This goes to show how distorted Quantitative Easing (QE) has made things. It’s a value investors nightmare… It’s important to use your head when investing in this market. A common mistake that investors tend to make is to pick a fund (or stock) based on past performance. They’ll think “look how well this fund has done…

The Concept of a Superior Investment

Everyone knows what it means when something is superior to something else. In this post, I’ll try to explain how I view potential investments in terms of superiority and what a superior investment looks like to me. Let’s say we’re looking at 3 potential investments: A, B & C. If B is superior to C…

Chart of the Week: One Way I “Time” Buying & Selling Decisions

I haven’t posted anything on the blog lately because there hasn’t been much to talk about in terms of new updates. Overall, things have been playing out “to a T” this month, following the same playbook as back in October/November (you can read about it here). Early April is when we’ll start to see whether the analog will continue…

A Case of Deja Vu

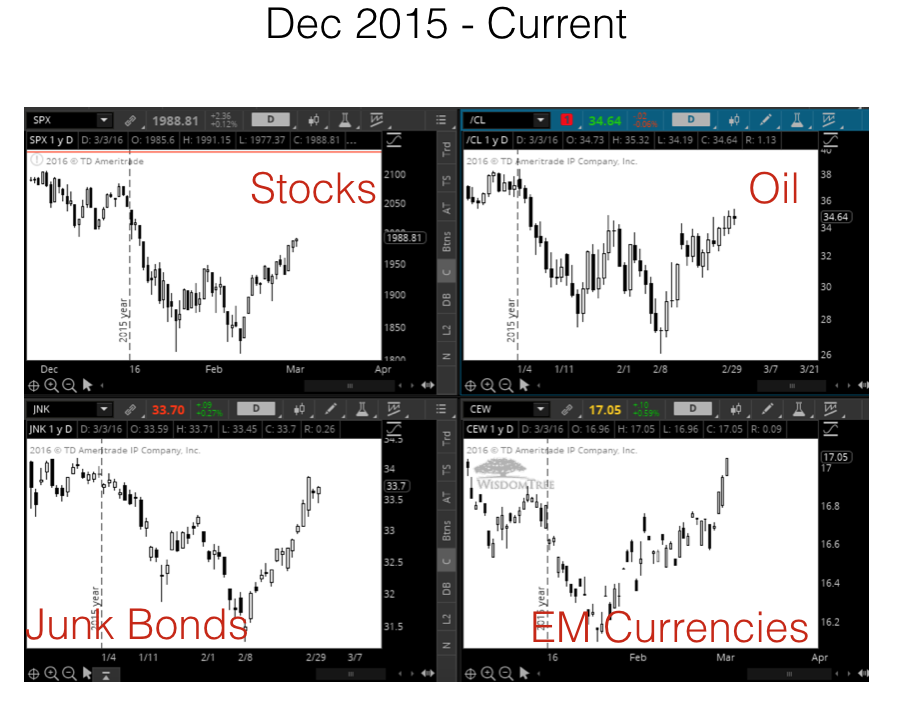

The move in the S&P 500 since January 1st (the selloff, bounce, weak test of the lows and a big surge afterwards) has been so eerily similar to the Aug-Oct move a few months back that it’s a little weird… Even the multiple 2-day retracements in the middle of the surge. The August selloff unfolded after…

What Drives the Trajectory of Stocks

With high growth companies leading this recent downturn in the stock market, I thought it would be helpful to explain what drives the direction, or trajectory, of the stock market in the short-term. By short-term, I mean over the next year or so. The trajectory of a stock is the second derivative of the company. We…

Market & Portfolio Updates

I haven’t written on the blog in about two weeks because we’re in the middle of quarterly earnings. There is a 2 or 3 week stretch each quarter where I’m pretty busy listening to the earning’s conference calls of the companies we own as well as other companies I’m looking into. The good news is…

What it Means to be “Hedged”

I’ve mentioned a few times over the past couple of months that I currently have the “Growth” allocation of client portfolios hedged against a drop in the stock market. In this post, I hope to explain what it means to be “hedged,” why it’s important to hedge risk, and how I’m currently doing so. From…

Why I Like Risk, Volatility and a Falling Stock Market

I know the posts this week weren’t the most upbeat, but hey, I’m not CNBC. My job is to be a fiduciary on behalf of my clients which means I need to be realistic. I understand that it’s more enjoyable to read about exciting, new investment opportunities so I try to limit the doom and gloom.…