I haven’t written on the blog in about two weeks because we’re in the middle of quarterly earnings. There is a 2 or 3 week stretch each quarter where I’m pretty busy listening to the earning’s conference calls of the companies we own as well as other companies I’m looking into. The good news is…

How to Produce Outsized Long-Term Returns from the Perspective of Value Investing

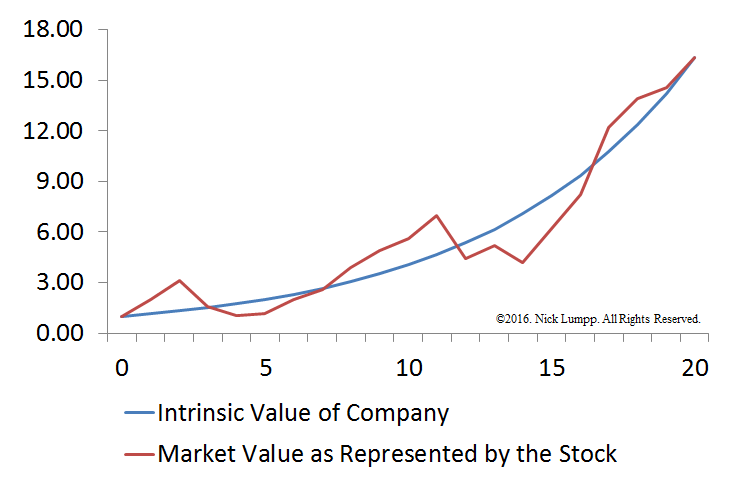

I’m going to let you in on a little secret: Wall Street doesn’t look out beyond 1 year. That’s it. Just 1… Wall Street is part of the brokerage industry and all that the brokerage industry cares about is making sure: 1) you remain invested in their expensive products, and 2) you continually churn your…

What it Means to be “Hedged”

I’ve mentioned a few times over the past couple of months that I currently have the “Growth” allocation of client portfolios hedged against a drop in the stock market. In this post, I hope to explain what it means to be “hedged,” why it’s important to hedge risk, and how I’m currently doing so. From…

Why I Like Risk, Volatility and a Falling Stock Market

I know the posts this week weren’t the most upbeat, but hey, I’m not CNBC. My job is to be a fiduciary on behalf of my clients which means I need to be realistic. I understand that it’s more enjoyable to read about exciting, new investment opportunities so I try to limit the doom and gloom.…

Update on Kinder Morgan

I rushed to get yesterday’s post out and realized afterwards that I didn’t update you on what I was doing with the position. In short, we’re moving on to greener pastures. This story offers some good investment lessons so I’ll provide a few more details. Despite my concerns, I chose to stick with Kinder Morgan…

Here’s What Happens When you Play with Fire

Earlier this year I cut all exposure to energy except for one company… A few month later, I started cutting back on all companies that were highly leveraged with debt because I could see the turn in the credit cycle coming and I knew that companies that were relying on the ability to access the…

Making Sense of the Nonsense

I’d like to comment on two things that have been a huge disservice to the average (nonprofessional) investor. One is CNBC and the second is the Federal Reserve. Do yourself a favor and don’t watch CNBC. Like all media companies, CNBC is in the business of collecting eyeballs. They want strong ratings so they can…

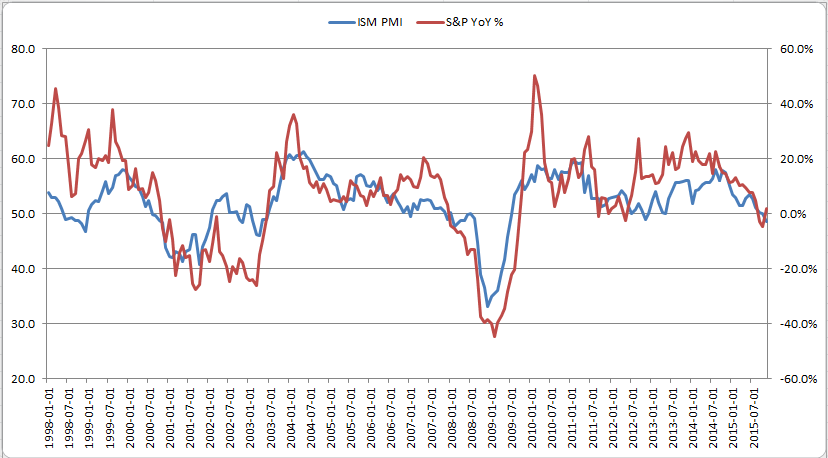

Are New Opportunities on the Horizon?

I find it fascinating that the stock market is still so fixated on stimulus (more quantitative easing), which says a lot about the nature of the global economy. Stocks posted a pretty strong rally yesterday after the European Central Bank (ECB) hinted at increasing their QE program. Then, this morning, the futures were driven even…