GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

When a Health Savings Account (HSA) is Right for You

Most of my posts are investment market related but I’m also an advisor who helps my clients with their financial planning. This post is more in that arena. With the annual “get screwed by health insurance season” right around the corner, I thought it would be useful to talk about HSA’s and whether or not…

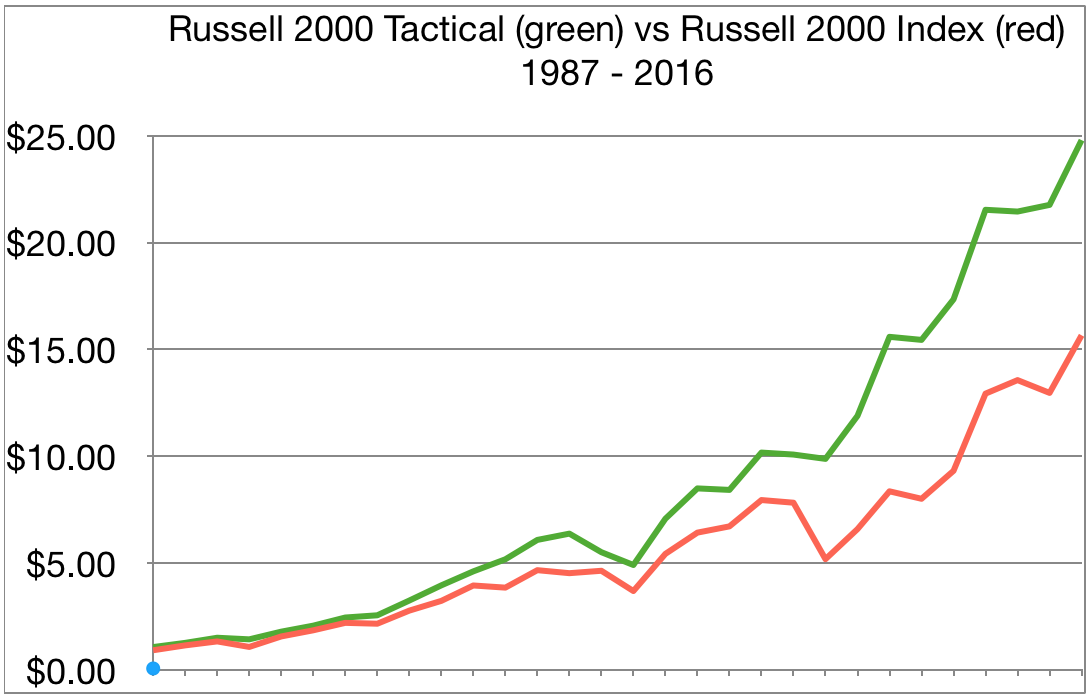

The Most Important Investment Concept & How to Win the Long Game

This post discusses a very high level concept that is crucial to successful investing and is most applicable to the growth side of investing. Price fluctuations don’t matter all that much when investing for income but permanent losses obviously do. There’s a lot more that goes into portfolio construction and properly tailoring a portfolio to a…

How the Economic Cycle Impacts your Portfolio: Shifting to the Next Stage

There’s a general playbook for investing when it comes to the macro-economic business cycle. The cycle includes four stages: Reflation, Recovery, Overheat and Stagflation. You might also hear other terms used to describe each stage but we’ll run with these because Merrill Lynch made this nice chart for us. Within each stage, investment assets tend…

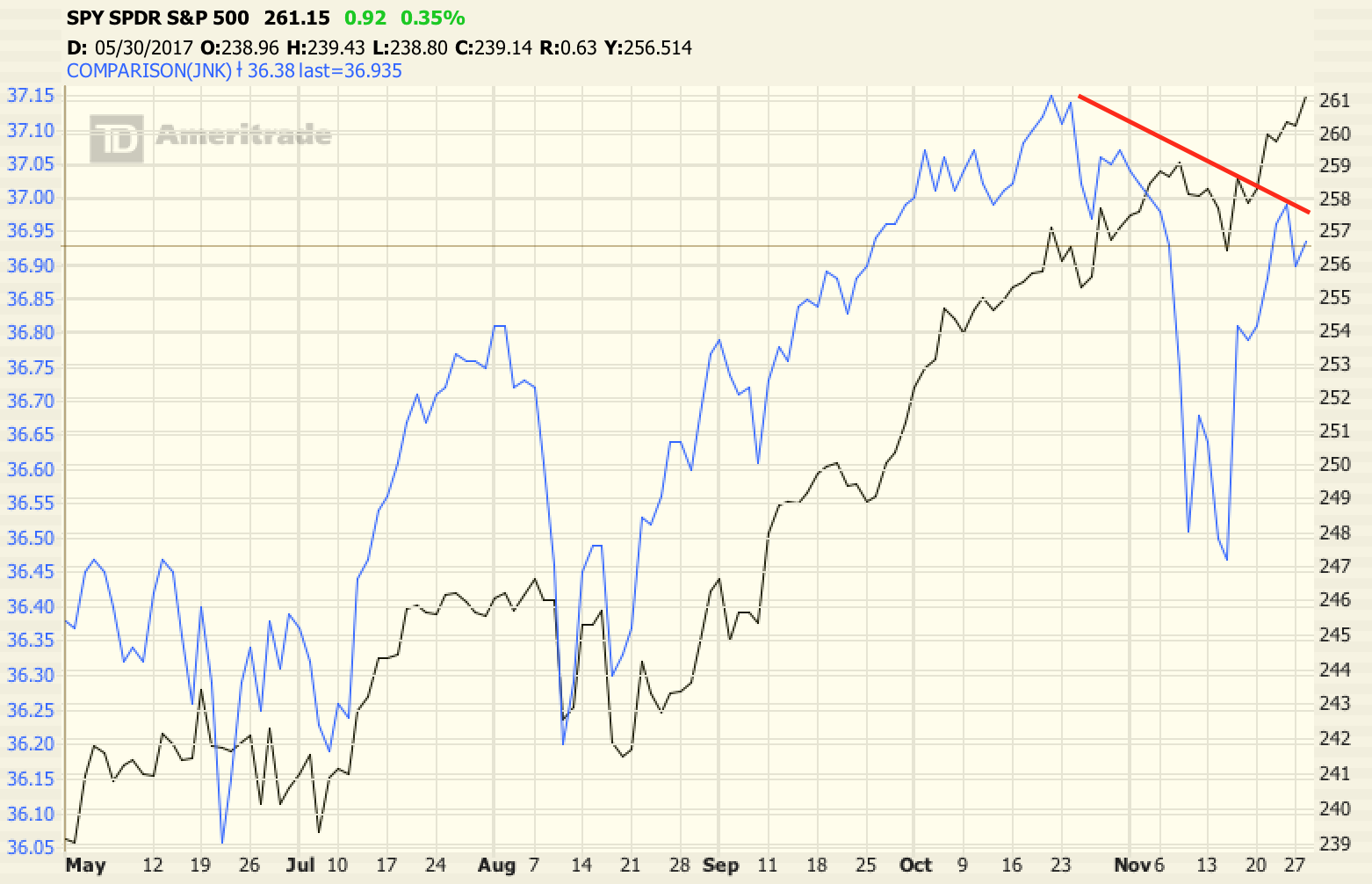

When Correlations go to 1, Short Volatility and Negative Convexity

2017 has been the year to sell volatility. Volatility on nearly all asset classes has been compressed to historically low levels, which is a function of the world’s major Central Banks going into asset purchase overdrive for the past 18 months. When you flood the global financial system with free money, people tend to leverage…

Highlighting Some New Investments

Here’s a brief overview of some recent investments made over the past few weeks. TripAdvisor (TRIP) We purchased stock in TripAdvisor as a growth investment. This is a unique stock that has tremendous long-term growth potential if management can execute. I’m sure almost everyone is familiar with TripAdvisor. They run a site where users can…

Why Boring is Usually Best

I bought stock in Kimberly Clark (KMB) this week as a new Income investment at a 3.2% dividend yield. Kimberly Clark is a global consumer products company with many recognizable brands used by a quarter of the world’s population in the paper products space. Some of their top brands include Huggies, Klenex, Cottonelle, Kotex, Depend…

Chart of the Week: Changing Auto Market, EV’s and Demand for Metals

There was an interesting article yesterday on Bloomberg about the changing demand for various metals as more cars shift to hybrids or fully electric vehicles (EV’s). Every major car maker is now starting to come out with their own EV’s and Volvo just announced last month that by 2019 all of their cars will be…