I rushed to get yesterday’s post out and realized afterwards that I didn’t update you on what I was doing with the position. In short, we’re moving on to greener pastures. This story offers some good investment lessons so I’ll provide a few more details. Despite my concerns, I chose to stick with Kinder Morgan…

Here’s What Happens When you Play with Fire

Earlier this year I cut all exposure to energy except for one company… A few month later, I started cutting back on all companies that were highly leveraged with debt because I could see the turn in the credit cycle coming and I knew that companies that were relying on the ability to access the…

Making Sense of the Nonsense

I’d like to comment on two things that have been a huge disservice to the average (nonprofessional) investor. One is CNBC and the second is the Federal Reserve. Do yourself a favor and don’t watch CNBC. Like all media companies, CNBC is in the business of collecting eyeballs. They want strong ratings so they can…

Allergan – the Gift that Keeps on Giving

Pfizer and Allergan have announced a “merger” where Pfizer is essentially acquiring Allergan so it can perform a tax inversion to relocate to Ireland (where Allergan is based). This is the second time Allergan has been acquired since we purchased it back in June, 2013, with the first being the takeover by Actavis last fall. Then…

Another Takeover!

There has been a lot of M&A activity in the biotech sector so many (most) of the smaller biotech stocks have been trading at very expensive valuations, often without any real profits, just the hope of a drug in development eventually being approved. It’s a high risk, high reward game so it’s important to keep…

What’s the Fundamental Problem with this Month’s Stock Market Rally?

In short, the breadth, or participation, is waning pretty dramatically. Basically, the rally isn’t nearly as strong as it appears. Let’s dive into some charts to illustrate what I mean by comparing the S&P 500 Index (Large Cap US stocks) to various sectors and asset classes. The S&P 500 is the blue line in all…

Are New Opportunities on the Horizon?

I find it fascinating that the stock market is still so fixated on stimulus (more quantitative easing), which says a lot about the nature of the global economy. Stocks posted a pretty strong rally yesterday after the European Central Bank (ECB) hinted at increasing their QE program. Then, this morning, the futures were driven even…

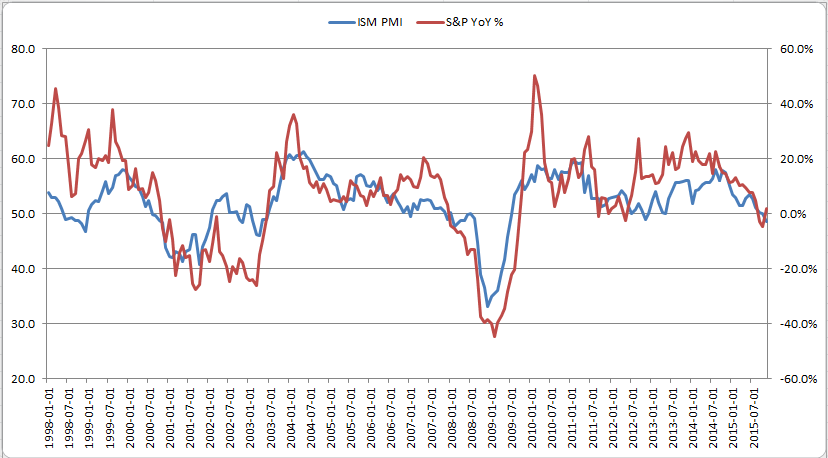

Why I Don’t Trust this Bounce in Stocks

One of the most important determinants of stock market returns in the short/intermediate term is investor appetite for risk. When investors in the market are confident and display risk seeking behavior, we tend to see assets (like stocks) ignore bad news and rally on good news. However, the reverse occurs when investors are displaying a…