Just about all of my clients are long-term, retirement oriented investors. The most frustrating thing the past few years for long-term investors is how the central banks have largely “killed” the markets in the traditional investment sense. What I mean by “killed” is that I cannot honestly consider bonds yielding less than 2% and stocks…

The Next Market Fad to Blow Up

Following the slowest month in a long time, with volatility being compressed again, I thought it was a good time to highlight an important underlying driver of markets these days: volatility. Volatility (more importantly implied volatility) is measured and today is an actual asset class that you can “invest” in for diversification purposes. A few…

Chart of the Week: Debt-Funded Buybacks

This week’s chart comes from an article on Bloomberg discussing the percentage of buybacks that are being funded by debt – now over 30% for the first time since June 2001. Notice how this measure tends to peak around high points in the overall market (2000/2001, 2007 and 2011). You can read the full article here.…

The Future of Business & Technology

Here’s an article published by one of the co-developers of Coinbase (one of the top Bitcoin exchanges in the US). Whether you just want to stay on top of new trends in technology or are looking ahead at new investment opportunities, this is imperative to understand how technology is changing the way companies are being started, operating…

New Stock Investments

I added to some existing positions (like Google and Celgene) during the selloff following the Brexit vote but also made some new purchases over the past few weeks that I’ve been meaning to detail. New Positions 1. Red Hat Software (RHT) Red Hat is a distributor of open-source Linux operating systems. Open-source means that the…

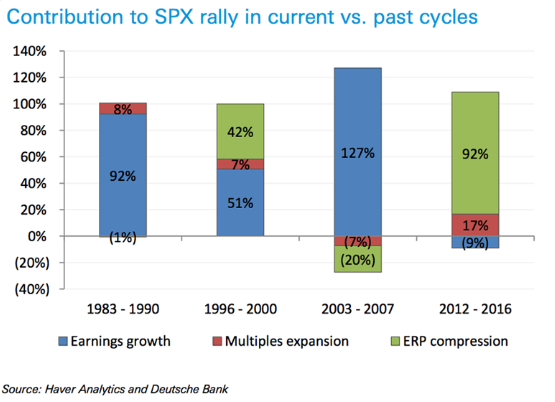

Charts of the Week: The Whole Story

These charts tell the whole story regarding the current state of the global economy and investment markets: Global central bank asset purchases compared to global equity % change (let’s be honest, there’s only one thing that matters…) Deutsche Bank’s recent report on the current stock market rally (’12 to ’16) compared to past market climbs…

So What do I Like?

I realize that a lot of posts lately have been more focused on the risk side of things, pointing out assets that I feel are overvalued these days. Believe it or not, I’m pretty optimistic about some of the innovation we’re seeing in the world. I think we will see huge strides made over the…

Chart of the Week: Stocks as Bond Proxies

This week’s chart comes from yours truly. For much of the year, and especially so since Treasury yields broke to new lows after the Brexit vote, the “safe” high yielding stocks like Utilities, Consumer Staples and Telecom have been tracking daily changes in the bond market – not the stock market. If bond yields move…