Asset markets move in cycles, flipping between periods of growth and decline (or consolidation). You can see these cycles in pretty much every asset class and on multiple levels due to the fractal nature of markets. This means there is a short-term cycle within an intermediate-term cycle within a long-term cycle, and so on. You…

Swapping Some Growth Stock Investments

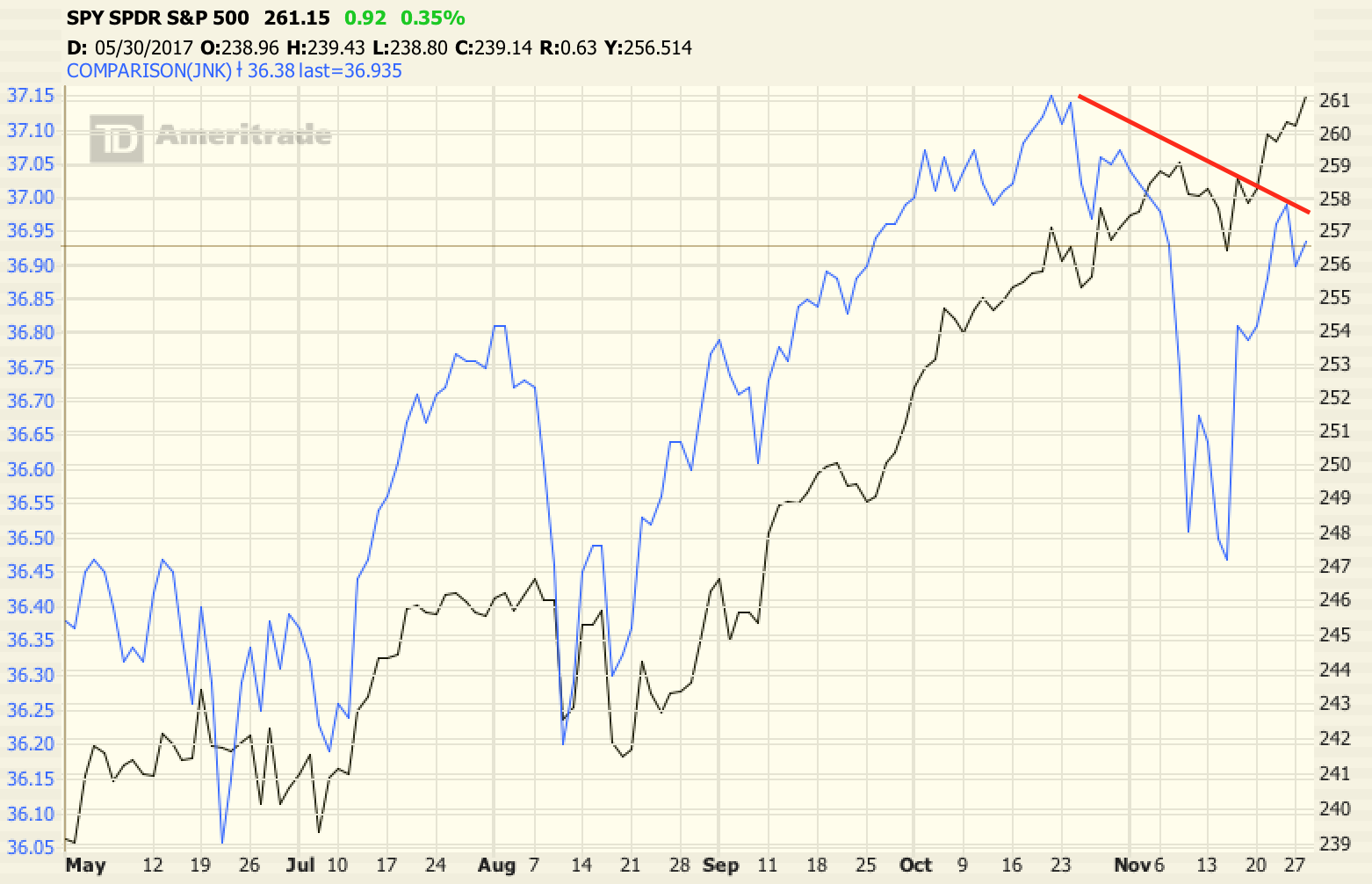

I’m becoming concerned about tech stocks in general as we move to the later stages of this economic cycle. We’ve seen a deterioration in market breadth with money continuing to chase fewer and fewer stocks (namely tech). Tech stocks were some of the biggest winners in 2017 and the recent bounce after the late January…

Starbucks, Dividends and the Power of Compounding

I purchased stock in Starbucks (SBUX) last week when the stock was trading down about 5% following an earnings release that fell short of analyst expectations. I love it when short-term momentum traders bail on a great long-term story, creating an opportunity for us to buy. After an over 2 year hiatus, we’re back to…

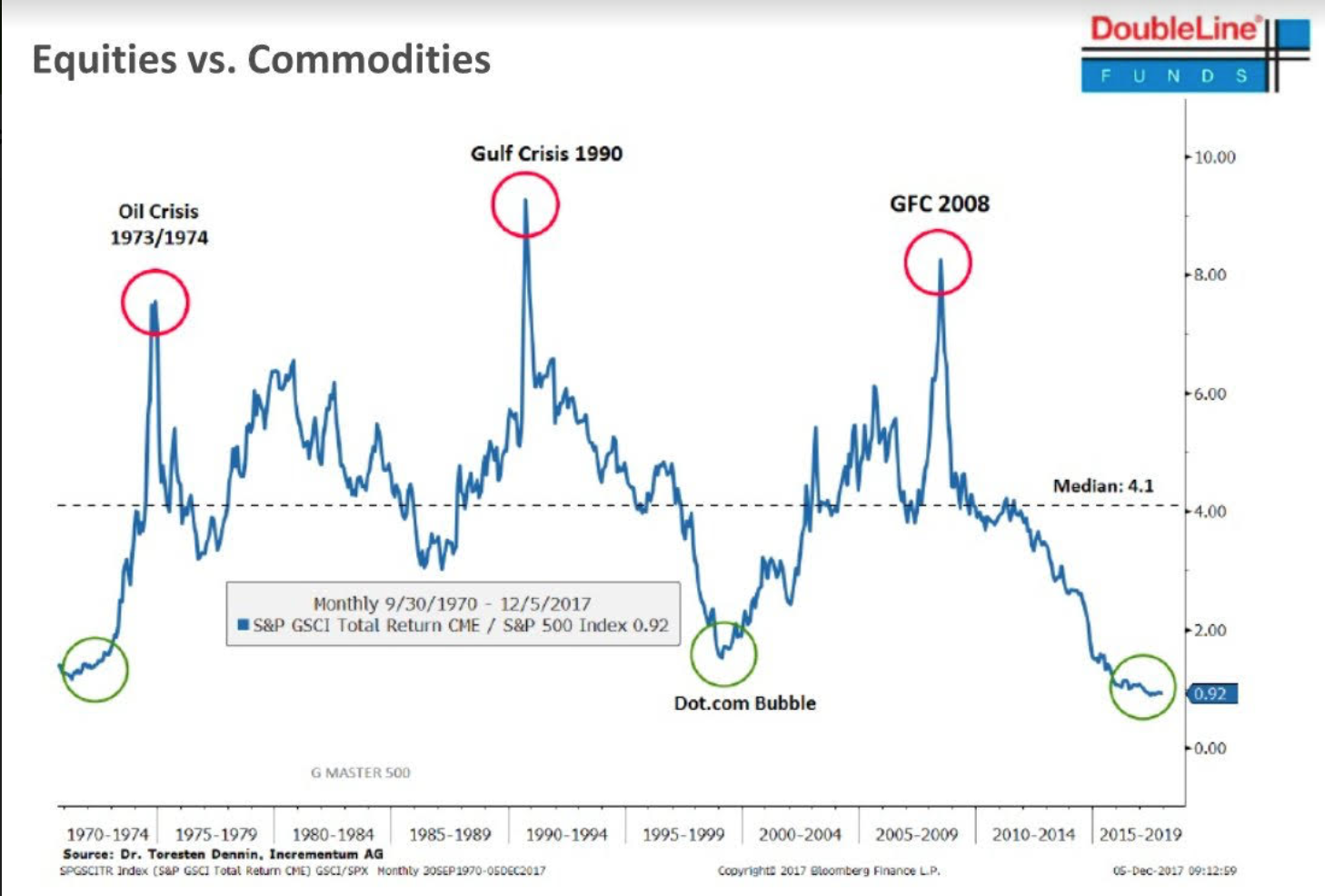

Why 2018 Might be the Year of Commodities

I’ve been telling my clients over the past few months that I expect inflation to pick up moving forward. The decline in the dollar this year and subsequent rally in most energy and industrial commodities is creating the year-over-year price change to bleed through to various inflation measures like CPI, PCE and (ISM) prices paid…

GE, a Lesson on the Perils of Debt and the Current Market Environment

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

Highlighting Some New Investments

Here’s a brief overview of some recent investments made over the past few weeks. TripAdvisor (TRIP) We purchased stock in TripAdvisor as a growth investment. This is a unique stock that has tremendous long-term growth potential if management can execute. I’m sure almost everyone is familiar with TripAdvisor. They run a site where users can…

Why Boring is Usually Best

I bought stock in Kimberly Clark (KMB) this week as a new Income investment at a 3.2% dividend yield. Kimberly Clark is a global consumer products company with many recognizable brands used by a quarter of the world’s population in the paper products space. Some of their top brands include Huggies, Klenex, Cottonelle, Kotex, Depend…

A High-Yield REIT for Retirement Income Portfolios

A Real Estate Investment Trust (REIT) is a type of investment structure that allows investors to add exposure to real estate in their portfolio. REITs receive preferential tax treatment at the company level, where virtually all taxation is passed on to the investors, if they pay out at least 90% of net income as dividends. …