As I’ve commented on a few times this summer, rising interest rates and a flatter yield curve have been applying pressure on the economy. One area in particular that has seen a fairly strong slowing is the housing market, with home builders and related housing stocks down significantly from their highs earlier this year. I…

Portfolio Updates: 2 New Buys, 1 Sale

Here are some portfolio changes from last week. New Investment: Walgreens Boots Alliance (WBA) We purchased stock in Walgreens last week. Concerns that Amazon is expanding into drug distribution with their purchase of Pillpack earlier this summer knocked the stock down to a pretty attractive valuation. I think this is a massive overreaction similar to…

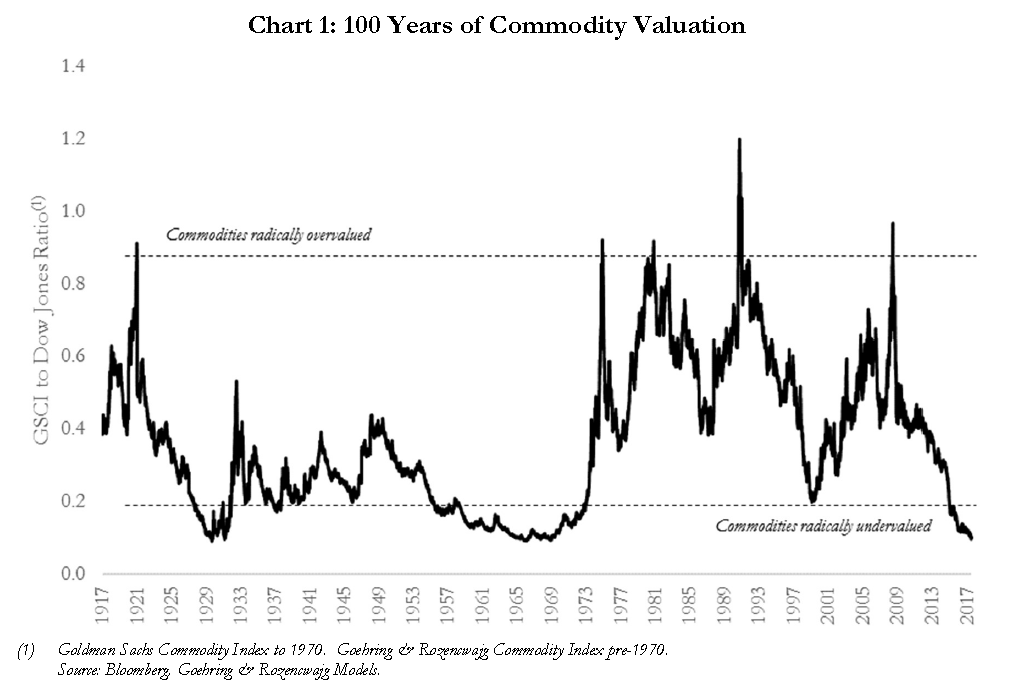

The Pain & Opportunity of a Dollar Squeeze

Global investment markets are becoming very macro driven and it’s pretty important to understand the big picture dynamics at play right now. The US dollar is the key to everything and there has been a growing shortage of dollars throughout the global economy over the past few years which we’re now seeing create the usual…

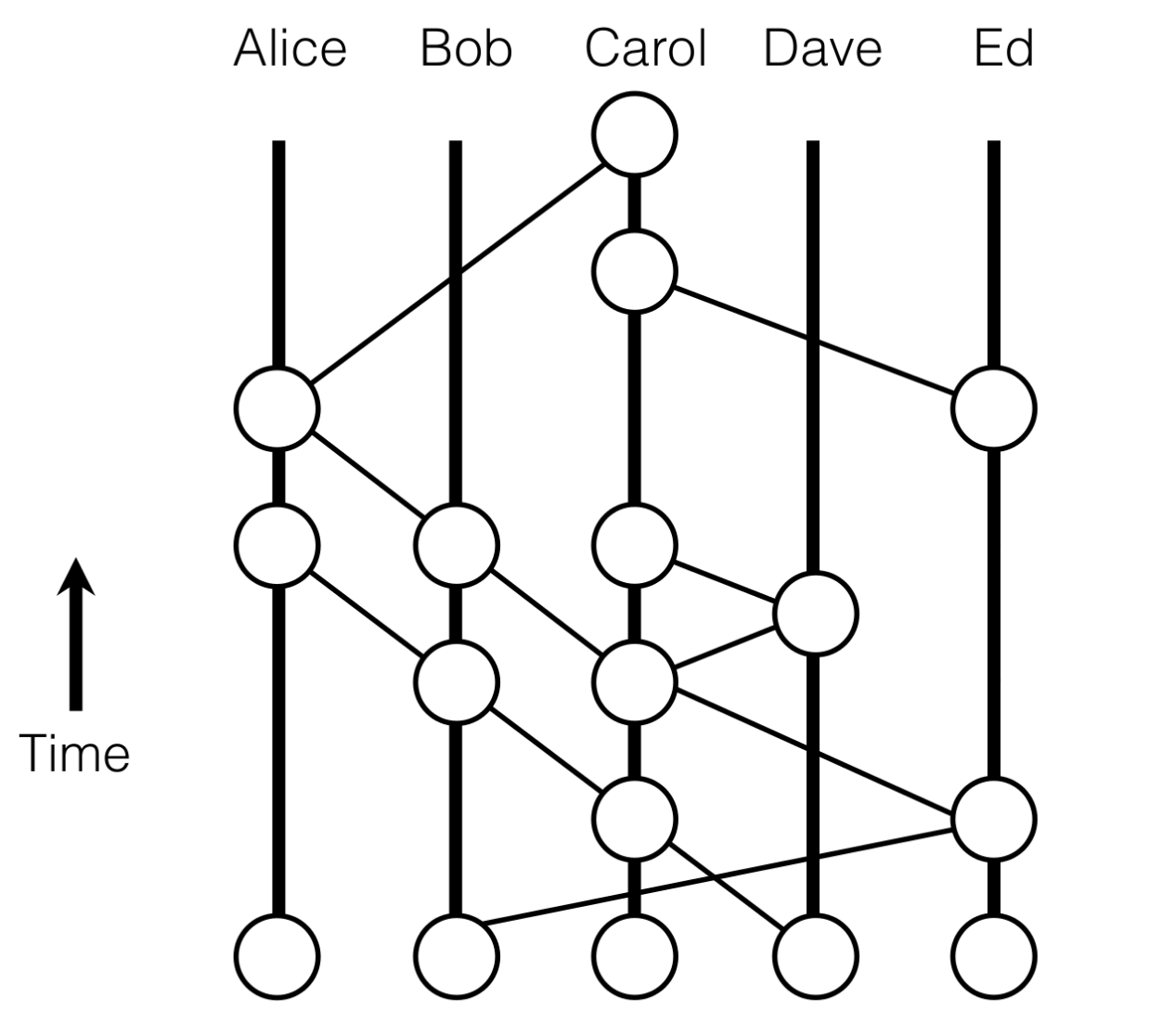

Why I Think Hashgraph will be the Cryptocurrency & DLT Winner

This post might seem a little off-course from the usual investments/markets I write about but I promise it’s relevant. Obviously the world is becoming more technology oriented and while most people still don’t really understand the details of cryptocurrencies, I believe we’re in the very, very early stages of a movement where the world is…

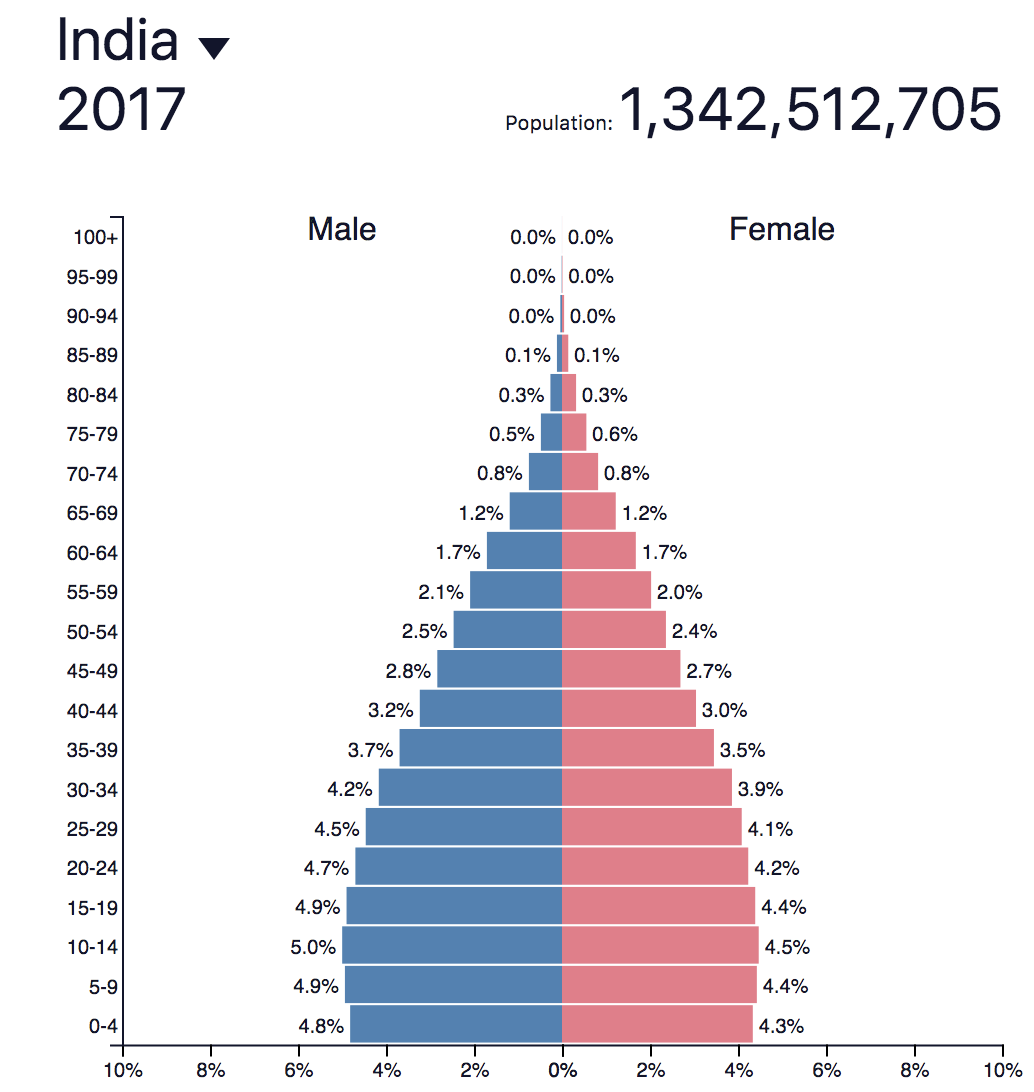

Why India will be the Center of Global Growth for the Next Decade

If you’re a long-term growth investor, you should be focusing on Asia. Everyone in the US loves to focus on the US stock market (home country bias) but valuations in the US are pointing to disappointing returns over the next decade. That’s not to say that there aren’t any attractive investment opportunities in the US…

2 Different Ways to Invest for Growth

I generally look at Growth investments in one of two ways: either steady compounders or huge reward-to-risk, asymmetric growth opportunities. The steady compounders are the companies that can consistently post growth year after year in a secular manner – secular meaning a long-term story not affected by short-term cycles. Whereas the high growth opportunities tend…

Some Key Metrics to Watch

Macro changes occur at a glacial speed but these are typically the most important metrics to track. This is separating the signal (macro shifts, leading data points, etc.) from the noise (CNBC). Warning Signals from the Yield Curve One of the most basic yet crucial metrics is the yield curve, which has certainly received a…

The Difference Between Speculating/Trading and Investing

You may have noticed that I often refer to investing in the stock of companies as “partnering” with the company instead of “buying the stock.” It might seem like a small difference but, to me, it’s conceptually a very big difference. Investing is much longer in nature. When I purchase shares of stock in a…