Bull markets tend to evolve in 3 waves. The first phase is when the “smart money” and institutional investors are buying at relatively low valuations, typically following a bear market, that ends a decline starts a steady push higher. The second phase is when the media finally catches on after noticing that a market has…

Reducing Risk Exposure

I use a few different risk management systems to help in determining when to reduce exposure to higher risk investments like stocks and high yield bonds. These take into consideration economic data, market data (i.e. bond spreads, market breadth, etc.) and technical charting for trend strength. Monday was the last day of October and the…

Update on Quarterly Earnings Season & the Election

We’re in the heart of companies reporting their Q3 earnings and it’s been a bit of a mixed bag. There are a handful of small pockets doing well (cloud related services, electronic payments, cybersecurity, etc.) but overall I would sum it up as stagnant. The consumer is hurting from rising costs like healthcare while incomes…

Recent Portfolio Updates

Here’s a quick summary of recent stock purchases and other areas of the market I have my eye on. I almost always build positions in multiple steps to create a better average price but this has especially been the case lately as I’m starting small and hoping for an opportunity to buy more at lower…

The Next Market Fad to Blow Up

Following the slowest month in a long time, with volatility being compressed again, I thought it was a good time to highlight an important underlying driver of markets these days: volatility. Volatility (more importantly implied volatility) is measured and today is an actual asset class that you can “invest” in for diversification purposes. A few…

Chart of the Week: Debt-Funded Buybacks

This week’s chart comes from an article on Bloomberg discussing the percentage of buybacks that are being funded by debt – now over 30% for the first time since June 2001. Notice how this measure tends to peak around high points in the overall market (2000/2001, 2007 and 2011). You can read the full article here.…

New Stock Investments

I added to some existing positions (like Google and Celgene) during the selloff following the Brexit vote but also made some new purchases over the past few weeks that I’ve been meaning to detail. New Positions 1. Red Hat Software (RHT) Red Hat is a distributor of open-source Linux operating systems. Open-source means that the…

Charts of the Week: The Whole Story

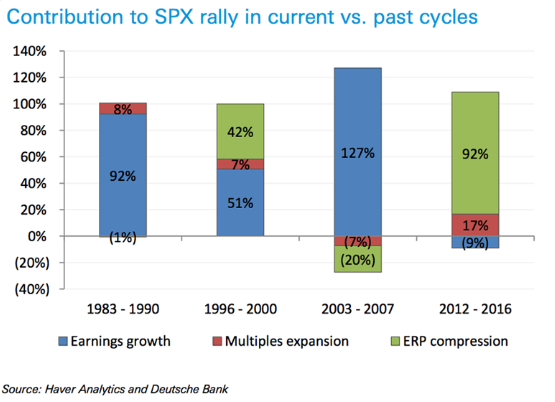

These charts tell the whole story regarding the current state of the global economy and investment markets: Global central bank asset purchases compared to global equity % change (let’s be honest, there’s only one thing that matters…) Deutsche Bank’s recent report on the current stock market rally (’12 to ’16) compared to past market climbs…