I’d like to comment on two things that have been a huge disservice to the average (nonprofessional) investor. One is CNBC and the second is the Federal Reserve. Do yourself a favor and don’t watch CNBC. Like all media companies, CNBC is in the business of collecting eyeballs. They want strong ratings so they can…

Allergan – the Gift that Keeps on Giving

Pfizer and Allergan have announced a “merger” where Pfizer is essentially acquiring Allergan so it can perform a tax inversion to relocate to Ireland (where Allergan is based). This is the second time Allergan has been acquired since we purchased it back in June, 2013, with the first being the takeover by Actavis last fall. Then…

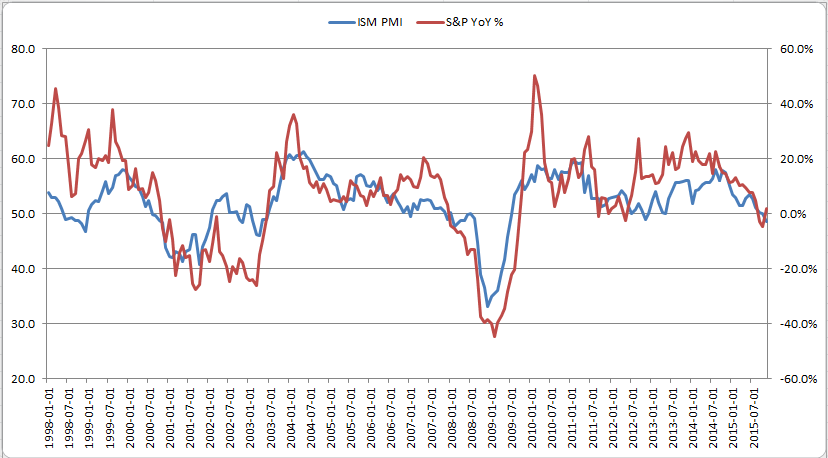

What’s the Fundamental Problem with this Month’s Stock Market Rally?

In short, the breadth, or participation, is waning pretty dramatically. Basically, the rally isn’t nearly as strong as it appears. Let’s dive into some charts to illustrate what I mean by comparing the S&P 500 Index (Large Cap US stocks) to various sectors and asset classes. The S&P 500 is the blue line in all…

Are New Opportunities on the Horizon?

I find it fascinating that the stock market is still so fixated on stimulus (more quantitative easing), which says a lot about the nature of the global economy. Stocks posted a pretty strong rally yesterday after the European Central Bank (ECB) hinted at increasing their QE program. Then, this morning, the futures were driven even…

Why I Don’t Trust this Bounce in Stocks

One of the most important determinants of stock market returns in the short/intermediate term is investor appetite for risk. When investors in the market are confident and display risk seeking behavior, we tend to see assets (like stocks) ignore bad news and rally on good news. However, the reverse occurs when investors are displaying a…

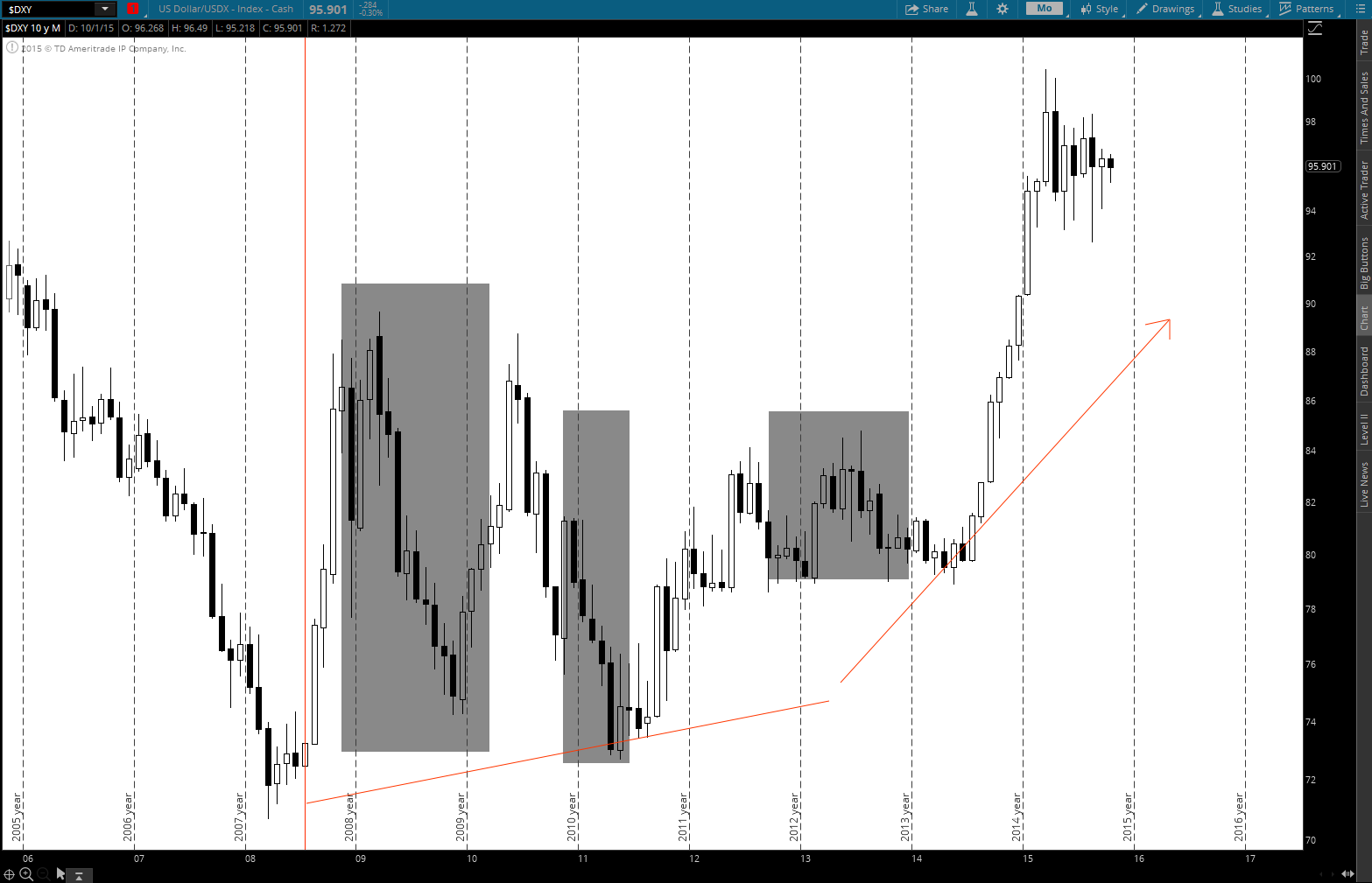

My Long Term View and How I’m Positioning Portfolios (Oct, 2015)

I’ll preface this post by saying that this is a long one (sorry about that) but it’s worth the time. To continue on the post from earlier this week where I mentioned that the best long-term investment opportunities typically come with short-term volatility, I’d like to outline my long-term view on how the world, global…

Should I Be Bothered by Drops in the Stock Market?

It all depends. As a long-term investor, which most people are, you shouldn’t necessarily worry about short-term volatility. The best long-term investments come with the baggage of short-term volatility, that’s just the way it is. This is where proper diversification and strategies like allocating “buckets” of money for retirement spending come into play so one…

Liquidation is Spreading

Ever since Janet Yellen finally admitted last week that the global economy does matter, we’ve seen the deflationary-based selling spread to additional sectors, not just energy and metals as it was earlier this year. Anything sensitive to China and/or the global economy – like industrials, materials, transports, Emerging Markets, etc. – is being thrown out…