I haven’t written anything in a while but I’m still here, still doing what I’ve always done. This post will be about how I’ve actually adapted the management of client portfolios over the past handful of years to an ever-changing market environment. I think markets may potentially be in for an extended period of tough…

Market Risk is Highest Since 2007/08

I’m going to try to keep this post a little shorter by not getting too deep into the explanations but I wanted to post an update with my thoughts based on what I’m seeing. Given the weakening economic backdrop, the risk across the board is probably at its highest point right now since 2007/08. The…

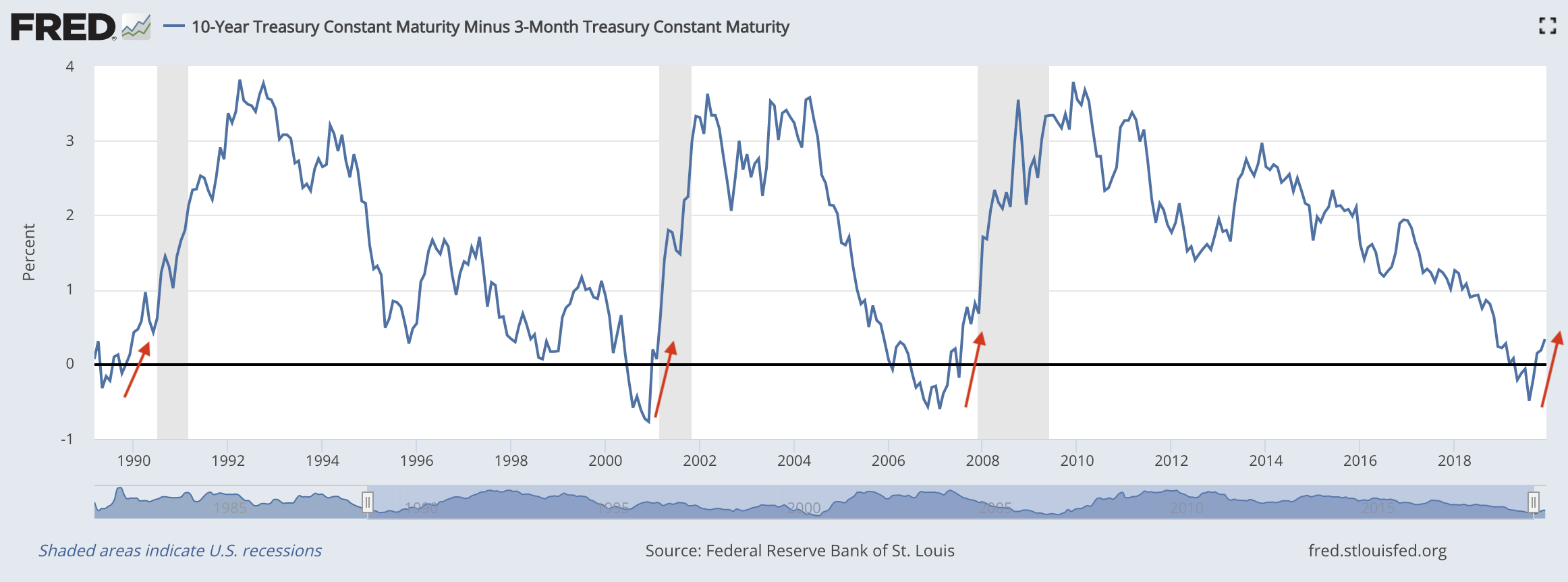

On the Verge of a Recession & the Most Important Chart Right Now (Feb 2020)

Unfortunately the employment numbers lately have been disappointing and the job openings number this morning was very worrying, down 14% on a year-over-year basis. Initial and Continuing Unemployment claims have also been rising on a year-over-year basis. So we have unemployment starting to tick higher and hiring slowing – two things seen at the…

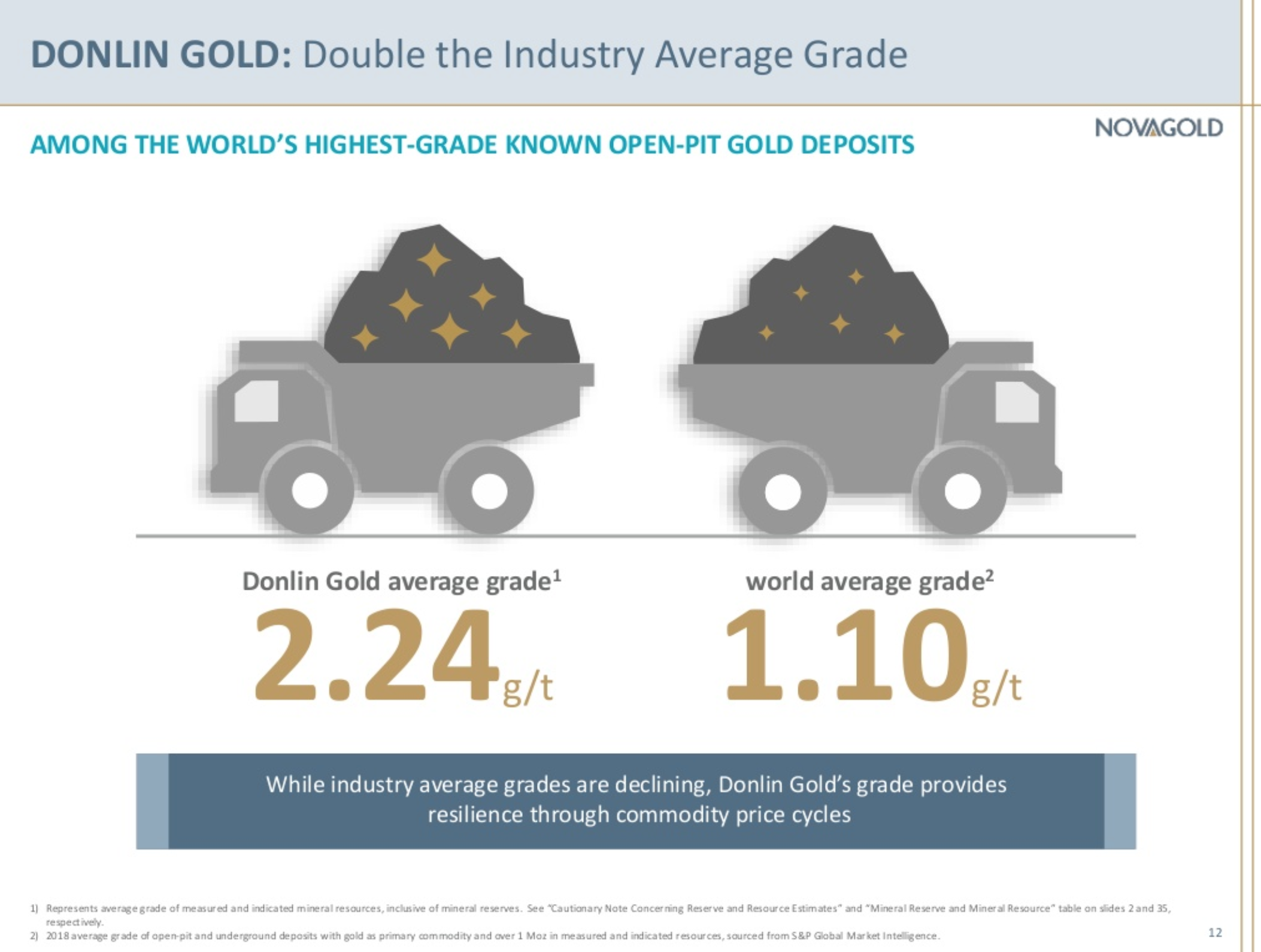

Some New Investments (January, 2020)

I’ve made 3 new investments over the last month or so for clients, all of which are Growth holdings. Two companies are junior gold miners and the third is a long-term compounder. Commodities are a tough business to operate in because companies don’t have control over the final selling price of the product which…

Macro & Markets Update: Dec 2019

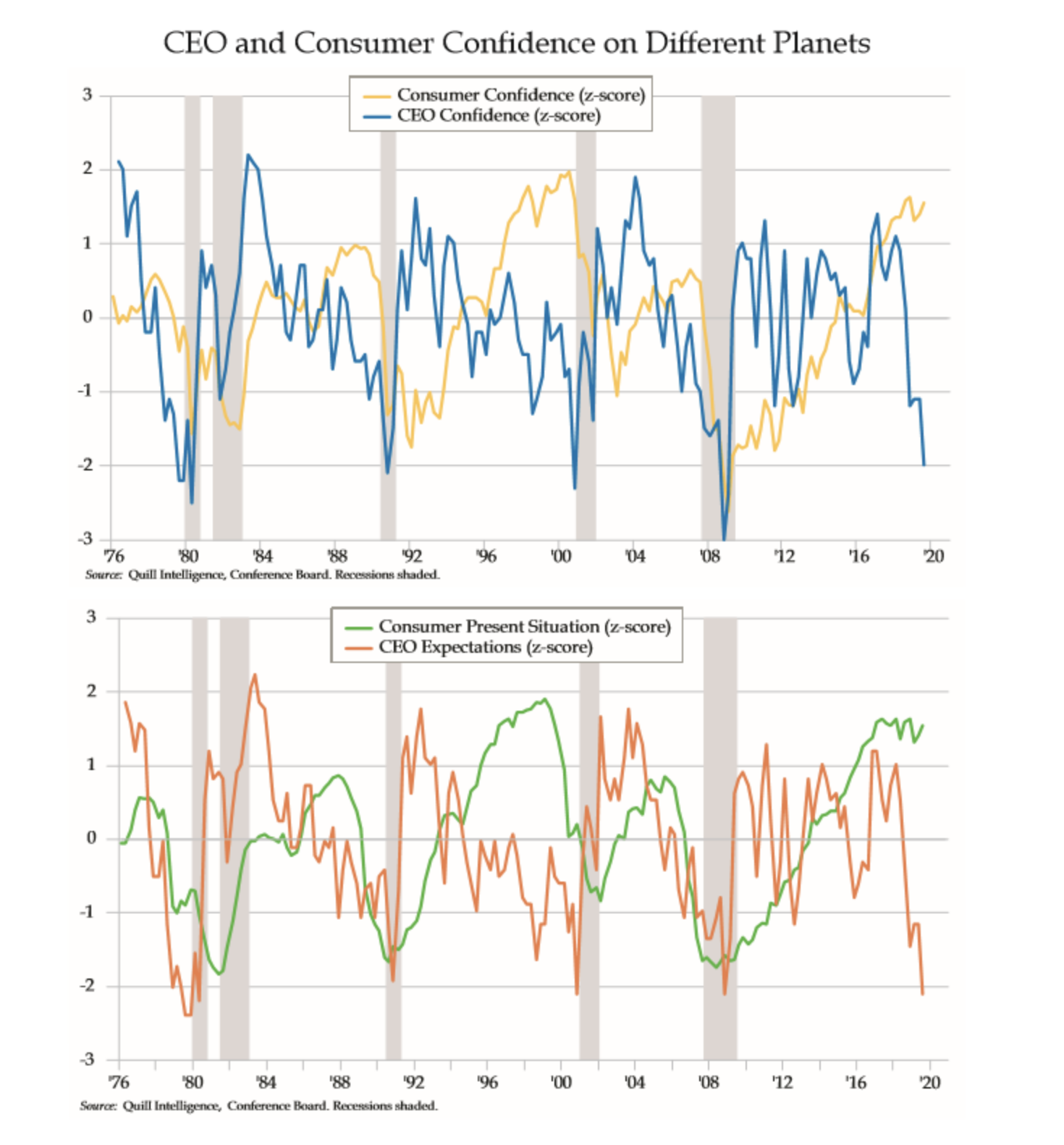

I haven’t posted anything in a while because every time I’m about to write an update, a new piece of pretty big news develops that potentially shifts the picture. So here’s a high level overview of my thoughts from the past month. There’s a debate going on right now if the current slowdown will…

Approaching a Critical Juncture

I continue to see classic signs of late cycle behavior. Late cycle doesn’t mean that it’s over today, and I still haven’t seen the deterioration in credit or stock markets to turn me bearish yet, but it does suggest caution and not being overexposed to risk. Danielle DiMartino Booth, a former advisor within the…

Using Mental Models to View and Classify Stocks

The stock market is often talked about like it’s one thing where an investor only has the choice of being in or out of “the market.” The usual perpetrators like the media and brokerage industry (you know, the people that always have something to sell) deserve most of the blame for this. In actuality, as…

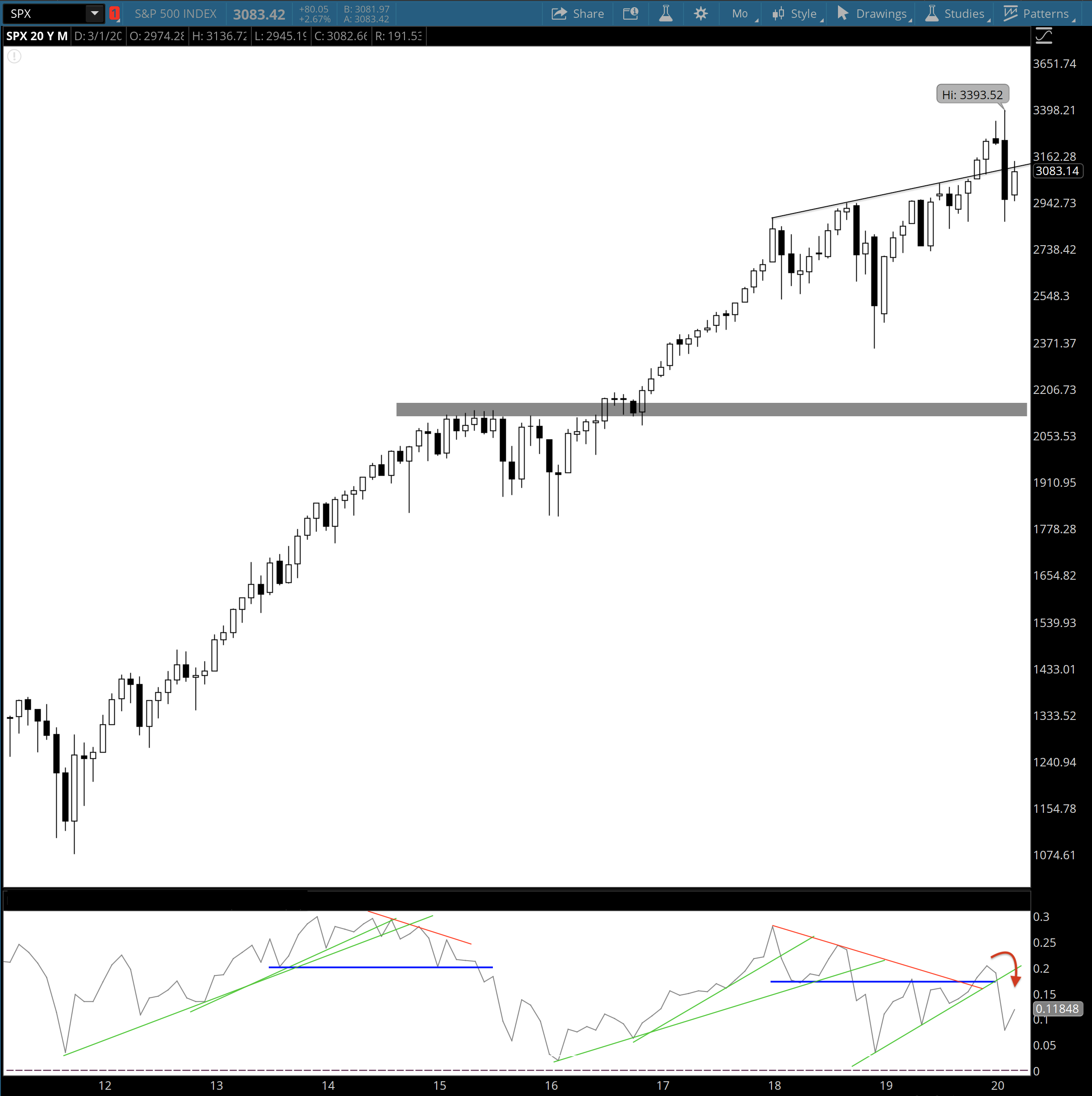

What Should vs What Is

Markets have been fascinating this year. From my perspective, it has been a big battle of opposing forces. Macro economic analysis and fundamental analysis create a framework of what markets should do but obviously they don’t always cooperate. Technical analysis and systematic strategies attempt to analyze how one should be positioned based on what markets…