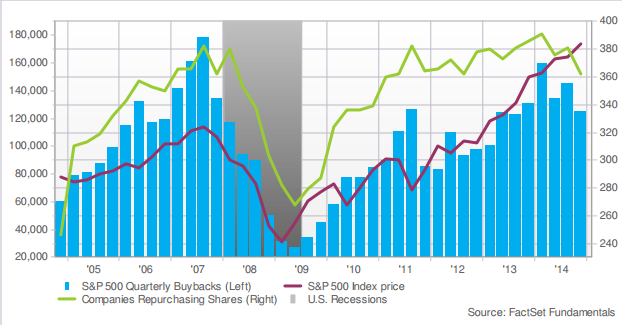

As with almost everything in finance, the answer is that it depends. Buybacks have been receiving a lot of criticism lately in the financial media. The most common complaint I here is that companies are only growing earnings per share year-over-year because they’re reducing the outstanding number of shares and not making investments in the…

Portfolio Update: Options & Volatility

I wrote in my letter to clients earlier this year that the only thing I’m certain about in the markets moving forward is that volatility will be higher than the past few years. As we move further down the path of currency wars and central bank policy divergences, there are some large risks looming overhead…

My Reaction When the Market Knocks Down the Stocks I Want to Buy

Couldn’t have said it any better myself. Thanks, Will Ferrell. -Nick

Where Many People Go Wrong When Buying Stocks

Have you ever felt like you were missing out on a stock that was rising and wanted to buy it? Or worse, after watching it go up for a few days or even a few weeks in a row, couldn’t take it anymore and decided to actually buy it before it went up even more? …

Is Bitcoin the Future of Money?

My next few posts will take a look at the world from a longer-term perspective and discuss some potential investment themes that I think provide interesting opportunities. This first post will discuss Bitcoin, the very confusing and often misunderstood cryptocurrency. I’ve loosely followed bitcoin for the past 2 years but just started doing some in-depth research…

Why Government Bonds are the Worst Long-Term Investment

Things are heating up between Greece and the rest of Europe and time is quickly running out without a solution. There are really only two solutions: Greece either 1) leaves the Eurozone and returns to the drachma which will rapidly lose value as they once again have the ability print as much as they want,…

New Position in Google

I began a position in Google earlier this week when it dipped under $525 and added to it this morning under $500. If it drops another 5%, I’ll buy more. It’s not as cheap as I typically like to see when buying stock in a new company but relatively speaking it’s one of the cheaper…

On the Lookout for Some Holiday Deals & New Year Trend Changes

The end of the year tends to bring some odd movements in the markets. These can occur for a handful of reasons but most are driven by funds with short-term incentive policies and year-end bonuses. Fortunately, their short-sighted foolishness can be our gain since we’re in the position of investing for the long-term. Many funds…