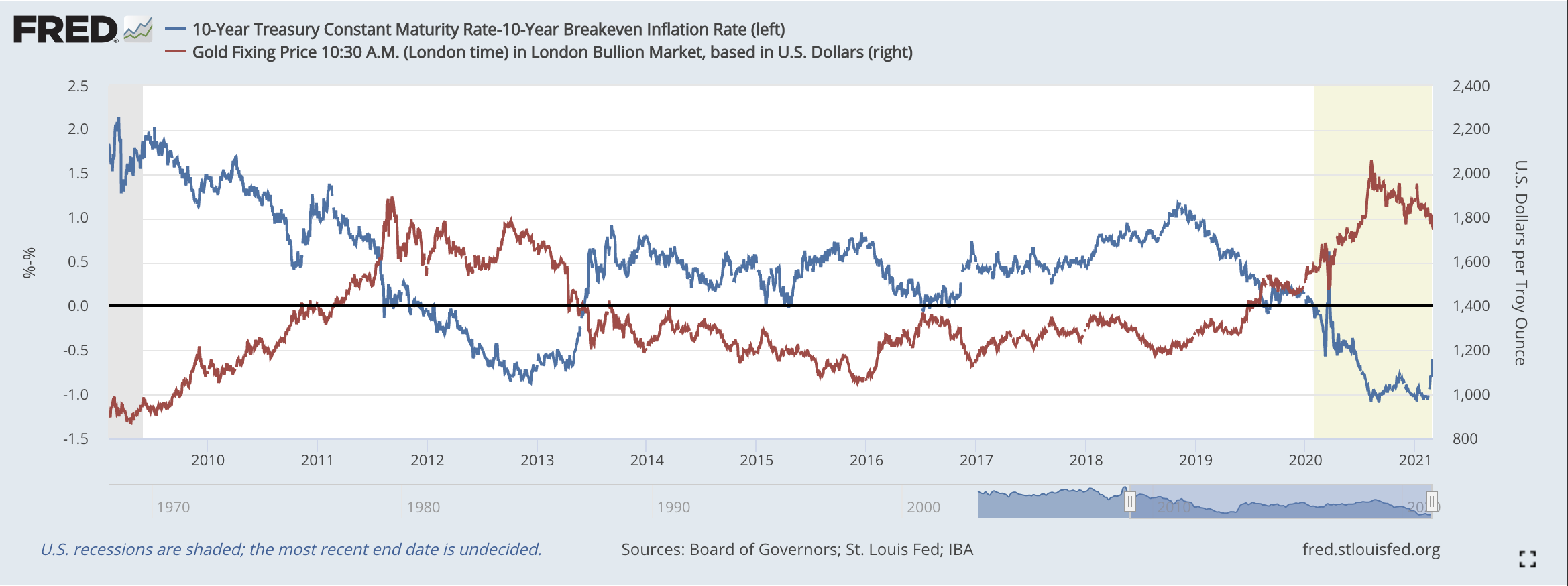

We’re soon going to find out where the Fed’s pain point lies. Treasury yields on the long end of the curve have been relentlessly pushing higher this year with the 10-year treasury pushing past 1.5%, all while pressures within the plumbing of the money markets and repo are pushing into negative territory. Quite the mix…

The Writings That Have Most Influenced My Thinking This Year

Here are some books and writings that I have found to be the most helpful in shaping my thinking this year. For a longer-term geopolitical framework, I highly recommend Disunited Nations, by Peter Zeihan. It’s a very easy, somewhat fun, yet informative read on the shifting geopolitical tides we’re likely to see play out over…

The Importance of Asymmetric Convexity for a Portfolio Moving Forward

After a long hiatus from the blog, I’m back! I never really went anywhere. Things were so hectic in March and April that I was focusing all of my time on staying on top of everything. After that, I was using direct communication to keep my clients updated and since then I just haven’t had…

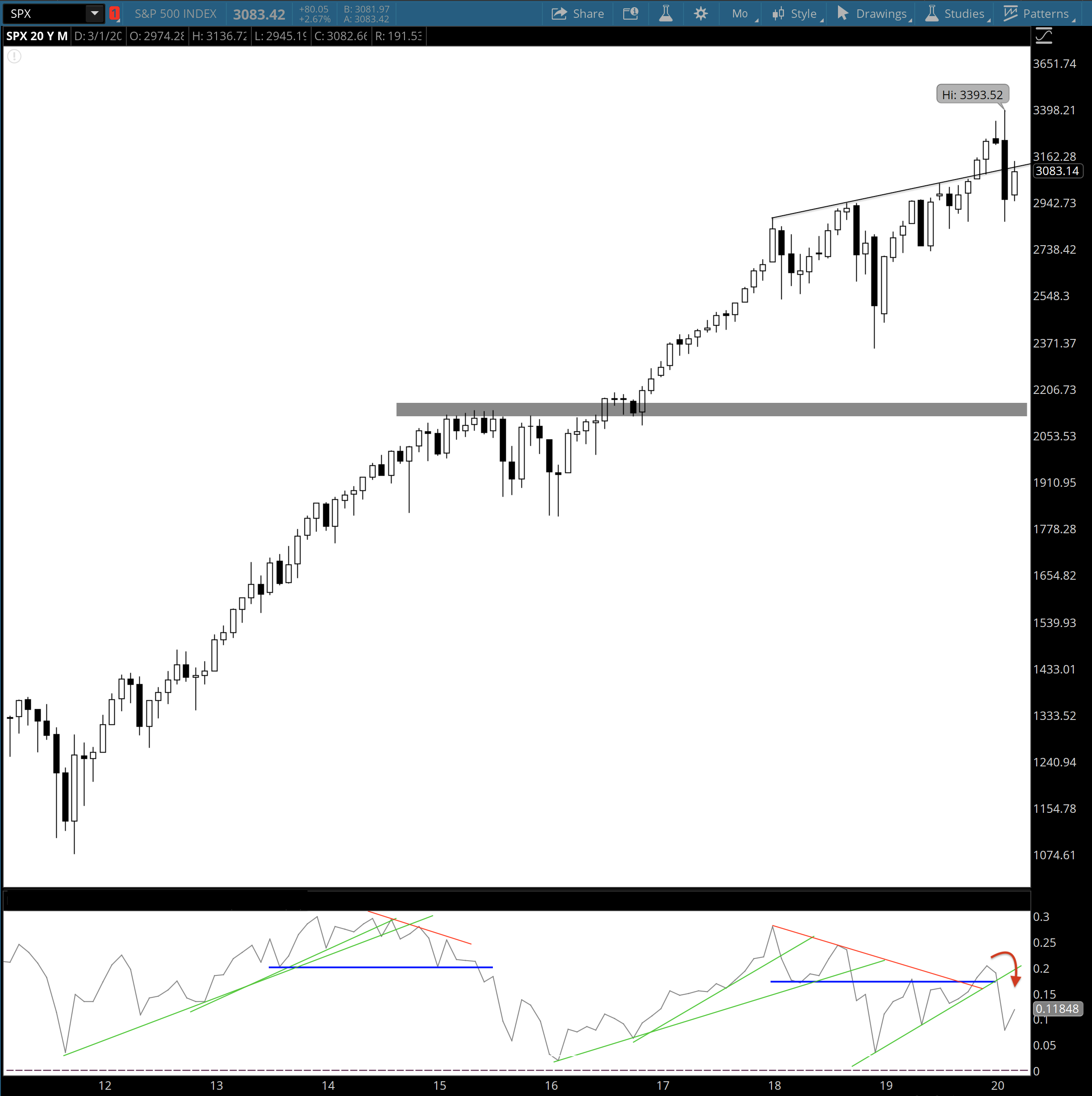

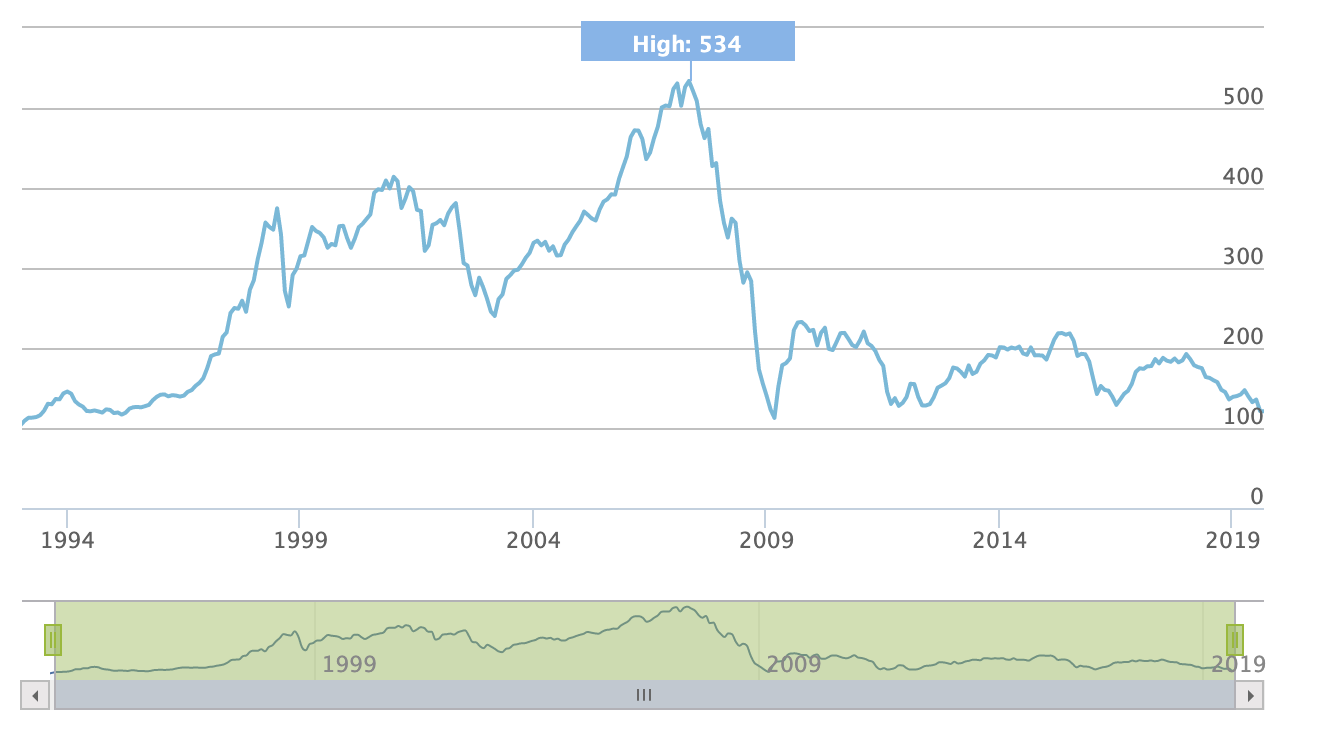

Market Risk is Highest Since 2007/08

I’m going to try to keep this post a little shorter by not getting too deep into the explanations but I wanted to post an update with my thoughts based on what I’m seeing. Given the weakening economic backdrop, the risk across the board is probably at its highest point right now since 2007/08. The…

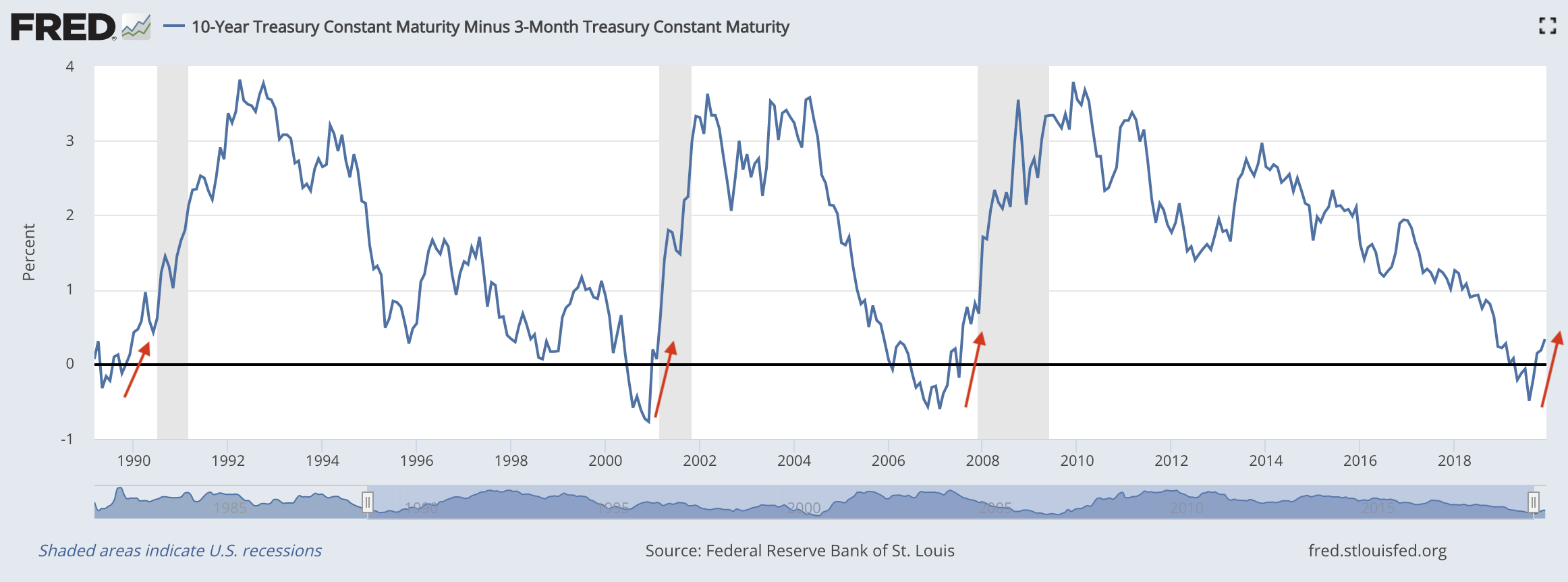

On the Verge of a Recession & the Most Important Chart Right Now (Feb 2020)

Unfortunately the employment numbers lately have been disappointing and the job openings number this morning was very worrying, down 14% on a year-over-year basis. Initial and Continuing Unemployment claims have also been rising on a year-over-year basis. So we have unemployment starting to tick higher and hiring slowing – two things seen at the…

Macro & Markets Update: Dec 2019

I haven’t posted anything in a while because every time I’m about to write an update, a new piece of pretty big news develops that potentially shifts the picture. So here’s a high level overview of my thoughts from the past month. There’s a debate going on right now if the current slowdown will…

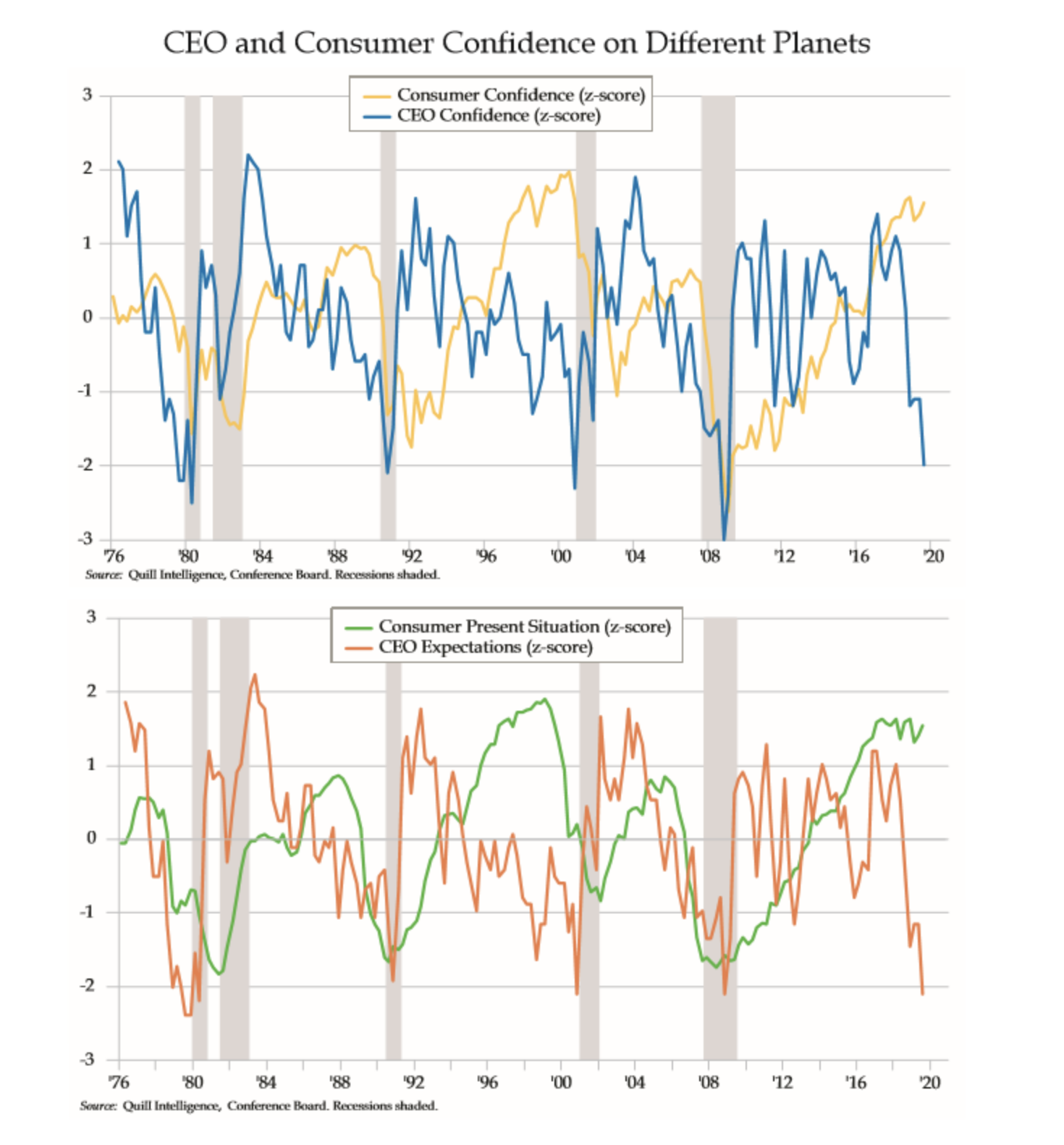

Approaching a Critical Juncture

I continue to see classic signs of late cycle behavior. Late cycle doesn’t mean that it’s over today, and I still haven’t seen the deterioration in credit or stock markets to turn me bearish yet, but it does suggest caution and not being overexposed to risk. Danielle DiMartino Booth, a former advisor within the…

Things That Have Caught My Eye Lately – Sept, 2019

This post will be an all encompassing update of things that have caught my eye over the past month. The ECB, the IMF & Christine Lagarde Christine Lagarde, the head of the IMF, was selected to be the next president of the European Central Bank (ECB) and secured the backing of the European Parliament…