed cuts interest rates for the first time since the GFC a decade ago and the market’s response was pretty interesting. After referencing the 1995/96 one-and-done cut that prolonged the 90’s expansion all summer, I think they were hoping that they could get away with one cut as “insurance” that would ease…

Macro Update: Stocks, Bonds, and the Dollar – One is Wrong

For most of this spring, I’ve been telling clients that I’ve been in “wait and see” mode. The US dollar, bonds and stocks have all been rallying this year, and while that can happen in the short-term, the dynamics of the market say that can’t last in the long run. Basically, 1 of the 3…

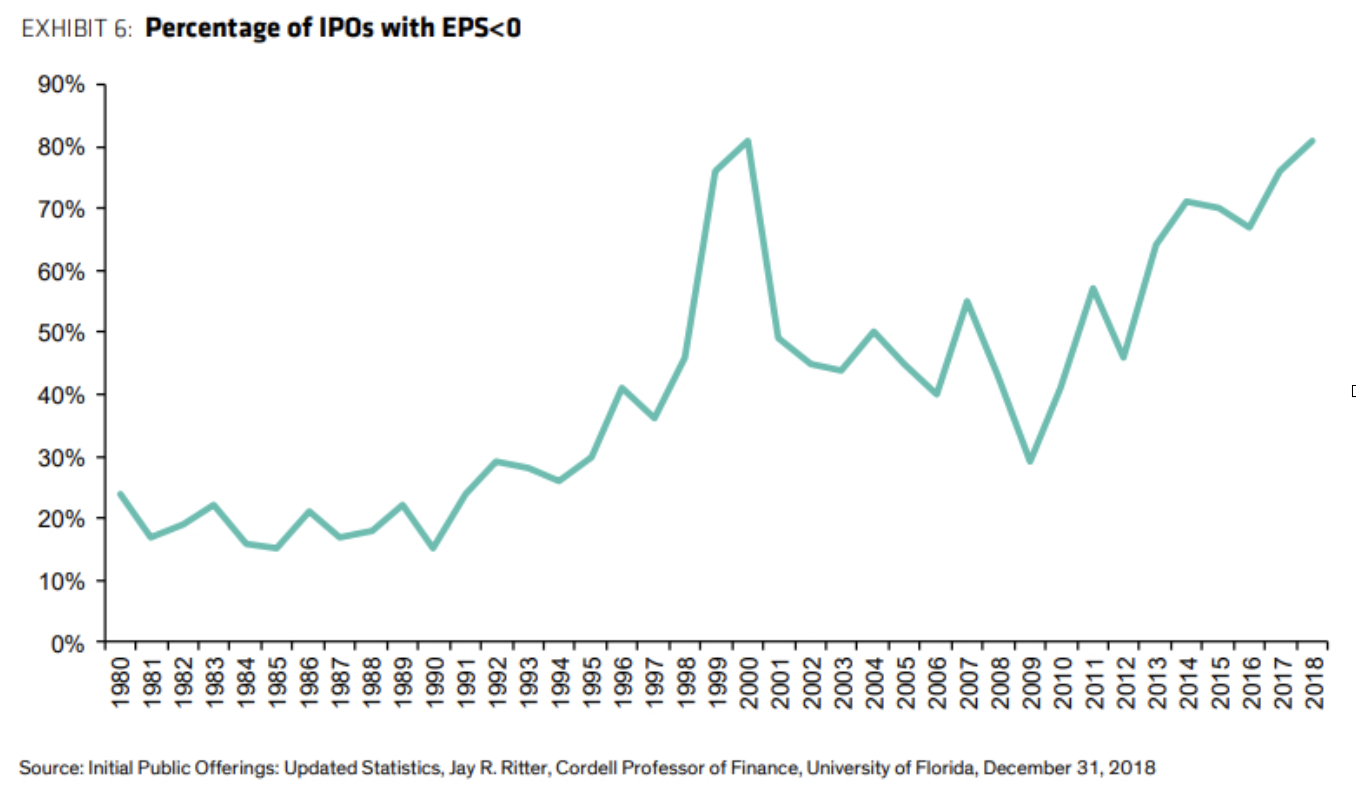

What’s Catching my Eye: IPOs & Fed Policy Change

Two things have jumped out at me over the past few weeks that have larger investment implications. First, the number of large IPOs (namely various tech companies) and second, some new messages from the Fed. I’ll touch on the Initial Public Offerings (IPOs) first. A slew of pretty large tech companies have been racing to…

It’s All Connected – Why Gold is Starting to Shine

If you don’t own gold, you know neither history nor economics. -Ray Dalio I haven’t written anything in a little while because, well, there hasn’t been a whole lot going on to write about. We have had the usual Fed go full-panic-dove-mode, we’ve reportedly made progress on a trade deal with China about 28 times…