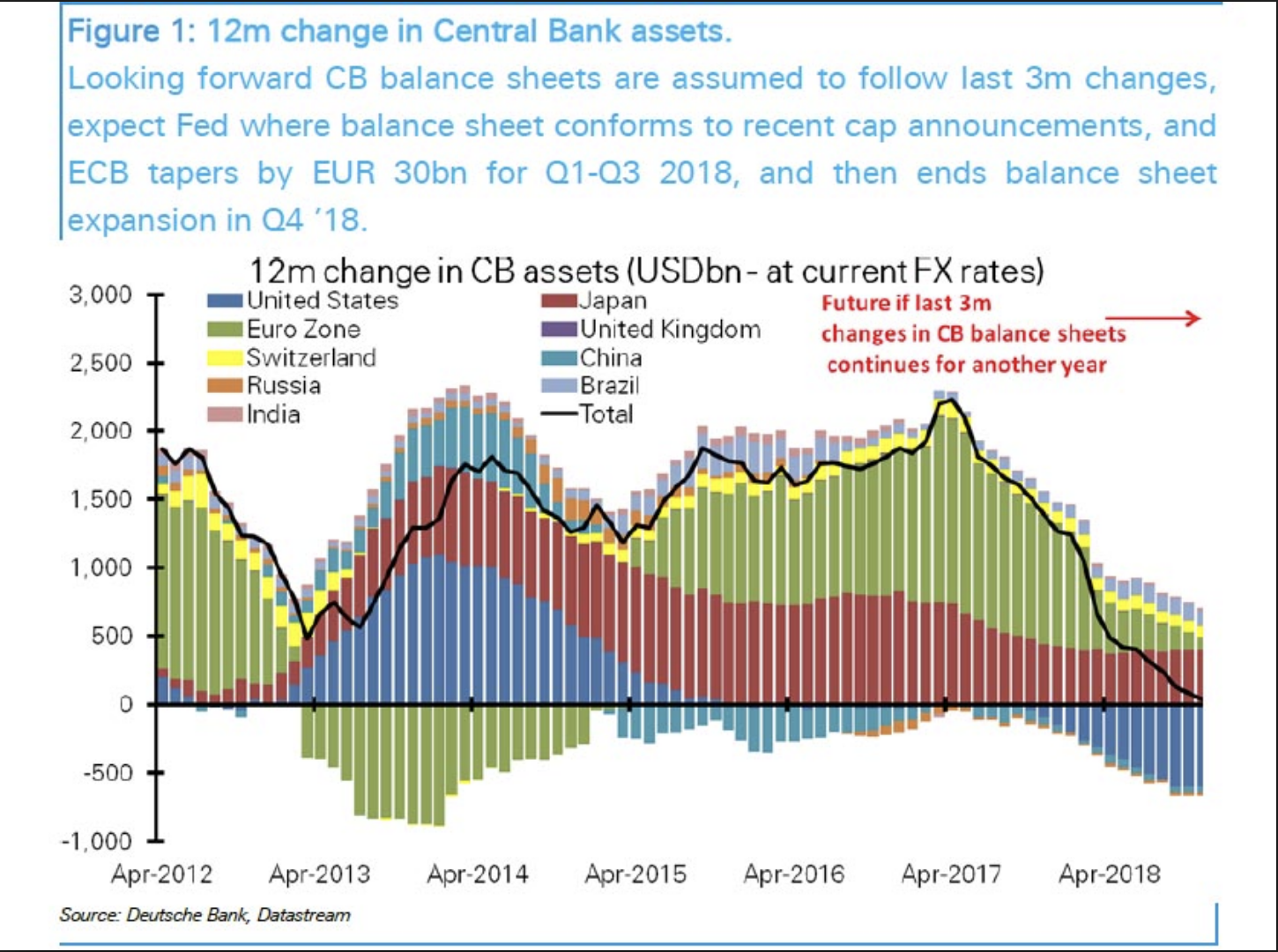

Unsurprisingly, the Fed finally got the message from the markets and pulled a hard 180 last month. In a very short six weeks, they went from “balance sheet runoff on autopilot and more rate increases to come in 2019” to “we’re pausing rate increases and we’ll be flexible with the balance sheet.” Risk assets have…

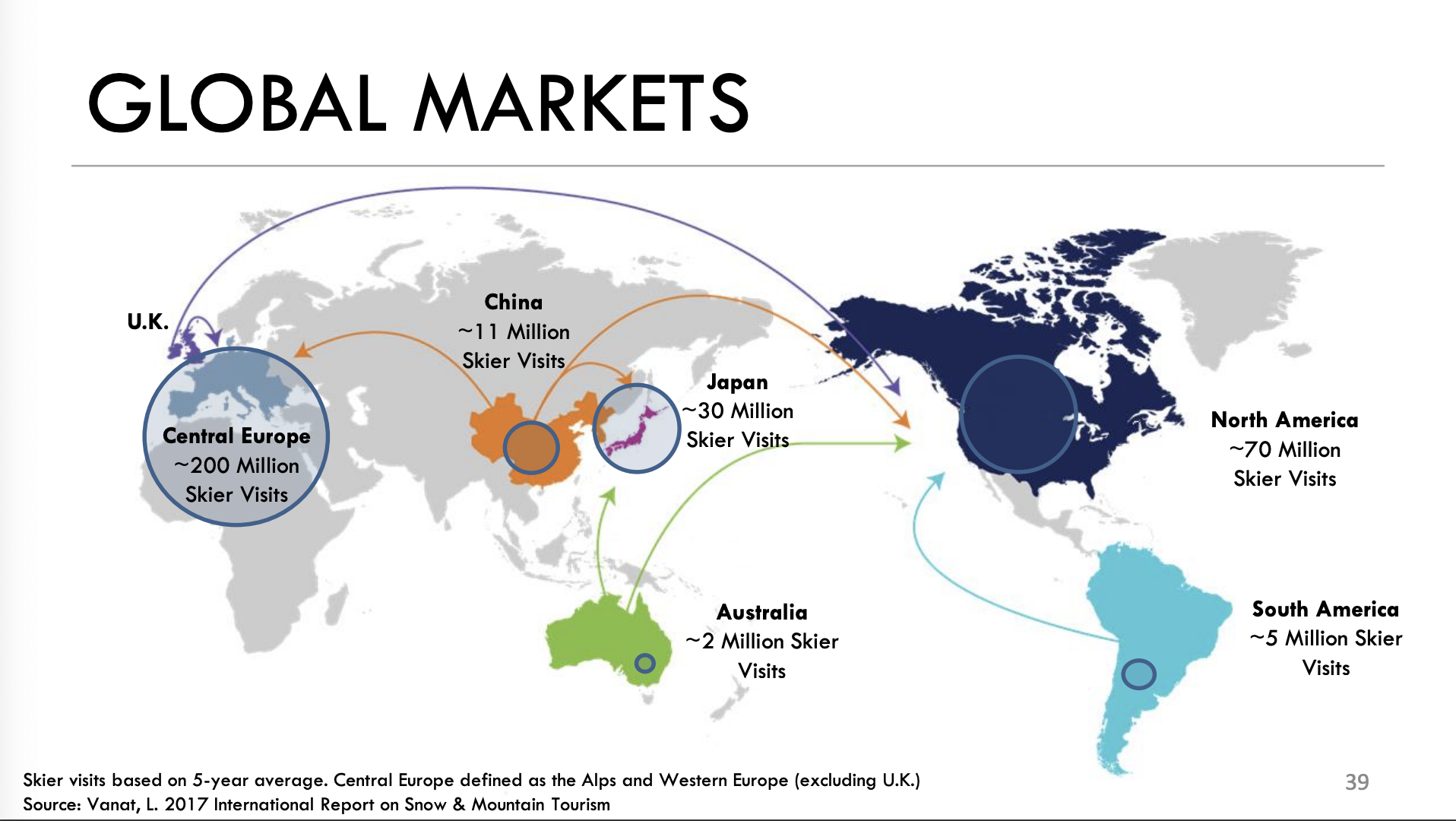

The Value of Scarcity

I very much value scarce and unique investments. One of the first economic lessons we tend to learn as kids is that the more rare something is, the more it is worth. This is something you probably learned quickly if you ever collected or traded something like baseball cards when you were younger. These are…

A Few Thoughts on Recent Events

Here’s my brain dump on the recent market action and how I’m approaching things: Since stocks started to slide in October, I’ve been seeing signals that only appear during bear markets so I’ve been operating under that assumption by reducing exposure to higher risk assets (stocks, corporate bonds, etc.) on bounces. We’re now…

How to Improve your Long-Term Investment Returns

Is this recent volatility in the stock market bothering you? I have a simple solution for you. Just stop looking at it! One of the most common traits that the vast majority of us share is that a loss of something hurts more than the equivalent gain (in our case it will be money). This…

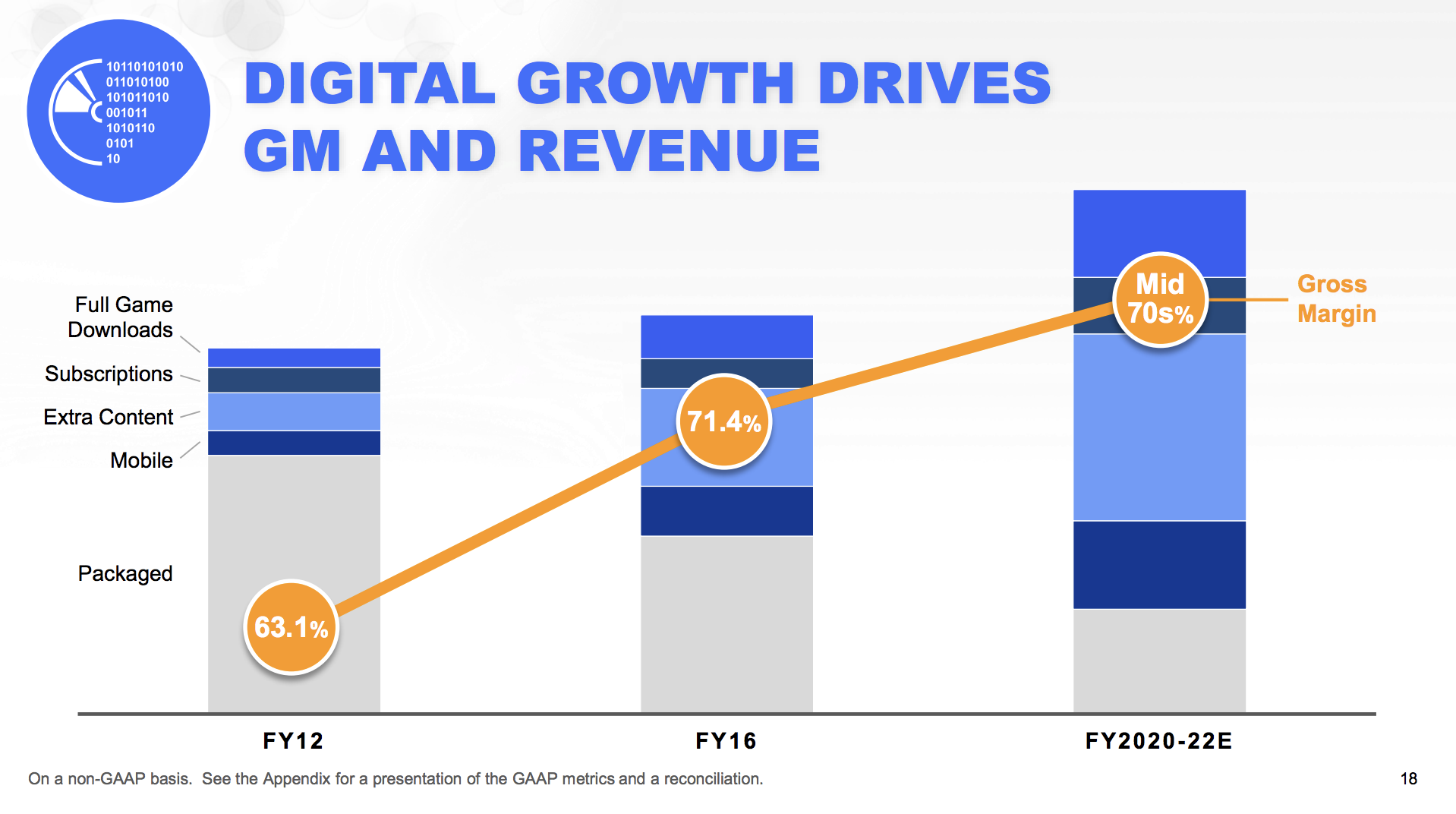

Finding Long-Term Opportunities in the Short-Term Weakness

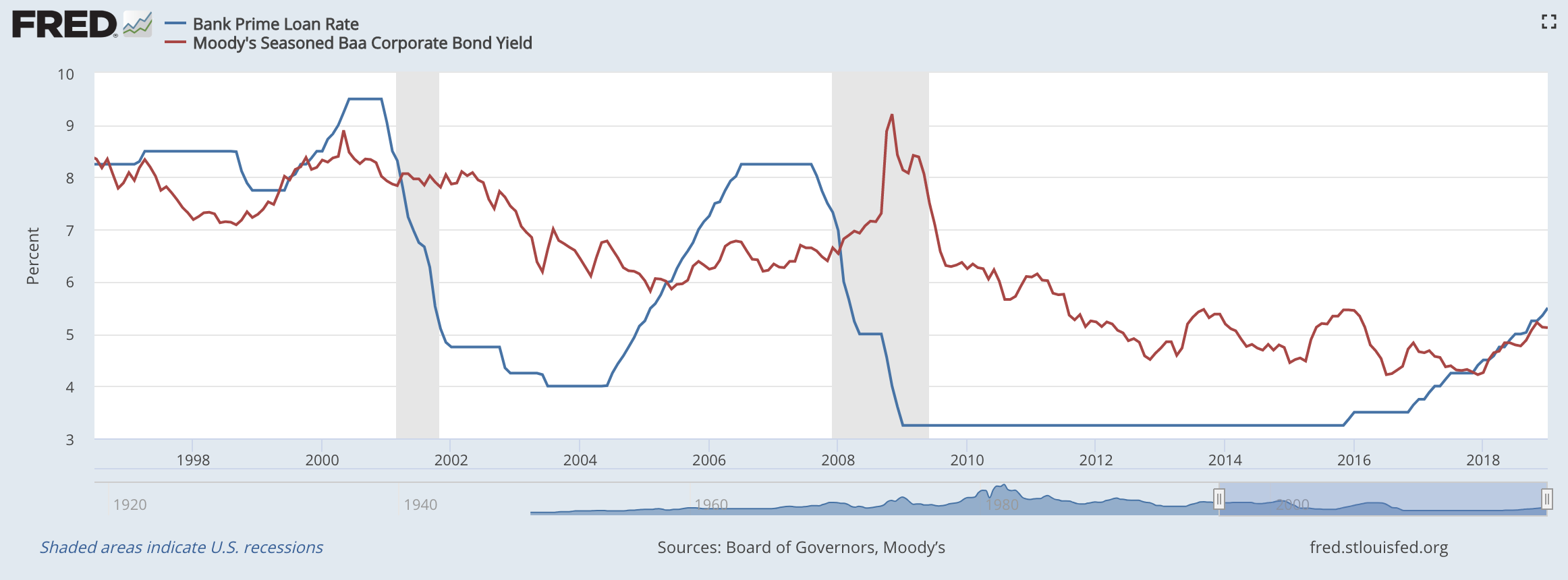

As I’ve commented on a few times this summer, rising interest rates and a flatter yield curve have been applying pressure on the economy. One area in particular that has seen a fairly strong slowing is the housing market, with home builders and related housing stocks down significantly from their highs earlier this year. I…

Stock Market Update: October 2018

I haven’t written anything in over a month but now feels like a good time to provide an update of what I’m seeing and expecting. Investment markets in general, and stocks especially, typically act in one of two frames of mind. When investors are comfortable taking on risk virtually all bad news is ignored and…

Macro Update: Late Cycle Dynamics

I’ve been seeing warning signals since the spring that we’re in the later stages of this economic cycle so I wanted to post an update to illustrate. One thing to mention is that cycles tend to move very slowly which can be a double-edged sword. It’s nice because you can typically read the tea leaves…

Portfolio Updates: 2 New Buys, 1 Sale

Here are some portfolio changes from last week. New Investment: Walgreens Boots Alliance (WBA) We purchased stock in Walgreens last week. Concerns that Amazon is expanding into drug distribution with their purchase of Pillpack earlier this summer knocked the stock down to a pretty attractive valuation. I think this is a massive overreaction similar to…