Asset markets move in cycles, flipping between periods of growth and decline (or consolidation). You can see these cycles in pretty much every asset class and on multiple levels due to the fractal nature of markets. This means there is a short-term cycle within an intermediate-term cycle within a long-term cycle, and so on. You…

Are your Investments Antifragile? Are your Investments Essential?

Two really great books that I highly recommend are Antifragile: Things that Gain from Disorder by Nassim Taleb and Essentialism: The Discipline Pursuit of Less by Greg McKeown. I read Antifragile a little while ago but saw an article this week that I thought was worth passing on. It discusses how to live an antifragile…

Volatility is Back with a Vengeance

Well, it finally happened. The short volatility trade blew up and the volatility genie is now out of the bottle. Credit and monetary conditions are still extremely loose so this should calm down soon, but I doubt we see a low volatility regime like 2017 in a long time. So here’s what happened: Two Inverse…

Starbucks, Dividends and the Power of Compounding

I purchased stock in Starbucks (SBUX) last week when the stock was trading down about 5% following an earnings release that fell short of analyst expectations. I love it when short-term momentum traders bail on a great long-term story, creating an opportunity for us to buy. After an over 2 year hiatus, we’re back to…

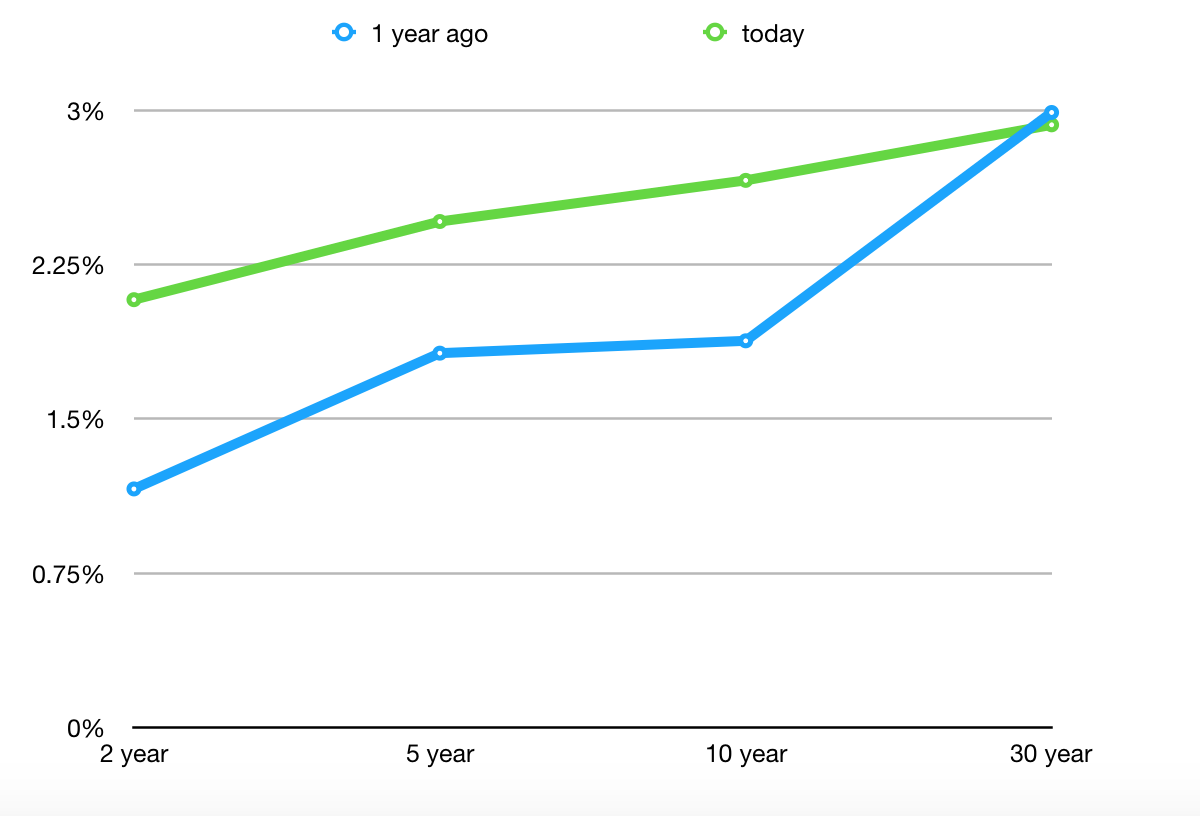

Rising Yields are Creating an Opportunity for Income Focused Investors

With stocks continuing to climb higher I’ve been a lot less active in terms of buying, especially on the Growth side of portfolios. However, there are some attractive opportunities popping up in the Income arena due to rising short and intermediate term bond yields. The yield curve is a line that measures yields at each…

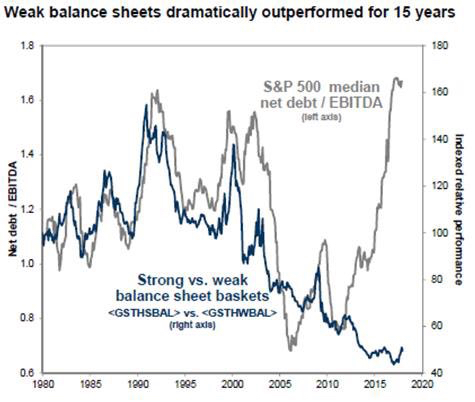

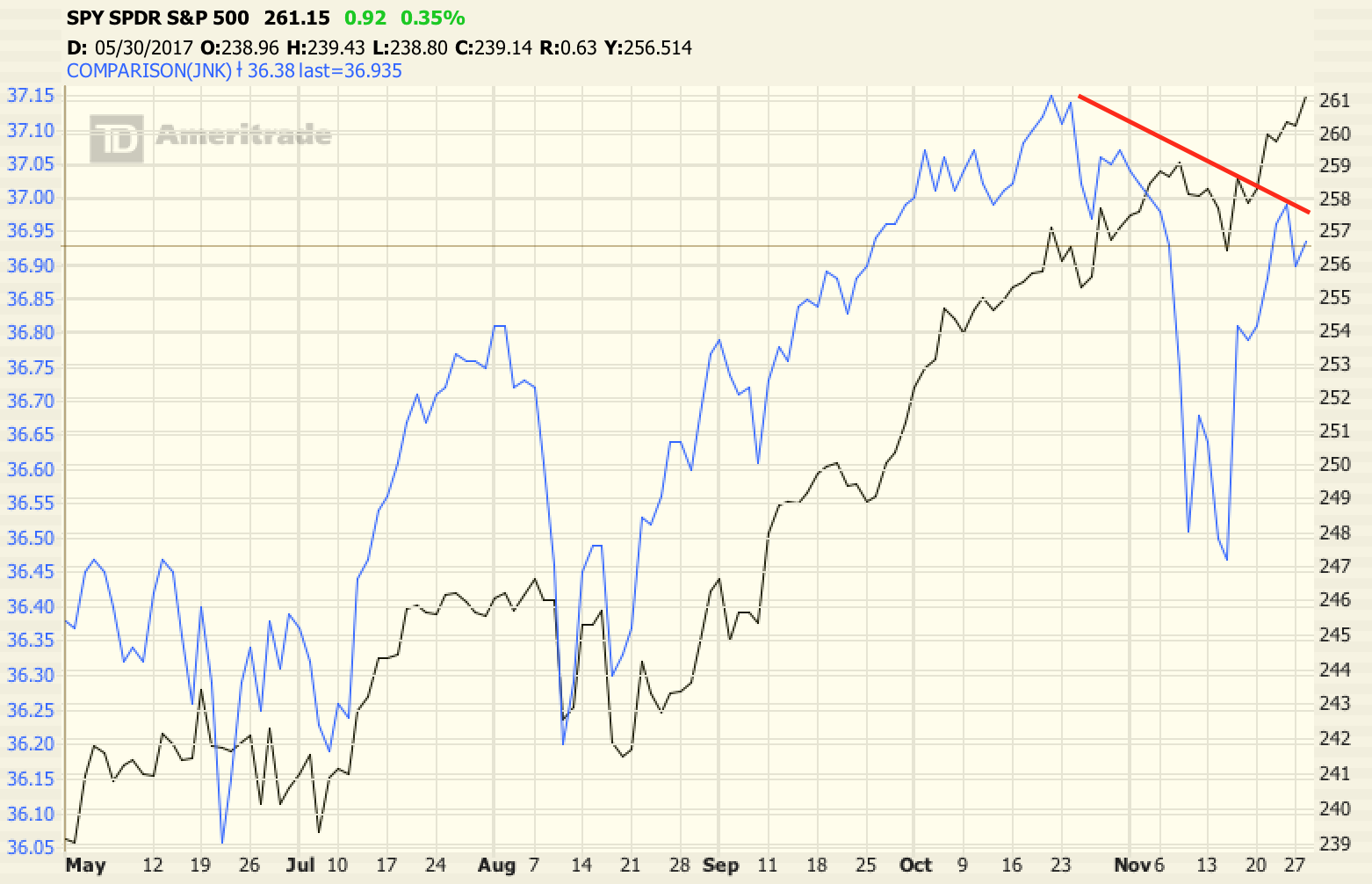

GE, a Lesson on the Perils of Debt and the Current Market Environment

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

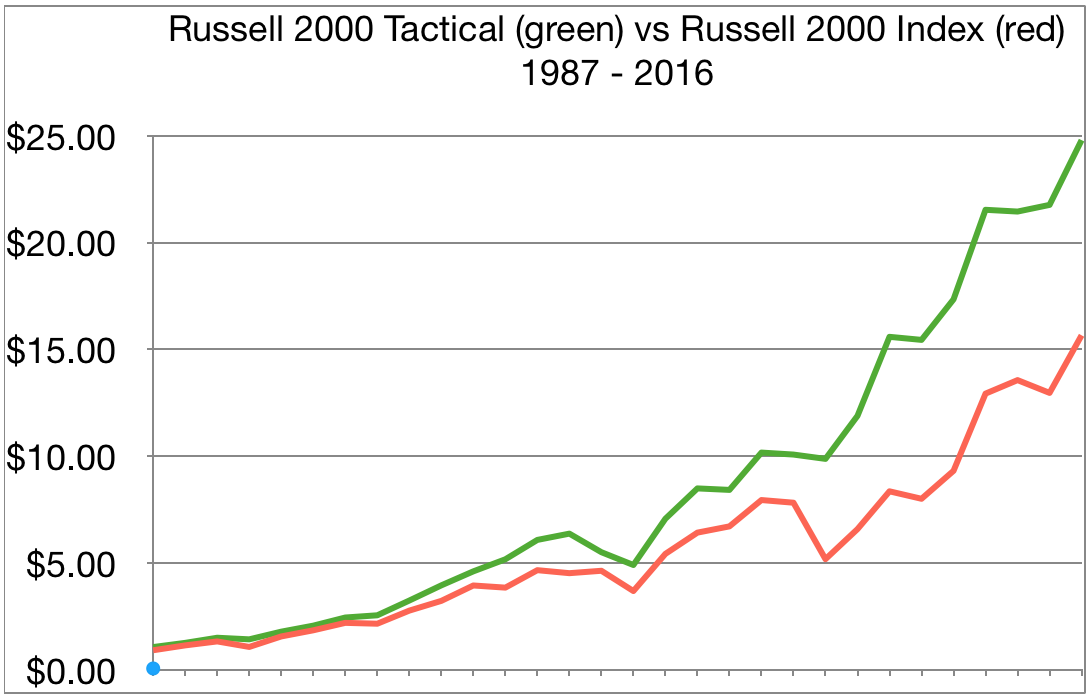

The Most Important Investment Concept & How to Win the Long Game

This post discusses a very high level concept that is crucial to successful investing and is most applicable to the growth side of investing. Price fluctuations don’t matter all that much when investing for income but permanent losses obviously do. There’s a lot more that goes into portfolio construction and properly tailoring a portfolio to a…

How the Economic Cycle Impacts your Portfolio: Shifting to the Next Stage

There’s a general playbook for investing when it comes to the macro-economic business cycle. The cycle includes four stages: Reflation, Recovery, Overheat and Stagflation. You might also hear other terms used to describe each stage but we’ll run with these because Merrill Lynch made this nice chart for us. Within each stage, investment assets tend…