“What could be more advantageous in an intellectual contest – whether it be bridge, chess, or stock selection – than to have opponents who have been taught that thinking is a waste of energy?” ~Warren Buffett The debate between passive and actively managed money has been ongoing since the 1970’s when Jack Bogle started Vanguard. …

Adapting Our Approach Toward Growth

Just about all of my clients are long-term, retirement oriented investors. The most frustrating thing the past few years for long-term investors is how the central banks have largely “killed” the markets in the traditional investment sense. What I mean by “killed” is that I cannot honestly consider bonds yielding less than 2% and stocks…

The Next Market Fad to Blow Up

Following the slowest month in a long time, with volatility being compressed again, I thought it was a good time to highlight an important underlying driver of markets these days: volatility. Volatility (more importantly implied volatility) is measured and today is an actual asset class that you can “invest” in for diversification purposes. A few…

Chart of the Week: Debt-Funded Buybacks

This week’s chart comes from an article on Bloomberg discussing the percentage of buybacks that are being funded by debt – now over 30% for the first time since June 2001. Notice how this measure tends to peak around high points in the overall market (2000/2001, 2007 and 2011). You can read the full article here.…

The Future of Business & Technology

Here’s an article published by one of the co-developers of Coinbase (one of the top Bitcoin exchanges in the US). Whether you just want to stay on top of new trends in technology or are looking ahead at new investment opportunities, this is imperative to understand how technology is changing the way companies are being started, operating…

Charts of the Week: The Whole Story

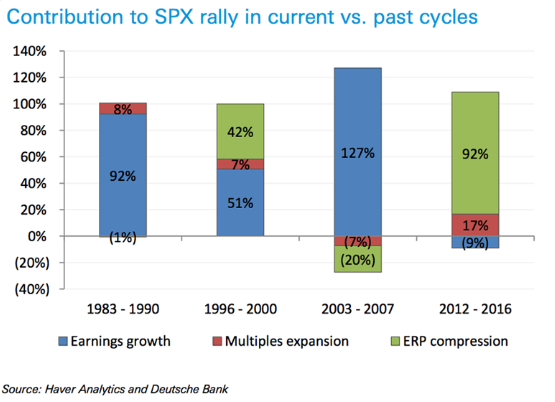

These charts tell the whole story regarding the current state of the global economy and investment markets: Global central bank asset purchases compared to global equity % change (let’s be honest, there’s only one thing that matters…) Deutsche Bank’s recent report on the current stock market rally (’12 to ’16) compared to past market climbs…

So What do I Like?

I realize that a lot of posts lately have been more focused on the risk side of things, pointing out assets that I feel are overvalued these days. Believe it or not, I’m pretty optimistic about some of the innovation we’re seeing in the world. I think we will see huge strides made over the…

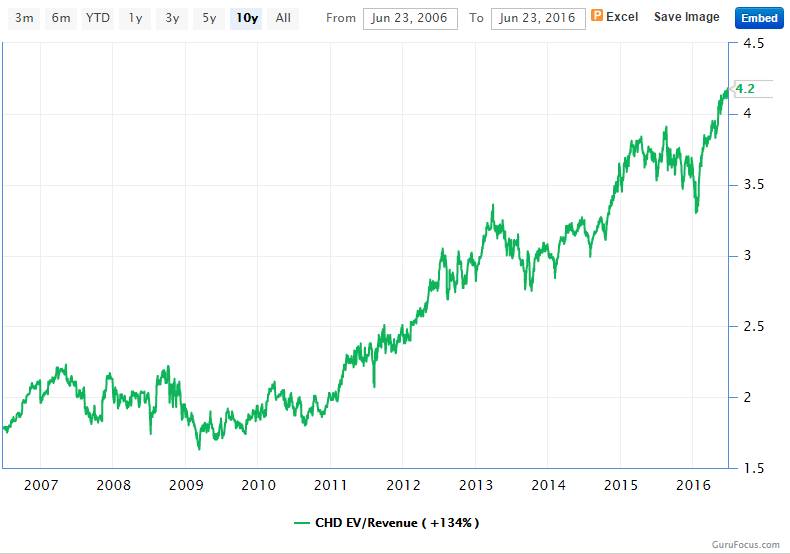

“Safe” Stocks Not Looking So Safe Anymore

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1” -Warren Buffett The most important part of investing is to avoid losses. This is why I so often use this blog to talk about the risks I’m seeing. If you can avoid the landmines and diversify among the rest, you’ll do pretty well. What…