I haven’t written anything in a while but I’m still here, still doing what I’ve always done. This post will be about how I’ve actually adapted the management of client portfolios over the past handful of years to an ever-changing market environment. I think markets may potentially be in for an extended period of tough…

The Writings That Have Most Influenced My Thinking This Year

Here are some books and writings that I have found to be the most helpful in shaping my thinking this year. For a longer-term geopolitical framework, I highly recommend Disunited Nations, by Peter Zeihan. It’s a very easy, somewhat fun, yet informative read on the shifting geopolitical tides we’re likely to see play out over…

The Importance of Asymmetric Convexity for a Portfolio Moving Forward

After a long hiatus from the blog, I’m back! I never really went anywhere. Things were so hectic in March and April that I was focusing all of my time on staying on top of everything. After that, I was using direct communication to keep my clients updated and since then I just haven’t had…

Using Mental Models to View and Classify Stocks

The stock market is often talked about like it’s one thing where an investor only has the choice of being in or out of “the market.” The usual perpetrators like the media and brokerage industry (you know, the people that always have something to sell) deserve most of the blame for this. In actuality, as…

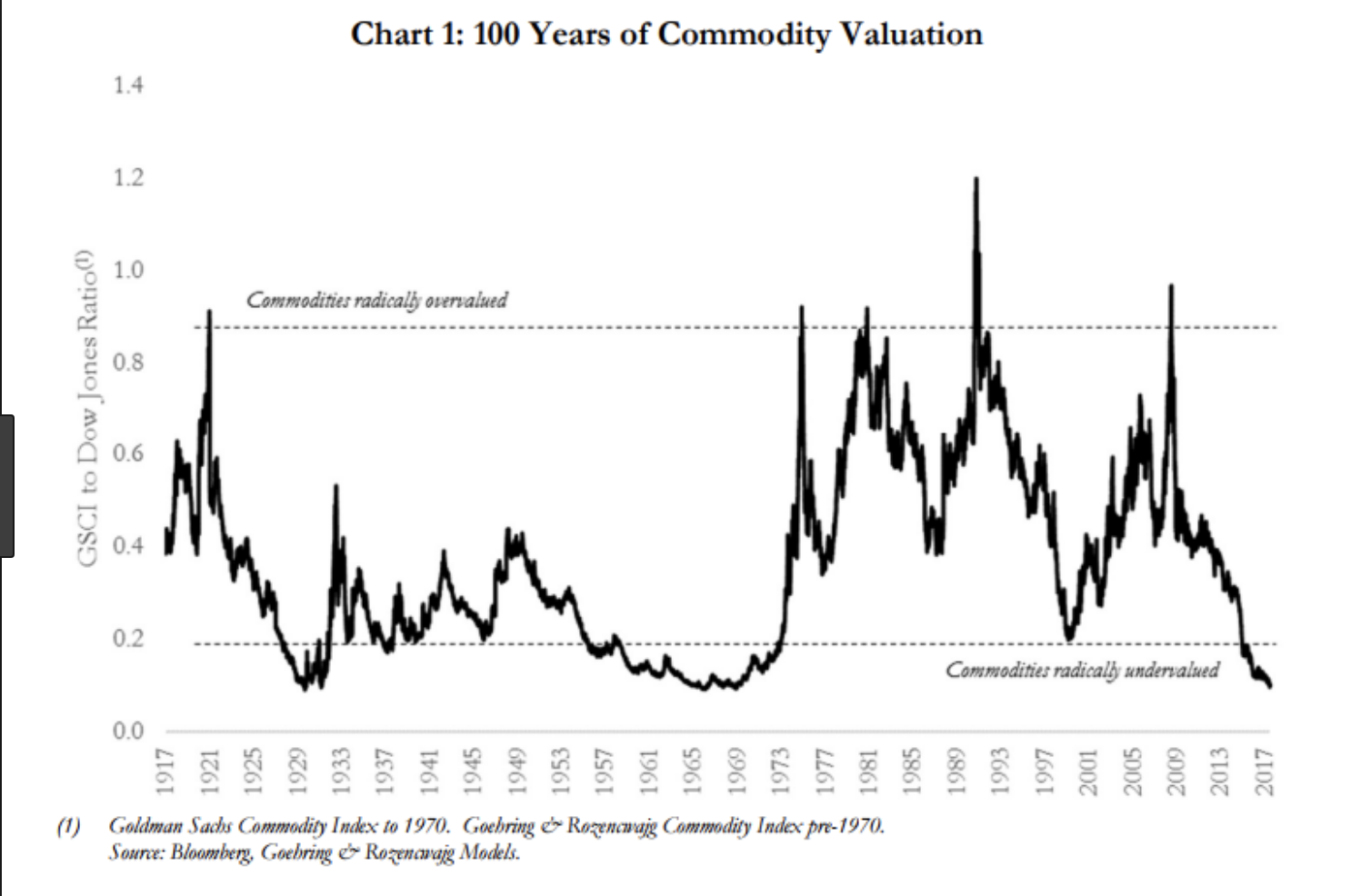

It’s All Connected – Why Gold is Starting to Shine

If you don’t own gold, you know neither history nor economics. -Ray Dalio I haven’t written anything in a little while because, well, there hasn’t been a whole lot going on to write about. We have had the usual Fed go full-panic-dove-mode, we’ve reportedly made progress on a trade deal with China about 28 times…

The Value of Scarcity

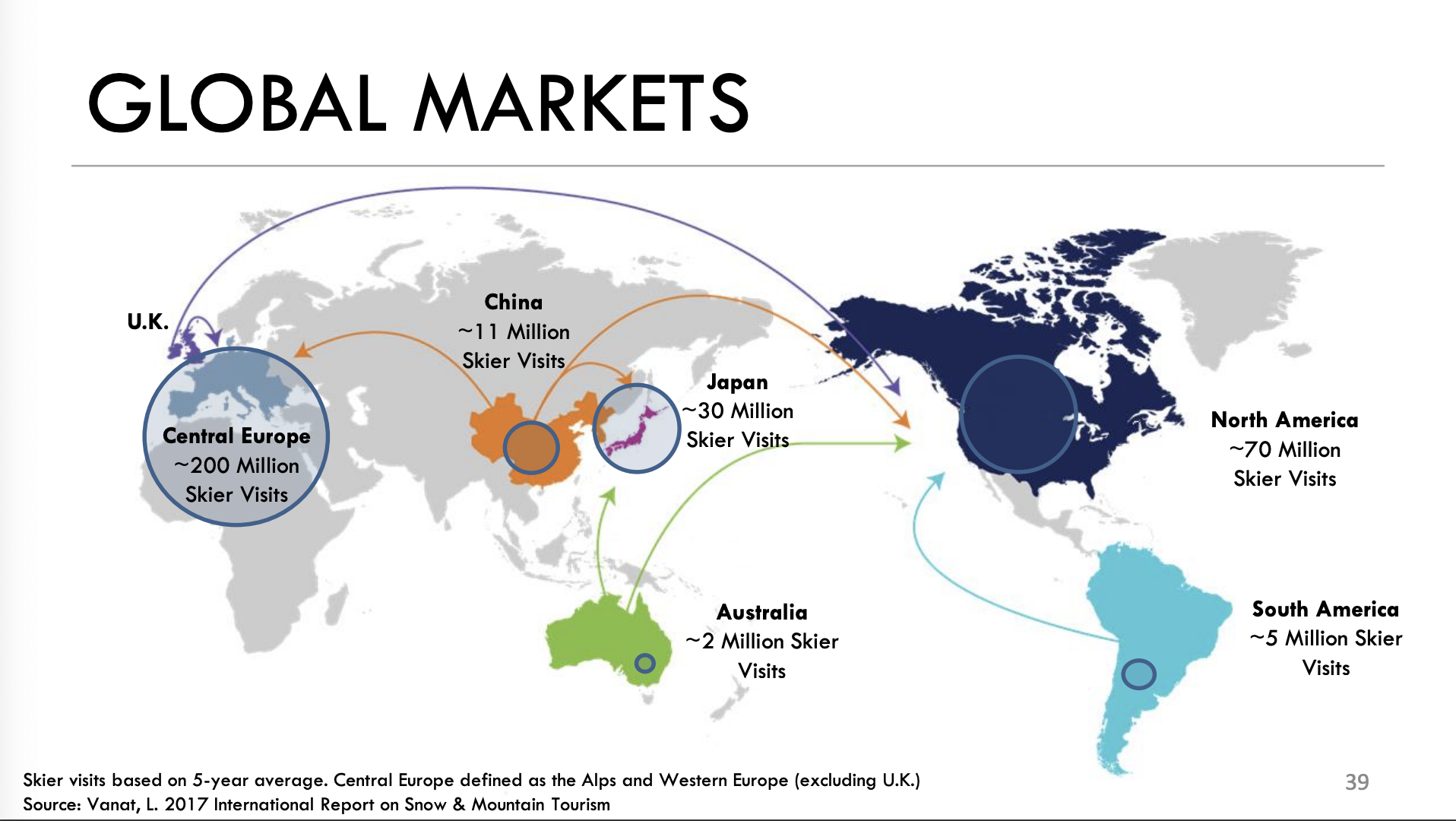

I very much value scarce and unique investments. One of the first economic lessons we tend to learn as kids is that the more rare something is, the more it is worth. This is something you probably learned quickly if you ever collected or traded something like baseball cards when you were younger. These are…

A Few Thoughts on Recent Events

Here’s my brain dump on the recent market action and how I’m approaching things: Since stocks started to slide in October, I’ve been seeing signals that only appear during bear markets so I’ve been operating under that assumption by reducing exposure to higher risk assets (stocks, corporate bonds, etc.) on bounces. We’re now…

How to Improve your Long-Term Investment Returns

Is this recent volatility in the stock market bothering you? I have a simple solution for you. Just stop looking at it! One of the most common traits that the vast majority of us share is that a loss of something hurts more than the equivalent gain (in our case it will be money). This…