I’ve been reworking the stock holdings within the income allocation of portfolios all year. To offer some background, I break portfolio allocations into two segments, Growth and Income, and fit clients based on the amount of volatility that’s appropriate for their retirement/financial plan. These days, “Income” oriented investments don’t offer much in the way of…

High Alert on US Stocks

The S&P 500 failed to close above some key levels last Friday for the end of the month which raises the probability we see some weakness this month. Interestingly, I recently read that the range of the stock market this year has been the tightest market since the 1880’s. So we’ll see if any weakness…

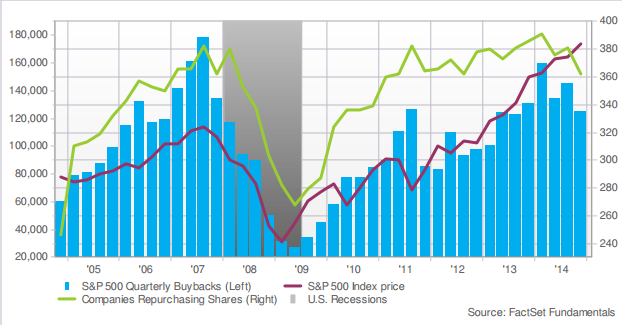

Are stock buybacks good or bad?

As with almost everything in finance, the answer is that it depends. Buybacks have been receiving a lot of criticism lately in the financial media. The most common complaint I here is that companies are only growing earnings per share year-over-year because they’re reducing the outstanding number of shares and not making investments in the…

Recent Market Musings

China The Chinese stock market has probably been the hottest market over the last year. While exciting for the time being, I don’t trust it one bit. The Chinese economy has been supported by an unsustainable increase in credit the past few years and the bubble has the potential to pop at any moment. There…

Portfolio Update: Options & Volatility

I wrote in my letter to clients earlier this year that the only thing I’m certain about in the markets moving forward is that volatility will be higher than the past few years. As we move further down the path of currency wars and central bank policy divergences, there are some large risks looming overhead…

My Reaction When the Market Knocks Down the Stocks I Want to Buy

Couldn’t have said it any better myself. Thanks, Will Ferrell. -Nick

Where Many People Go Wrong When Buying Stocks

Have you ever felt like you were missing out on a stock that was rising and wanted to buy it? Or worse, after watching it go up for a few days or even a few weeks in a row, couldn’t take it anymore and decided to actually buy it before it went up even more? …

The Age of Automation and the Internet of Things (IoT)

It’s no secret that technology continues to change just about everything. Two major themes that have been growing the past few years are automation/robotics and the Internet of Things (IoT). It all has to do with integrating everything with technology – the connectivity – to control, track, store and analyze data. This makes things more…