The answer is management, plain and simple. When you invest in the stock of a company, you entrust management to be the steward of your capital and to make smart, value enhancing business decisions. It doesn’t matter how great a product is or what competitive advantages a company may have, if management makes poor decisions…

Creative Destruction

Creative Destruction is effect of technological innovation, when something new kills the older incumbent. We’ve gone from horse and buggy to railroads to cars, etc. A new innovation dramatically changes, if not outright kills, the old way of doing things. It’s constantly occurring but usually happens so slowly that we don’t notice it unless we…

Earnings Updates

Once again, I’ve been very pleased with the earnings and outlook reported by the majority of the companies we own. A few of our core holdings held their conference calls this morning so I wanted to provide a quick update. CF Industries (CF) & Terra Nitrogen (TNH) CF is our largest “Growth” holding and TNH…

Chart(s) of the Week: Demographics, Health Trends & the Economy

Here are some recent charts from Bloomberg on demographics and health trends. Following the demographics of various countries is one of the best ways to get a sense of long-term trends. The first shows the number of children under age 5 vs people age 65 and above. For the first time ever, seniors are about…

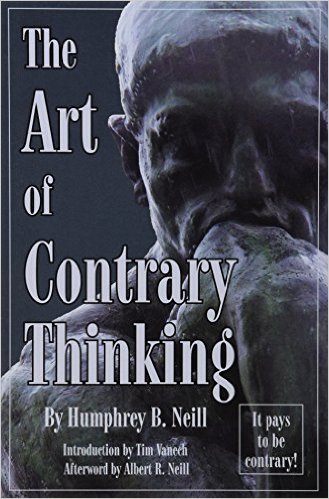

The Art of Contrary Thinking

I just finished a great book that I think is very fitting to read in this election year. It’s called The Art of Contrary Thinking, by Humphrey B Neill. It’s a collection of articles he wrote in the early 1950’s. You might think a book this old isn’t useful today but things haven’t changed all…

Recent Portfolio Updates

A few quick updates: Growth Allocation I bought a position in Check Point Software Technology (CHKP) this morning after the stock got knocked down following their earnings release. Check Point is one of the oldest Cybersecurity companies out there and is the global leader in unified threat management (UTM) – things like firewalls, network security,…

Adapting Portfolio Construction – 2 Updates

I’ve been thinking a lot lately about portfolio construction, especially for retirees, in these computer-algorithm dominated investment markets which swing wildly every time someone from the Fed speaks. Markets today are unbelievably short-term focused and my clients aren’t paying me to day-trade their retirement portfolios. This means that portfolios which are built with a long-term…

Chart of the Week: Consumer Discretionary Stocks are Not on Sale

This goes to show how distorted Quantitative Easing (QE) has made things. It’s a value investors nightmare… It’s important to use your head when investing in this market. A common mistake that investors tend to make is to pick a fund (or stock) based on past performance. They’ll think “look how well this fund has done…