As I’ve commented on a few times this summer, rising interest rates and a flatter yield curve have been applying pressure on the economy. One area in particular that has seen a fairly strong slowing is the housing market, with home builders and related housing stocks down significantly from their highs earlier this year. I…

Stock Market Update: October 2018

I haven’t written anything in over a month but now feels like a good time to provide an update of what I’m seeing and expecting. Investment markets in general, and stocks especially, typically act in one of two frames of mind. When investors are comfortable taking on risk virtually all bad news is ignored and…

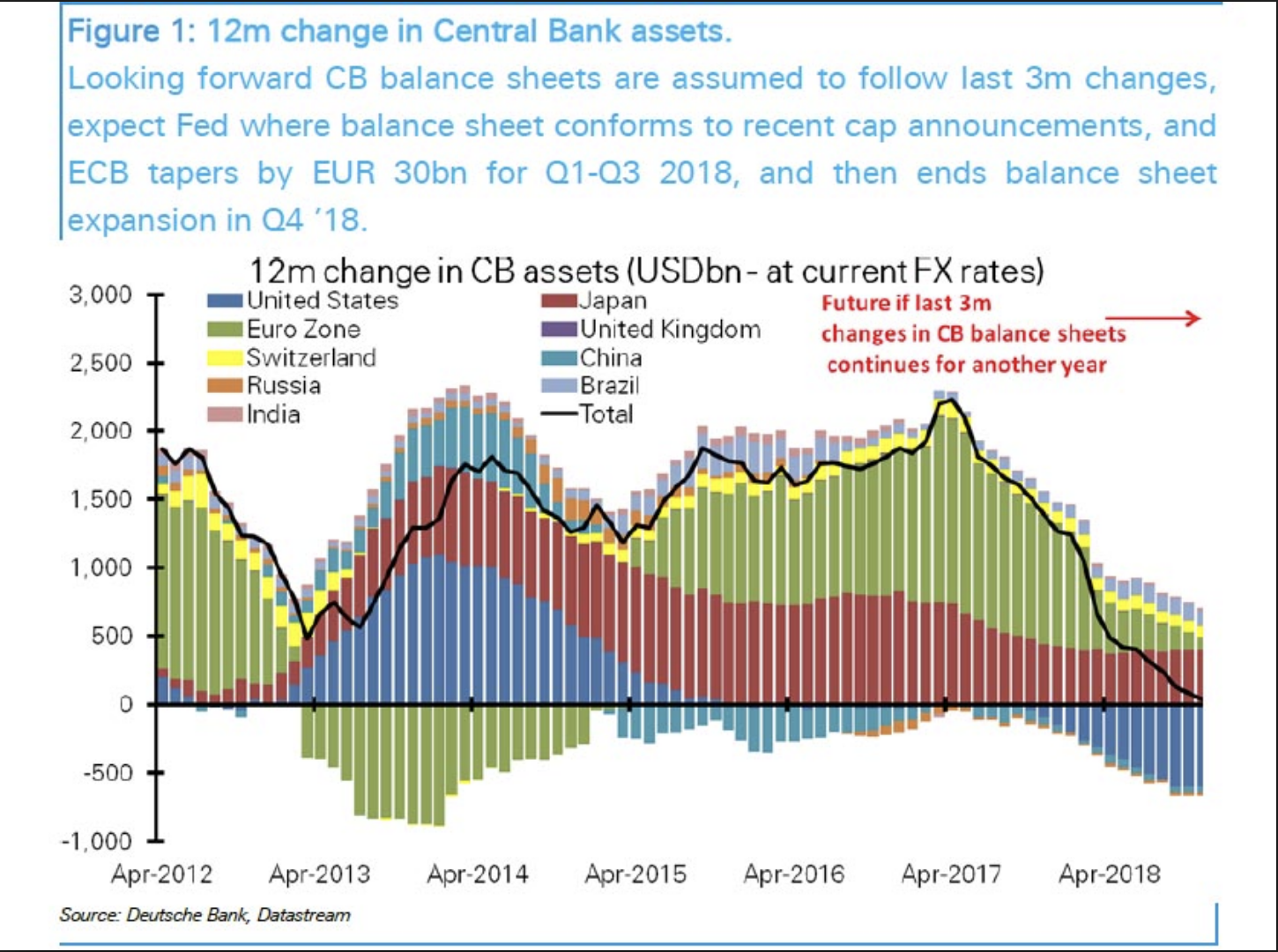

Macro Update: Late Cycle Dynamics

I’ve been seeing warning signals since the spring that we’re in the later stages of this economic cycle so I wanted to post an update to illustrate. One thing to mention is that cycles tend to move very slowly which can be a double-edged sword. It’s nice because you can typically read the tea leaves…

Portfolio Updates: 2 New Buys, 1 Sale

Here are some portfolio changes from last week. New Investment: Walgreens Boots Alliance (WBA) We purchased stock in Walgreens last week. Concerns that Amazon is expanding into drug distribution with their purchase of Pillpack earlier this summer knocked the stock down to a pretty attractive valuation. I think this is a massive overreaction similar to…

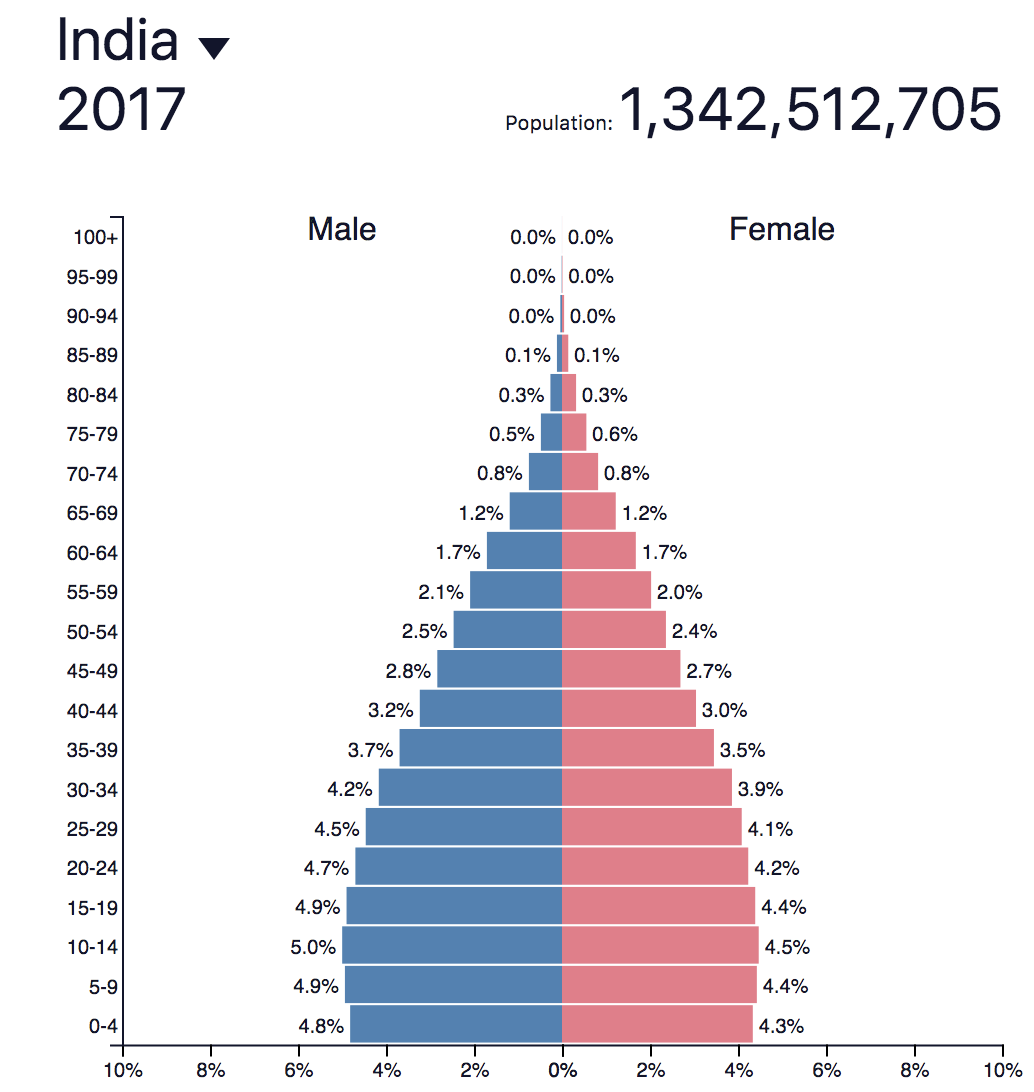

Why India will be the Center of Global Growth for the Next Decade

If you’re a long-term growth investor, you should be focusing on Asia. Everyone in the US loves to focus on the US stock market (home country bias) but valuations in the US are pointing to disappointing returns over the next decade. That’s not to say that there aren’t any attractive investment opportunities in the US…

The Fed, Curve Inversion & Conflicting Signals

The Federal Reserve raised the target range for the effective federal funds rates (EFF) again last week, now up to a range of 1.75% – 2.00%. They also raised the rate they pay banks interest on excess reserves (IOER) by 0.20%. With this bump, I wanted to see the print for the average bank prime…

The Difference Between Speculating/Trading and Investing

You may have noticed that I often refer to investing in the stock of companies as “partnering” with the company instead of “buying the stock.” It might seem like a small difference but, to me, it’s conceptually a very big difference. Investing is much longer in nature. When I purchase shares of stock in a…

Recent Updates – Insurance, Biotechs, Dividends and Rates

Here are some recent updates from this month, including some new investments and some thoughts on how the market is setting up in terms of the economic outlook, interest rates and higher yielding (dividend) stocks. New Investment – Chubb Limited (CB) Insurance is an interesting industry in which to invest. When run properly, it can…