The move in the S&P 500 since January 1st (the selloff, bounce, weak test of the lows and a big surge afterwards) has been so eerily similar to the Aug-Oct move a few months back that it’s a little weird… Even the multiple 2-day retracements in the middle of the surge. The August selloff unfolded after…

Why Recessions are Necessary for Growth

Why has the economy been stagnant since 2008? Not the stock market…the real economy: real growth, higher wages, etc. Because we never let the system clear itself of waste, excess, inefficiency and poor investment decisions. I think a good analogy to explain this concept is to think of the economy like a balloon. In order…

High-Level View of Today’s Global Economy & Markets

Here’s an article from the Financial Times earlier this month that pretty much sums up the current state of the global markets. I think an easy way to envision our global financial system (a credit-based fiat system) so that it’s easier to understand is to think of it like a balloon. When credit is easy and liquidity is being…

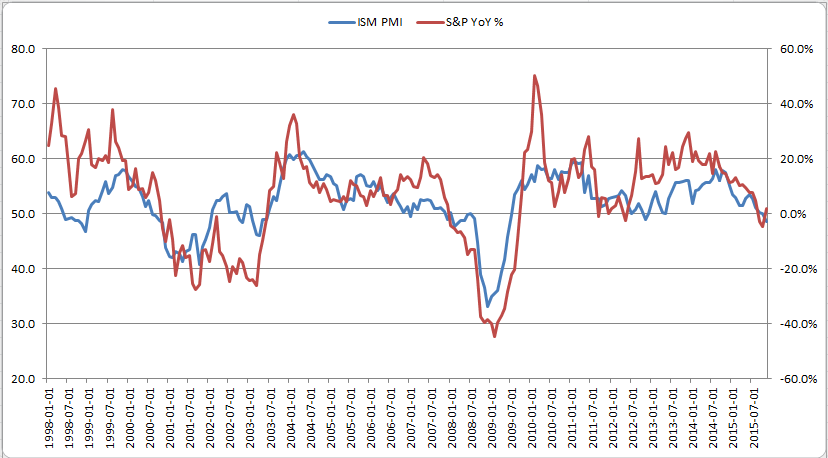

Chart of the Week: Not a Good Sign for Global Stock Markets

The chart below was going around a lot last week. It shows a composition of AP Moller-Maersk (the world’s largest container shipping company) and Sotheby’s (the auction house of high-end art, etc.) in blue vs. the MSCI World Stock Index in orange. That’s a pretty tight correlation and a pretty wide gap we’re seeing right…

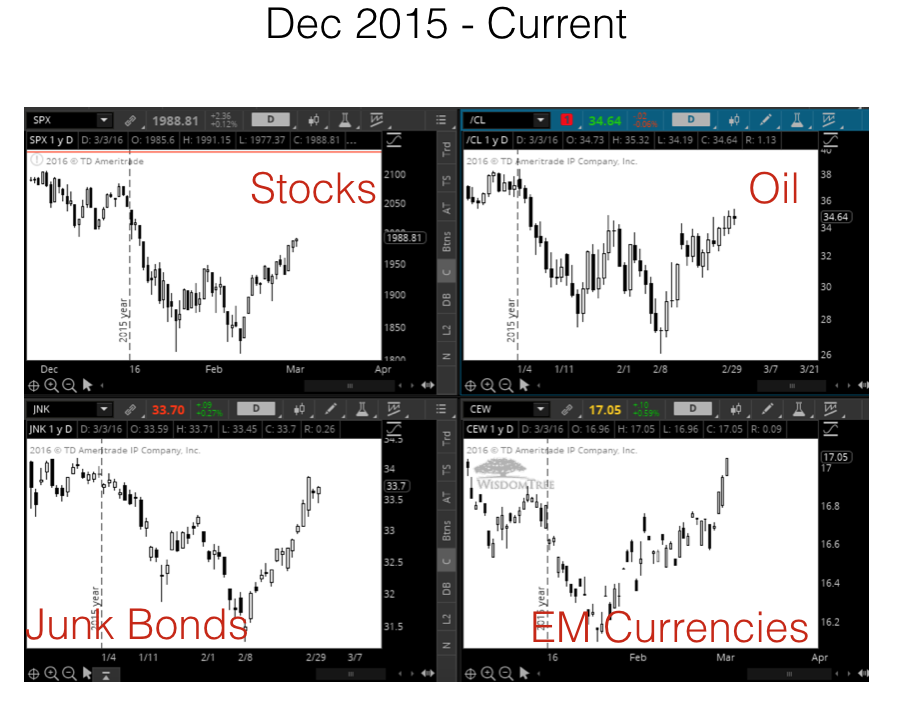

Market & Portfolio Updates

I haven’t written on the blog in about two weeks because we’re in the middle of quarterly earnings. There is a 2 or 3 week stretch each quarter where I’m pretty busy listening to the earning’s conference calls of the companies we own as well as other companies I’m looking into. The good news is…

Making Sense of the Nonsense

I’d like to comment on two things that have been a huge disservice to the average (nonprofessional) investor. One is CNBC and the second is the Federal Reserve. Do yourself a favor and don’t watch CNBC. Like all media companies, CNBC is in the business of collecting eyeballs. They want strong ratings so they can…

Allergan – the Gift that Keeps on Giving

Pfizer and Allergan have announced a “merger” where Pfizer is essentially acquiring Allergan so it can perform a tax inversion to relocate to Ireland (where Allergan is based). This is the second time Allergan has been acquired since we purchased it back in June, 2013, with the first being the takeover by Actavis last fall. Then…

Are New Opportunities on the Horizon?

I find it fascinating that the stock market is still so fixated on stimulus (more quantitative easing), which says a lot about the nature of the global economy. Stocks posted a pretty strong rally yesterday after the European Central Bank (ECB) hinted at increasing their QE program. Then, this morning, the futures were driven even…