I haven’t written on the blog in about two weeks because we’re in the middle of quarterly earnings. There is a 2 or 3 week stretch each quarter where I’m pretty busy listening to the earning’s conference calls of the companies we own as well as other companies I’m looking into. The good news is…

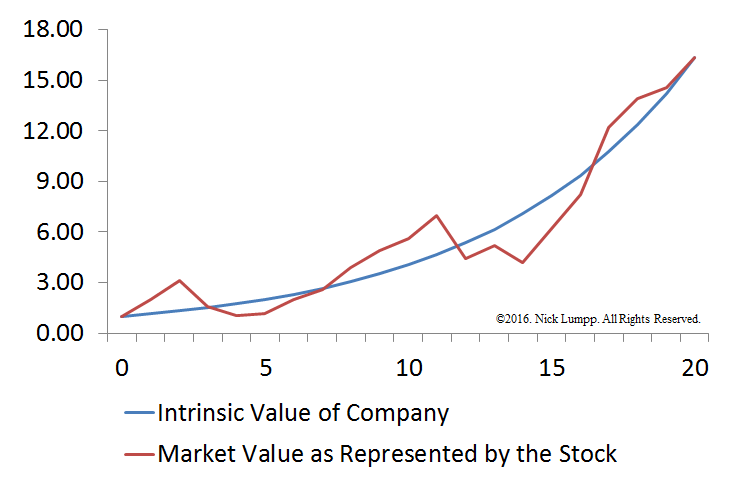

How to Produce Outsized Long-Term Returns from the Perspective of Value Investing

I’m going to let you in on a little secret: Wall Street doesn’t look out beyond 1 year. That’s it. Just 1… Wall Street is part of the brokerage industry and all that the brokerage industry cares about is making sure: 1) you remain invested in their expensive products, and 2) you continually churn your…

What it Means to be “Hedged”

I’ve mentioned a few times over the past couple of months that I currently have the “Growth” allocation of client portfolios hedged against a drop in the stock market. In this post, I hope to explain what it means to be “hedged,” why it’s important to hedge risk, and how I’m currently doing so. From…

Chart of the Week: Effects of QE, Straight from the Horse’s Mouth

This week’s Chart of the Week comes from Jesse Felder, a very astute investor. I’ve posted charts like this in the past, illustrating the effects of the Fed’s Quantitative Easing on asset markets, but it’s worth revisiting after the former head of the Dallas Federal Reserve branch, Richard Fisher, openly stated that the main goal of…

New Year’s Resolutions

This blog post will be a little different than usual in that it won’t be discussing the investment markets. Most people will make some sort of New Year’s resolution in hopes of bettering themselves in some way. I do as well but I also like to work on improving myself throughout the entire year. So…

Chart of the Week: Tertiary Impact of Lower Oil Prices

There was an article in the Wall Street Journal this week discussing the approximately 5-fold rise of Sovereign Wealth Fund assets off the back of rising oil prices over the past decade. Now that oil prices have fallen from over $100 per barrel to the mid-$30’s, most countries have begun tapping their funds to fill the…

Chart of the Week: The Fed Effect

A picture is worth a thousand words, right? I’m definitely a visual learner and know that charts are sometimes much better at illustrating a point than explaining it through 5 paragraphs of text, so I’m going to start a new series on the blog called “Chart of the Week” where I post something interesting I…

Why I Like Risk, Volatility and a Falling Stock Market

I know the posts this week weren’t the most upbeat, but hey, I’m not CNBC. My job is to be a fiduciary on behalf of my clients which means I need to be realistic. I understand that it’s more enjoyable to read about exciting, new investment opportunities so I try to limit the doom and gloom.…