Asset markets move in cycles, flipping between periods of growth and decline (or consolidation). You can see these cycles in pretty much every asset class and on multiple levels due to the fractal nature of markets. This means there is a short-term cycle within an intermediate-term cycle within a long-term cycle, and so on. You…

Are your Investments Antifragile? Are your Investments Essential?

Two really great books that I highly recommend are Antifragile: Things that Gain from Disorder by Nassim Taleb and Essentialism: The Discipline Pursuit of Less by Greg McKeown. I read Antifragile a little while ago but saw an article this week that I thought was worth passing on. It discusses how to live an antifragile…

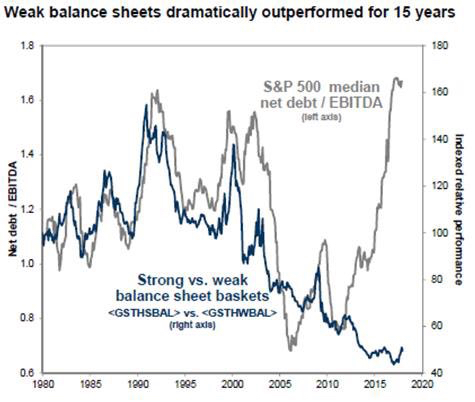

Swapping Some Growth Stock Investments

I’m becoming concerned about tech stocks in general as we move to the later stages of this economic cycle. We’ve seen a deterioration in market breadth with money continuing to chase fewer and fewer stocks (namely tech). Tech stocks were some of the biggest winners in 2017 and the recent bounce after the late January…

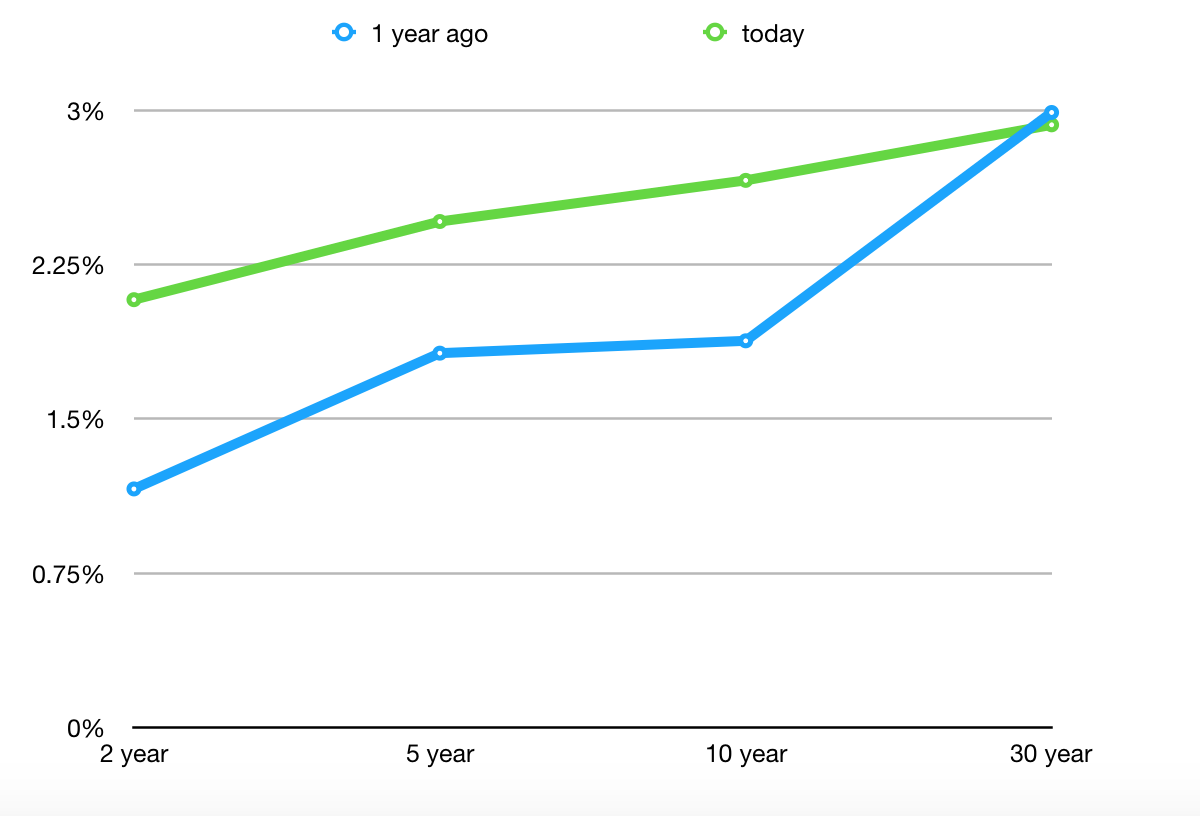

Yields & Income Investment Updates

The 10-year Treasury yield stopped just short of 3% last week and the recent Commitment of Trader’s data is showing massive short exposure to the 10-year futures contract by non-commercial traders. These are speculative positions betting that the 10-year yield will continue to rise (bond prices will continue to fall). The market has a funny…

Volatility is Back with a Vengeance

Well, it finally happened. The short volatility trade blew up and the volatility genie is now out of the bottle. Credit and monetary conditions are still extremely loose so this should calm down soon, but I doubt we see a low volatility regime like 2017 in a long time. So here’s what happened: Two Inverse…

Starbucks, Dividends and the Power of Compounding

I purchased stock in Starbucks (SBUX) last week when the stock was trading down about 5% following an earnings release that fell short of analyst expectations. I love it when short-term momentum traders bail on a great long-term story, creating an opportunity for us to buy. After an over 2 year hiatus, we’re back to…

Rising Yields are Creating an Opportunity for Income Focused Investors

With stocks continuing to climb higher I’ve been a lot less active in terms of buying, especially on the Growth side of portfolios. However, there are some attractive opportunities popping up in the Income arena due to rising short and intermediate term bond yields. The yield curve is a line that measures yields at each…

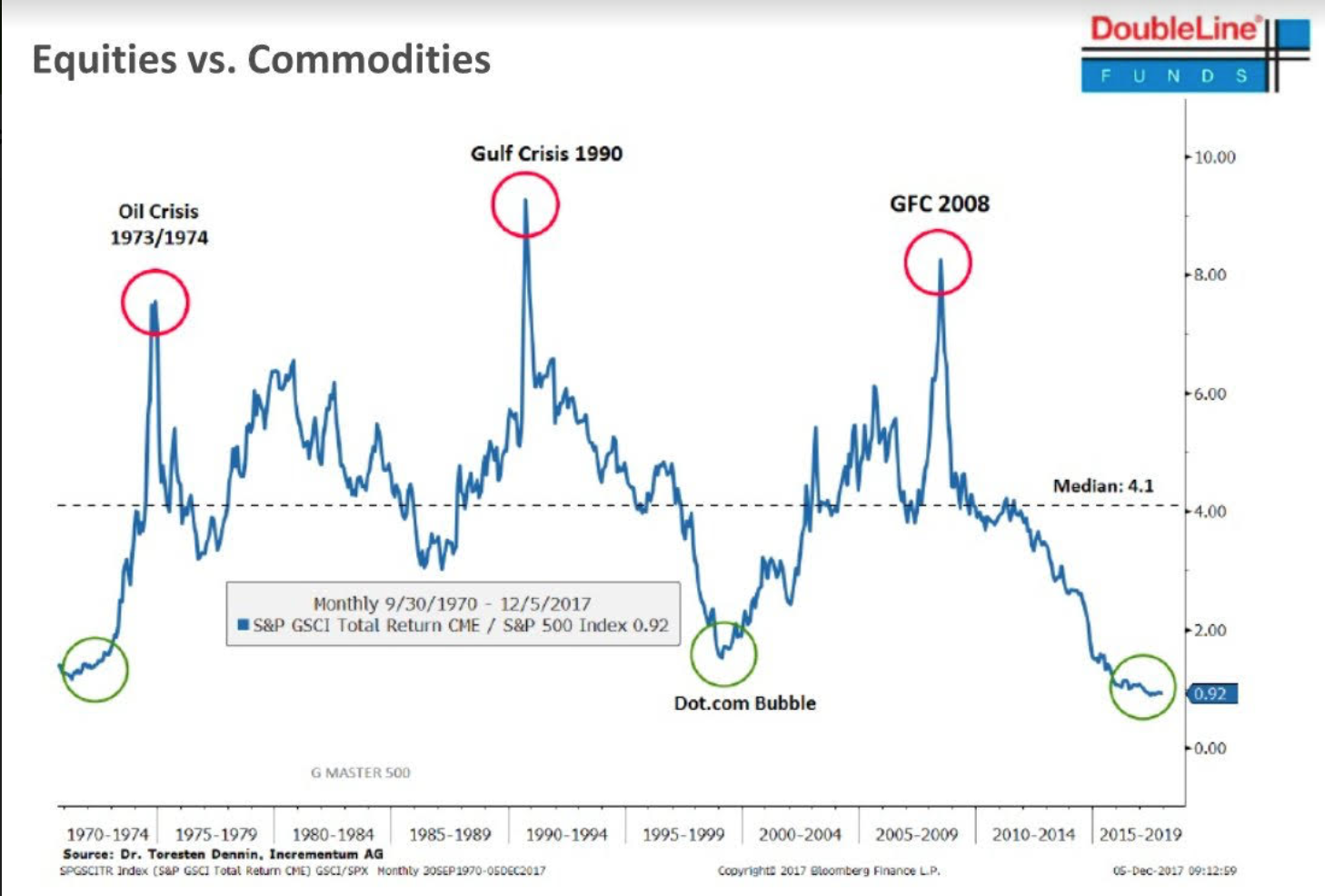

Why 2018 Might be the Year of Commodities

I’ve been telling my clients over the past few months that I expect inflation to pick up moving forward. The decline in the dollar this year and subsequent rally in most energy and industrial commodities is creating the year-over-year price change to bleed through to various inflation measures like CPI, PCE and (ISM) prices paid…