In the wake of Brexit, I thought the charts below would be helpful in understanding the political changes we’re seeing throughout the world. They might seem unrelated, but it’s the same story in most of the developed world and it’s all tied together. I’ve had quite a few discussions with people following the Brexit vote and everyone seems…

Brexit

If you haven’t yet seen the news this morning, the UK voted to leave the European Union (EU) yesterday (results came out late last night). We’re seeing this type of movement across the globe right now. The vote to leave is a global middle class that is frustrated by ever growing wealth inequality, stagnant wages…

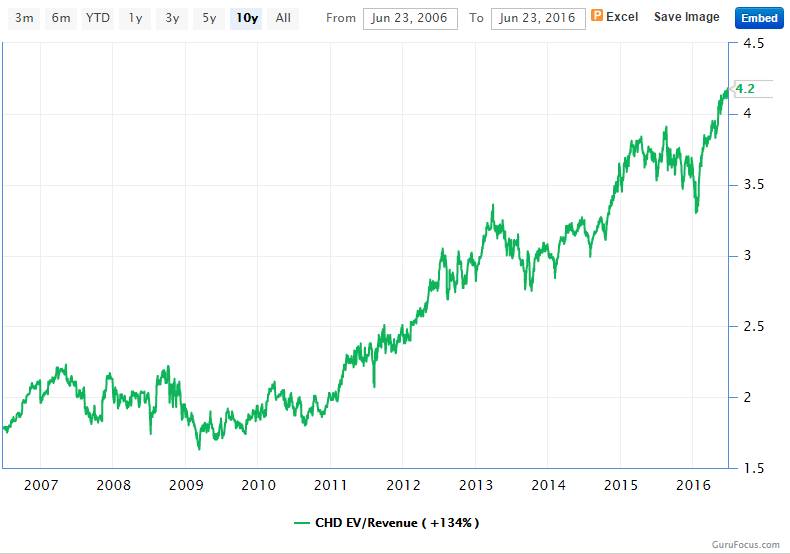

“Safe” Stocks Not Looking So Safe Anymore

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1” -Warren Buffett The most important part of investing is to avoid losses. This is why I so often use this blog to talk about the risks I’m seeing. If you can avoid the landmines and diversify among the rest, you’ll do pretty well. What…

The Difference Between a Company and a Stock

As a follow-up on my last post which you can read here, I wanted to discuss the important difference between a company and a stock when investing. The old adage of “invest in what you know and buy” is very general and only goes so far. I would also say that it’s not nearly as…

Watch out for Accounting Gimmicks

It was announced yesterday that Microsoft is buying LinkedIn for $26.2 billion. A lot of people are questioning the deal but I think Andrew Ross Sorkin hit the nail on the head regarding LinkedIn’s decision to sell – to get out of the accounting hole they were digging with massive amounts of stock based compensation and…

2 Portfolio Updates

Most of the activity in portfolios lately has been selling covered stock options to boost the yield on our holdings (attn clients: I’ll be discussing this in more detail with examples in this month’s video update). I did make two purchases in the last week that I wanted to bring to your attention though. First,…

Why Investing in Food Makes Sense for Retirees

I’ve been thinking a lot lately about the types of investments that offer the best risk adjusted returns in this environment. One of the toughest things to evaluate today, and perhaps the most important when investing in stocks, is the sustainability of a company’s business model, cash flows and profits. Technology continues to change things…

Say Hello to Your New “Synthetic” Corporate Bonds

Investors have been “starved” for yield for years now and unfortunately interest rates aren’t going up anytime soon. When looking at individual bonds, investors get to choose between high quality bonds at paltry yields or junk-rated bonds that look attractive but come with a slew of bad risks that often aren’t understood or appropriate for…