Last week the Fed cuts interest rates for the first time since the GFC a decade ago and the market’s response was pretty interesting. After referencing the 1995/96 one-and-done cut that prolonged the 90’s expansion all summer, I think they were hoping that they could get away with one cut as “insurance” that would ease…

Macro Update: Stocks, Bonds, and the Dollar – One is Wrong

For most of this spring, I’ve been telling clients that I’ve been in “wait and see” mode. The US dollar, bonds and stocks have all been rallying this year, and while that can happen in the short-term, the dynamics of the market say that can’t last in the long run. Basically, 1 of the 3…

Macro Update

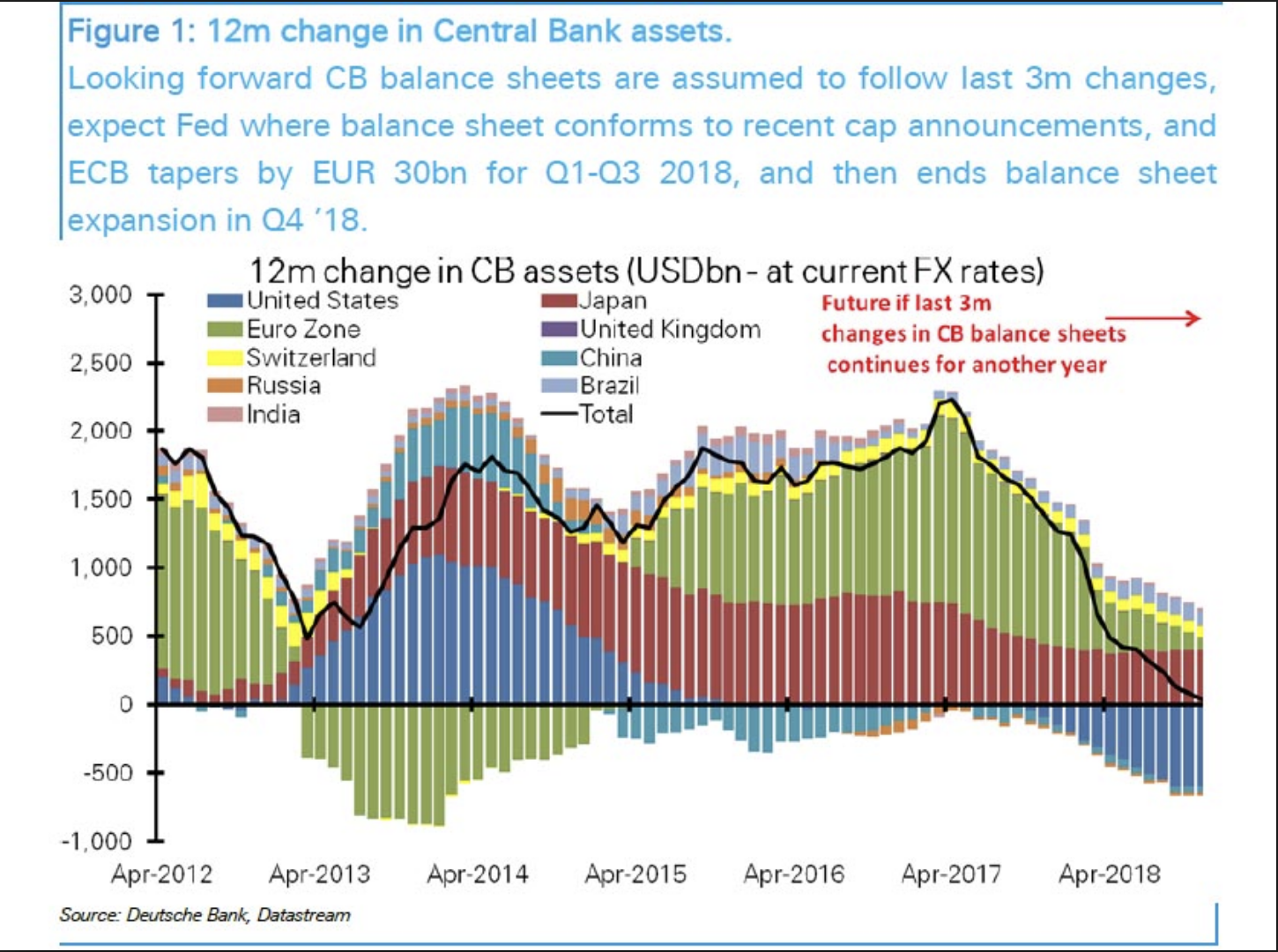

Unsurprisingly, the Fed finally got the message from the markets and pulled a hard 180 last month. In a very short six weeks, they went from “balance sheet runoff on autopilot and more rate increases to come in 2019” to “we’re pausing rate increases and we’ll be flexible with the balance sheet.” Risk assets have…

A Few Thoughts on Recent Events

Here’s my brain dump on the recent market action and how I’m approaching things: Since stocks started to slide in October, I’ve been seeing signals that only appear during bear markets so I’ve been operating under that assumption by reducing exposure to higher risk assets (stocks, corporate bonds, etc.) on bounces. We’re now…

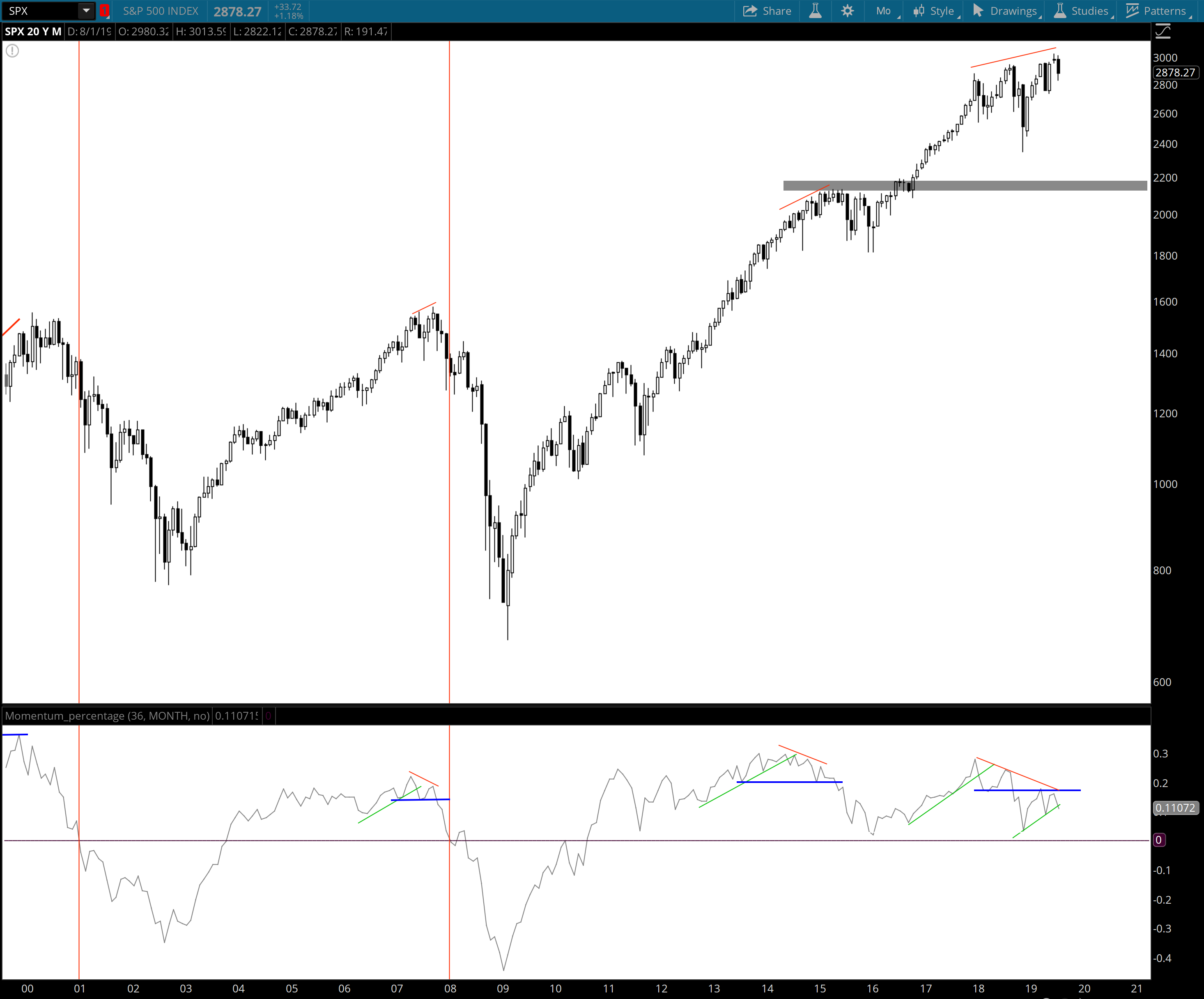

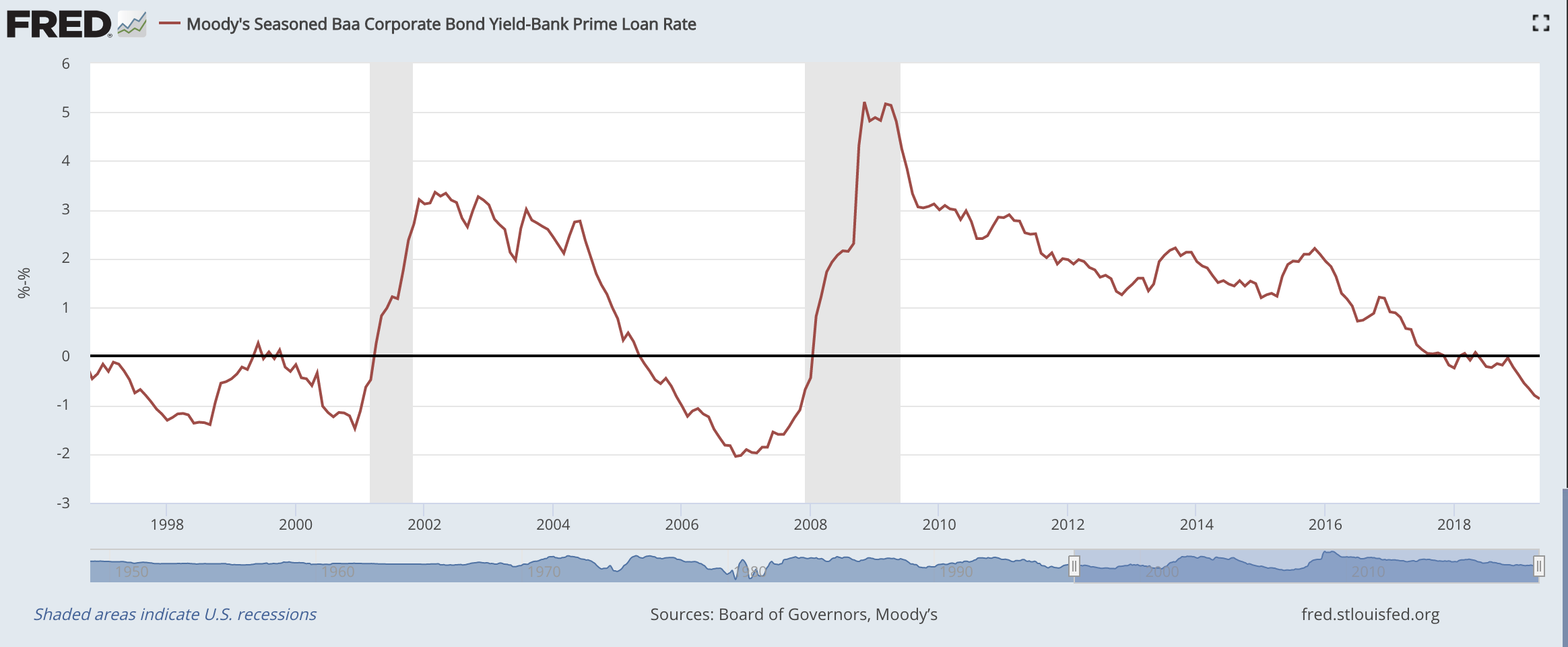

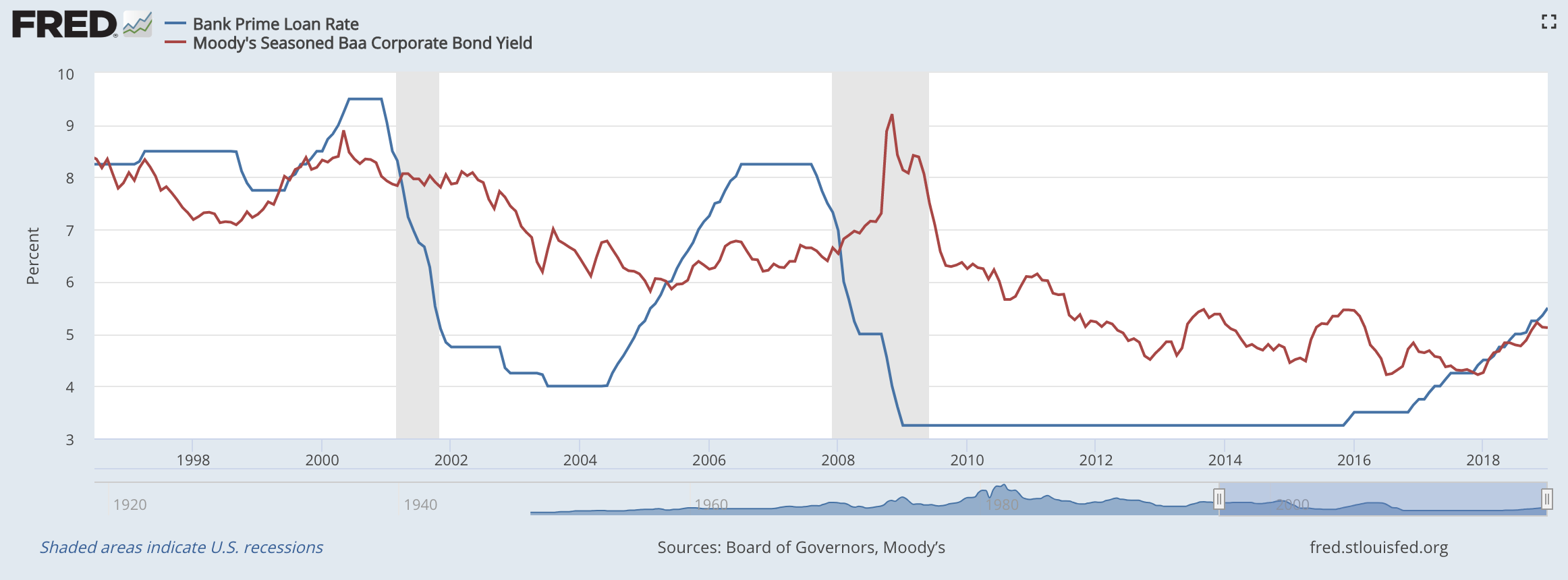

Macro Update: Late Cycle Dynamics

I’ve been seeing warning signals since the spring that we’re in the later stages of this economic cycle so I wanted to post an update to illustrate. One thing to mention is that cycles tend to move very slowly which can be a double-edged sword. It’s nice because you can typically read the tea leaves…

The Pain & Opportunity of a Dollar Squeeze

Global investment markets are becoming very macro driven and it’s pretty important to understand the big picture dynamics at play right now. The US dollar is the key to everything and there has been a growing shortage of dollars throughout the global economy over the past few years which we’re now seeing create the usual…

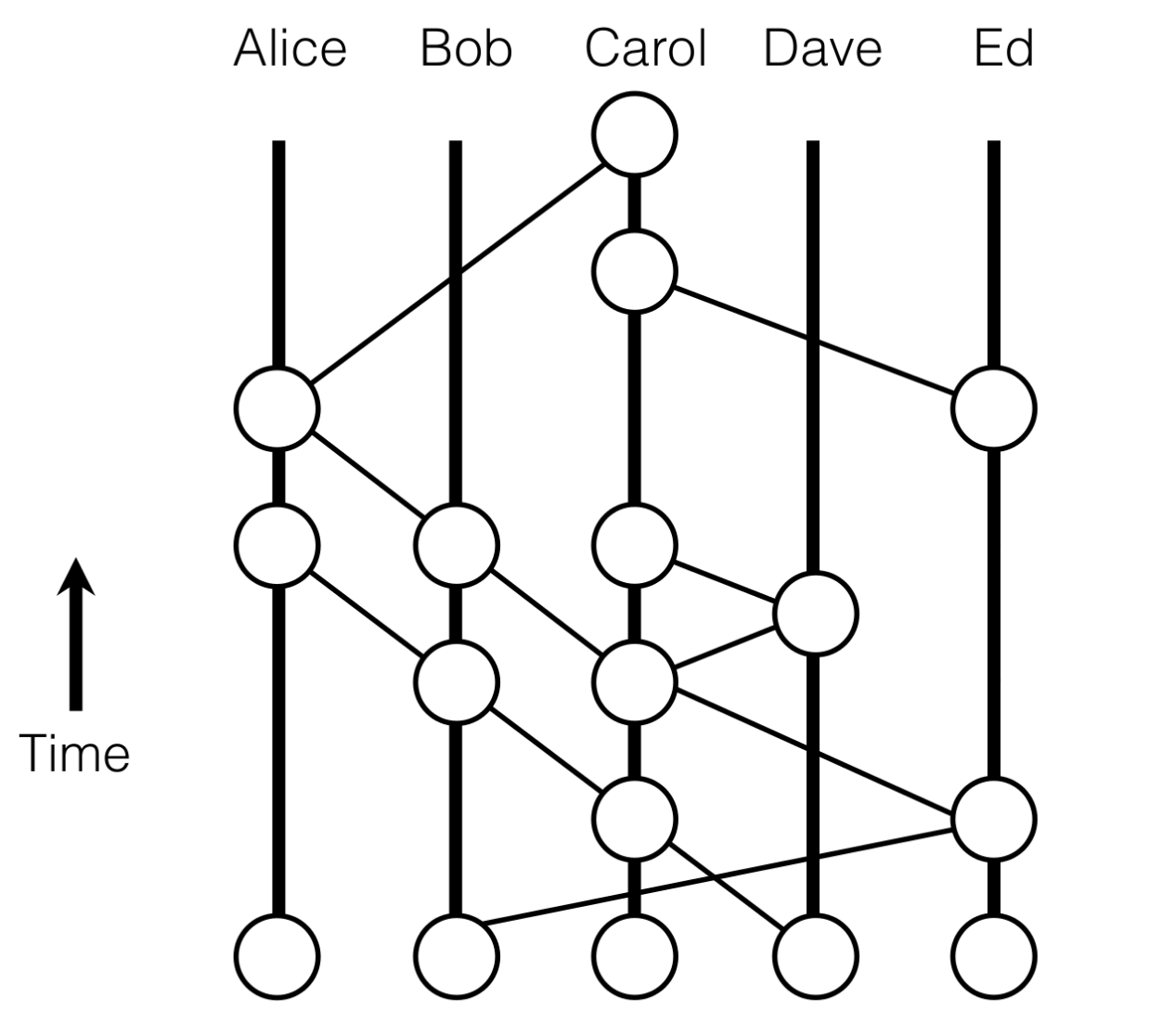

Why I Think Hashgraph will be the Cryptocurrency & DLT Winner

This post might seem a little off-course from the usual investments/markets I write about but I promise it’s relevant. Obviously the world is becoming more technology oriented and while most people still don’t really understand the details of cryptocurrencies, I believe we’re in the very, very early stages of a movement where the world is…

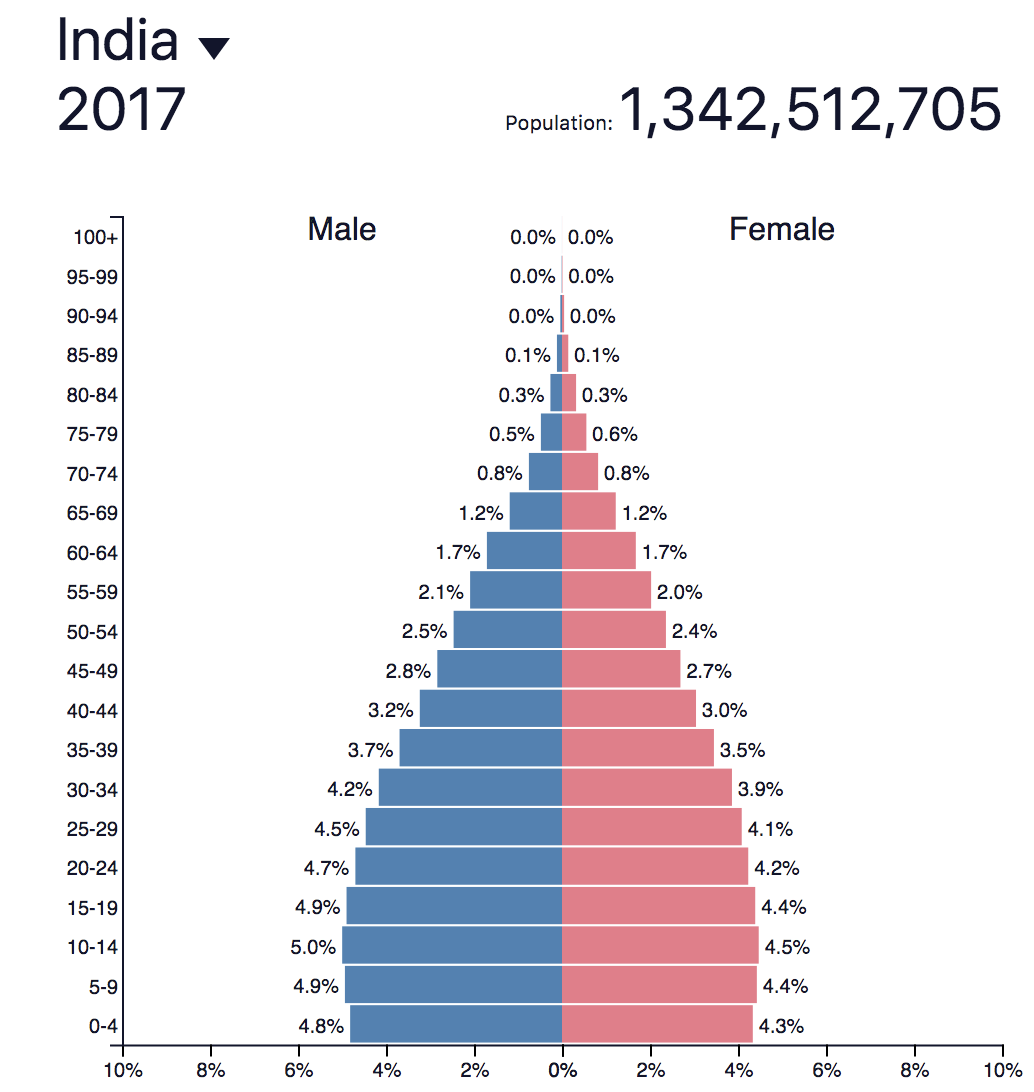

Why India will be the Center of Global Growth for the Next Decade

If you’re a long-term growth investor, you should be focusing on Asia. Everyone in the US loves to focus on the US stock market (home country bias) but valuations in the US are pointing to disappointing returns over the next decade. That’s not to say that there aren’t any attractive investment opportunities in the US…